Goldman Cuts Oil Forecasts on Slow US Growth, OPEC+ Policy

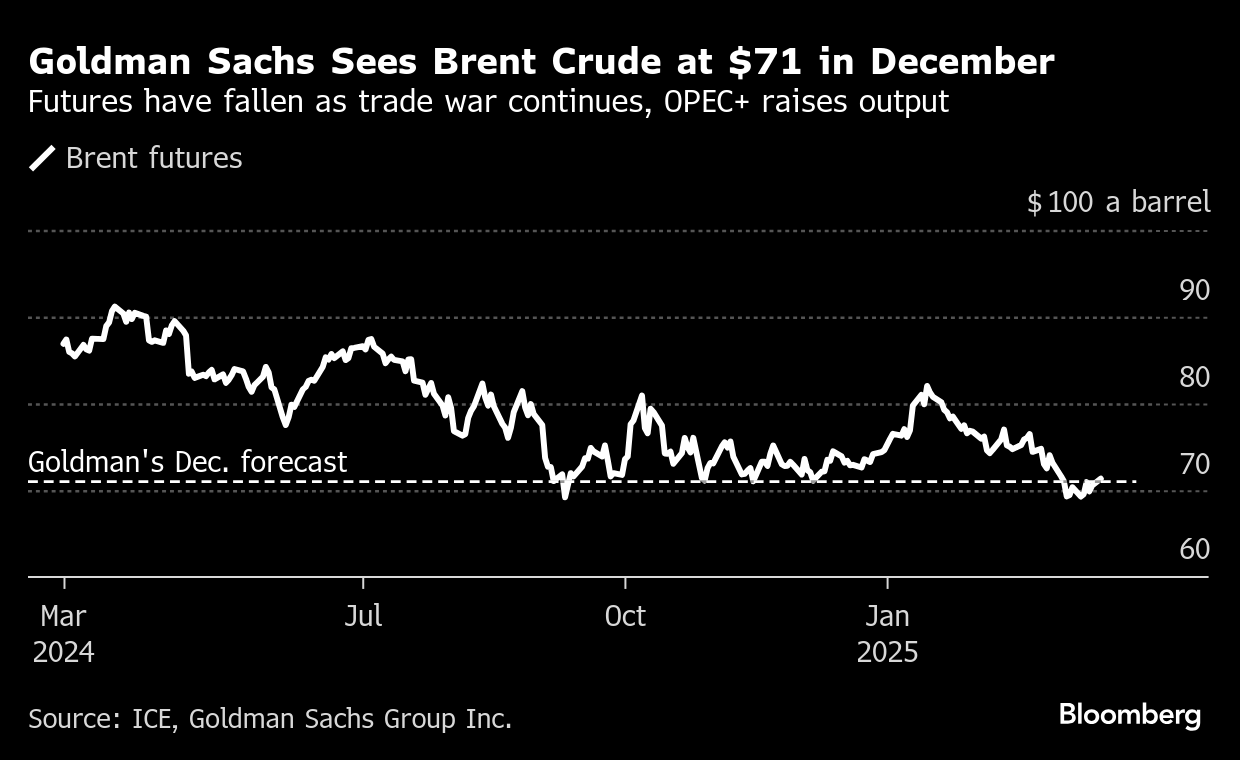

(Bloomberg) -- Goldman Sachs Group Inc. cut its oil price forecasts, as tariffs reduce the outlook for US growth while OPEC and its allies boost output.

The move follows a drop in crude prices from this year’s high in January on plentiful supply, a weak demand outlook from top importer China and an escalating international trade war.

“While the $10 a barrel sellof since mid-January is larger than the change in our base case fundamentals, we reduce by $5 our December 2025 forecast for Brent to $71,” Goldman analysts including Daan Struyven said in the note dated Sunday. “The medium-term risks to our forecast remain to the downside given potential further tariff escalation and potentially longer OPEC+ production increases.”

Some of the world’s biggest oil traders have turned increasingly bearish, with the likes of Vitol Group and Gunvor Group forecasting oversupply. The International Energy Agency said last week that demand is being eroded by the escalating trade war and the pledge by the Organization of Petroleum Exporting Countries and its allies to increase shipments, forecasting a surplus of 600,000 barrels this year — or about 0.6% of daily global consumption.

However, Goldman Sachs said it expects prices to recover “modestly” in the coming months as US economic growth remains resilient for now, and Washington’s sanctions regime is showing no immediate signs of easing. Other geopolitical risks remain, including the latest US order to attack sites in Yemen controlled by the Houthis as they continue menacing Red Sea shipping.

Oil demand will rise 900,000 barrels a day in January, 18% less than a previous forecast, Goldman said. Brent will trade in a range of $65 to $80 a barrel, and average $68 next year, the bank said.

(Updates with context from second paragraph.)

©2025 Bloomberg L.P.