S&P 500 Rally Fades in Last Stretch of Big Quarter: Markets Wrap

(Bloomberg) -- Wall Street’s rally waned in the final moments of a banner quarter while Treasuries were on pace for their best first-half stretch in five years amid hopes the Federal Reserve will resume its rate cuts. The dollar eyed its longest monthly slide since 2017.

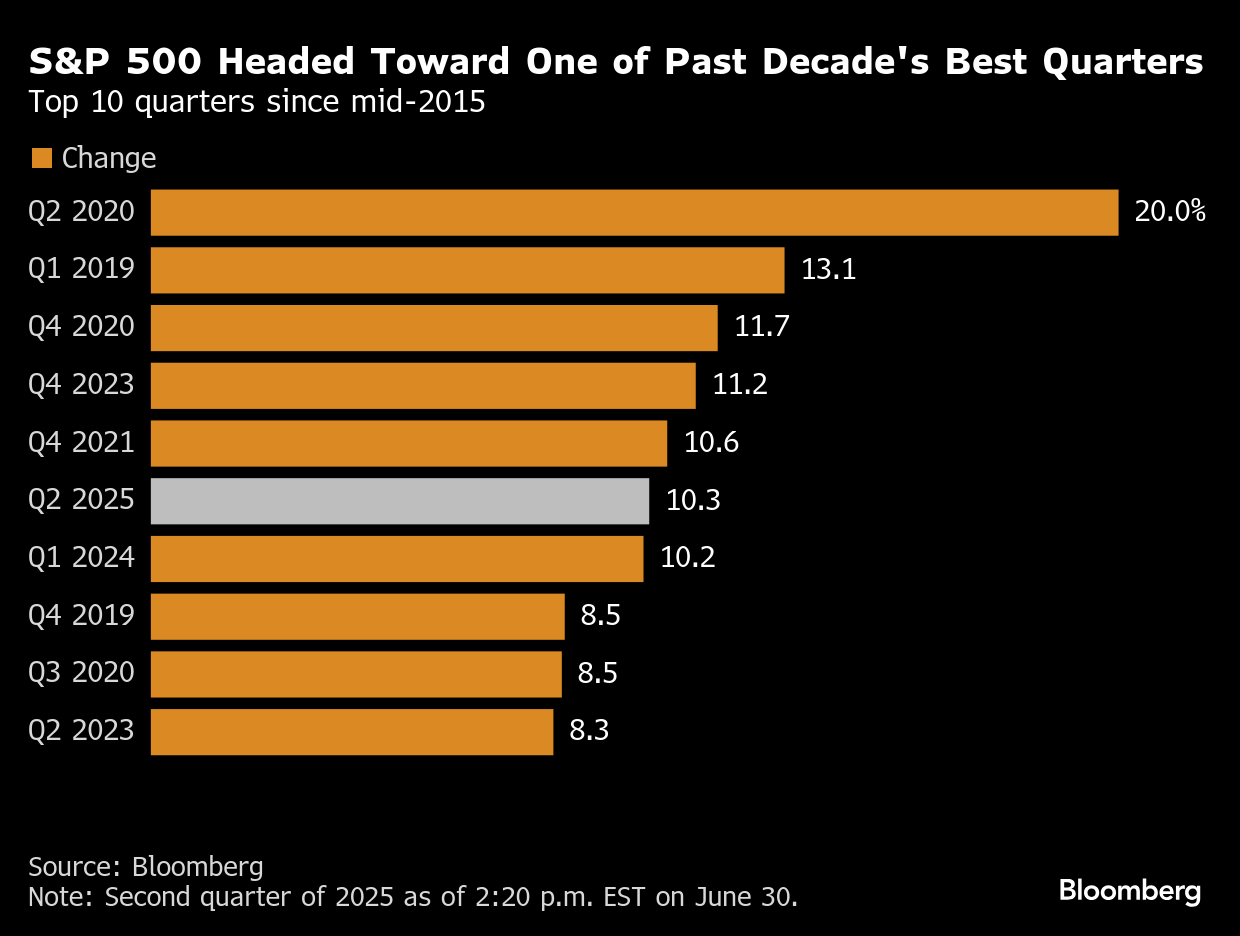

The S&P 500 was little changed, while on pace for its best quarter since March 2024. Just days ahead of the US jobs report, bond yields fell. Treasury Secretary Scott Bessent indicated it wouldn’t make sense to ramp up sales of longer-term debt given where yields are, though he held out hope that rates across maturities will be falling as inflation slows. Goldman Sachs Group Inc. is now projecting a Fed cut in September as the inflationary effects of tariffs “look a bit smaller” than expected.

A relative sense of calm prevailed at the end of a first half that saw wild swings lashing Wall Street amid President Donald Trump’s fast-evolving trade war, world conflicts, recession jitters as well as concerns about a ballooning deficit that could threaten America’s status as a safe haven.

“No one could fault an investor if at one point during the first half of 2025 they shouted, ‘Stop the world, I want to get off’,” said Sam Stovall at CFRA.

With Trump’s July 9 trade deadline fast approaching, Canada withdrew its digital services tax on tech companies in a move to restart talks with the US. The European Union is willing to accept a trade arrangement with the US that includes a 10% universal tariff on many of the bloc’s exports, but seeks key exemptions. Trump threatened to impose a fresh tariff level on Japan, citing what he said was the country’s unwillingness to accept rice exports from the US.

“The biggest catalyst for financial markets as a whole could be progress in trade talks – of a lack thereof,” said Fawad Razaqzada at City Index and Forex.com. “As long as there are no major escalations again in the Middle East or in the trade war, you’d think stock markets may not suffer much on any macro data. Still, there is always room for surprises.”

“While tariff headlines could periodically unsettle markets, we do not currently see them as a catalyst for a sustained market selloff,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “For investors under-allocated to broad equity markets, we recommend gradually increasing exposure to diversified global stocks or balanced portfolios to position for stronger potential returns in 2026 and beyond.”

US stocks could come under pressure if Fed rate cuts are accompanied by weaker economic growth, according to JPMorgan Chase & Co. strategists led by Mislav Matejka. As long as there isn’t a meaningful rise in the unemployment rate, American equities are likely to get a boost from Fed policy easing, said Morgan Stanley strategists led by Michael Wilson.

“The market has shrugged off signs of a slowing economy, but with the tariff picture still up in the air, a negative surprise on the jobs front could have more of an impact, especially during what will likely be a light-volume holiday week,” said Chris Larkin at E*Trade from Morgan Stanley.

Economists forecast employers added 113,000 jobs in June, the fewest in four months yet still consistent with healthy labor demand. The Bureau of Labor Statistics report is due Thursday, a day earlier than usual because of the Independence Day holiday. It’s also forecast to show the unemployment rate crept up to 4.3%.

For a Fed awaiting more clarity on the potential inflationary impact from tariffs, any pronounced deterioration in the labor market would likely lead to more pressure on officials to lower interest rates.

But the higher the S&P 500 goes, the louder the concern that its multiples are starting to look frothy. The index is trading at 22 times expected profits in the next 12 months, 35% above its long-term average, data compiled by Bloomberg show.

Earlier on Friday, Bank of America Corp. strategists warned of the increasing risk of a speculative stock-market bubble as traders drive massive flows into equities on expectations of US interest-rate cuts. The upcoming earnings season could also test the foundation of the recent rally, especially with lackluster forecasts piling in.

US profit margins will face a big test in the upcoming reporting season as investors assess the damage from Trump’s trade war, according to Goldman Sachs Group Inc. strategists led by David Kostin. They say earnings will “capture the immediate effects” of tariffs that have already increased by about 10 percentage points since the start of the year.

“Healthy economic fundamentals are an ultimate buffer for negative headlines, after all,” said Seema Shah at Principal Asset Management. “As such, equities should remain resilient unless an adverse event materializes into something larger that curtails household spending and company earnings.”

That said, Shah also notes that given the uncertain policy backdrop, a broader hit to market sentiment cannot be ruled out.

“In this environment, it’s essential for investors to maintain well-diversified portfolios designed to navigate periods of heightened uncertainty,” she said.

“Those looking for an accommodative Fed to keep the market rising in the second half of the year will be quite disappointed,” said Matt Maley at Miller Tabak. “The market could indeed push higher as we move through July/August and beyond. Momentum can be a powerful force in the markets, so if the stock market rallies further as we move through earnings season, the whole thing could feed on itself.”

Since World War II, there have only been three times where the market was down more than 10% and still finished positive – and we’re shaping up to do it again, noted Mark Hackett at Nationwide.

“As we look ahead, the labor market data will be critical, but it will be how the market reacts that is most important, not the numbers themselves,” he said. “If equities rally on weak jobs figures, we’re clearly in ‘bad news is good news’ mode, with investors betting on Fed support.”

While momentum is working in the market’s favor, with valuations at such levels and earnings estimates holding, “we are likely stealing returns from the back half of the year,” Hackett said.

Corporate Highlights:

- Republican lawmakers are debating a bill that ramps up President Donald Trump’s assault on wind and solar power, a worse-than-expected jolt to clean energy while providing aid for fossil fuels.

- Robinhood Markets Inc. is joining the growing push to trade US equities on the blockchain, making tokenized US securities available to 150,000 customers in 30 countries, 24 hours a day, five days a week.

- Boeing Co.’s $4.7 billion deal to buy Spirit AeroSystems Holdings Inc. will face UK antitrust investigation, the country’s antitrust watchdog said.

- Home Depot Inc. has agreed to acquire specialty building products distributor GMS Inc. for $4.3 billion, its latest effort to grab more spending from professional contractors.

- The Justice Department settled its lawsuit challenging Hewlett Packard Enterprise’s $13 billion takeover of Juniper Networks, less than two weeks before a trial was set to start.

- Meta Platforms Inc. Chief Executive Officer Mark Zuckerberg announced a major restructuring of the company’s artificial intelligence group, including a commitment to developing AI “superintelligence,” or systems that can complete tasks as well as or even better than humans.

- The US Supreme Court refused to hear American Airlines Group Inc.’s appeal of a lower court ruling that its partnership with JetBlue Airways Corp. violated federal antitrust laws by eliminating competition between the carriers and limiting travelers’ choices for flights.

- Apollo Global Management Inc. is launching a new homebuilder financing effort, its latest bid to invest in residential development amid a persistent shortage of US housing.

- Hyatt Hotels Corp. agreed to sell a portfolio of 15 resorts for $2 billion as the company continues to add to its all-inclusive offerings while cutting back on real estate.

- Nintendo Co. pulled its products from Amazon.com Inc.’s US site after a disagreement over unauthorized sales, meaning the e-commerce company missed out on the recent debut of Nintendo’s Switch 2 — the biggest game console launch of all time.

- Moderna Inc. said its experimental flu shot met its goal in a late-stage trial, clearing the path for its broader strategy of selling combination vaccines.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 2:42 p.m. New York time

- The Nasdaq 100 rose 0.2%

- The Dow Jones Industrial Average rose 0.2%

- The MSCI World Index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro rose 0.5% to $1.1775

- The British pound was little changed at $1.3717

- The Japanese yen rose 0.3% to 144.15 per dollar

Cryptocurrencies

- Bitcoin fell 0.1% to $107,253.12

- Ether rose 2.1% to $2,483.53

Bonds

- The yield on 10-year Treasuries declined five basis points to 4.23%

- Germany’s 10-year yield advanced two basis points to 2.61%

- Britain’s 10-year yield declined one basis point to 4.49%

Commodities

- West Texas Intermediate crude fell 0.7% to $65.09 a barrel

- Spot gold rose 0.8% to $3,299.21 an ounce

©2025 Bloomberg L.P.