S&P 500 Erases Trade-Fueled Decline as Bonds Slide: Markets Wrap

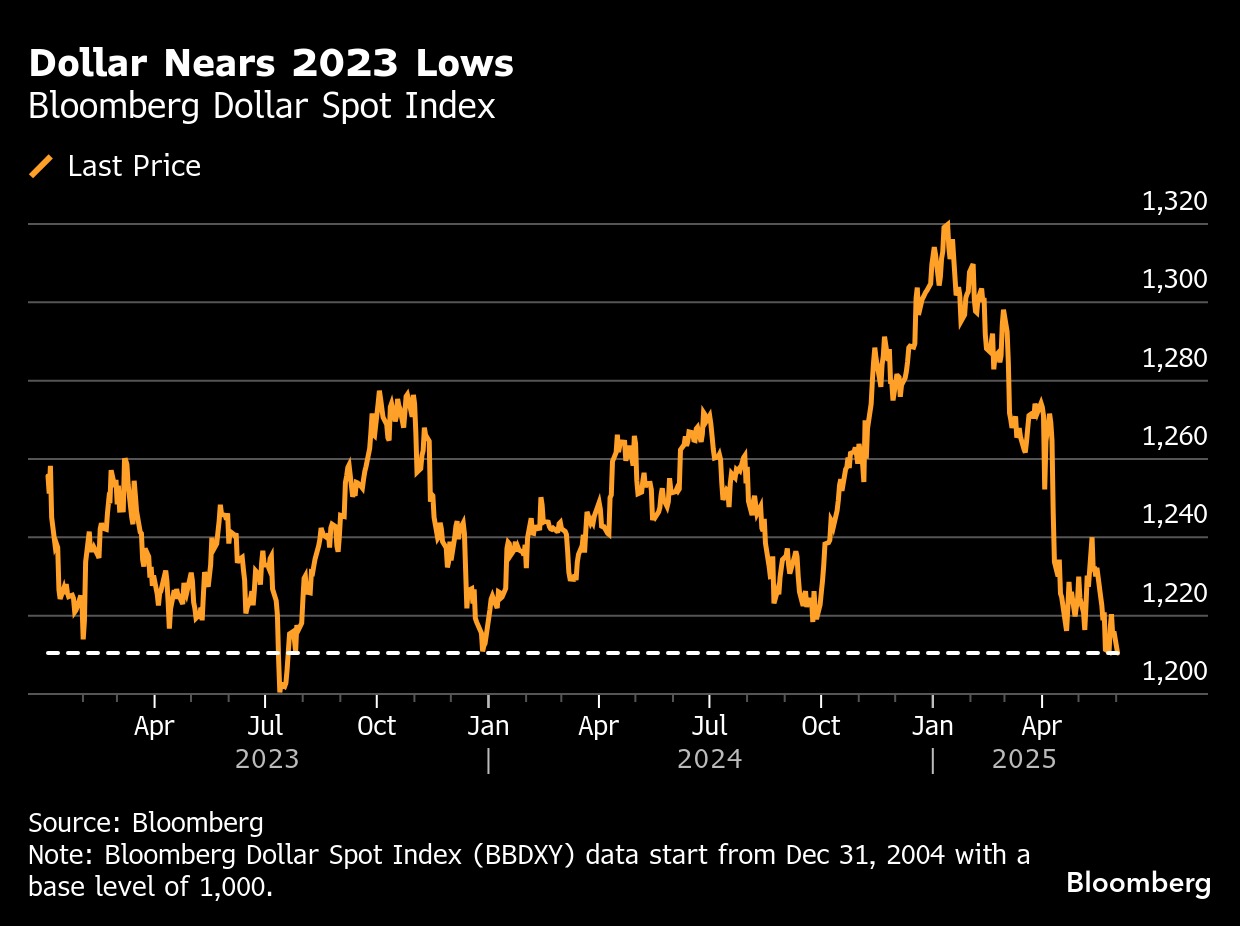

(Bloomberg) -- A rebound in big tech drove stocks higher after a slide driven by weak manufacturing, trade and geopolitical risks. Bonds fell as the dollar headed toward its lowest since 2023. Among policymakers speaking was Federal Reserve Chair Jerome Powell, who didn’t comment on the rate outlook.

Coming off the best May for the S&P 500 in 35 years, the benchmark edged up at the start of what’s historically one of its quietest months for gains. Nvidia Corp. led an almost 2% rally in a closely watched gauge of chipmakers. US steel and aluminum shares surged on Donald Trump’s pledge to double levies on the metals. Longer-term Treasuries underperformed, with the spread between five- and 30-year yields near a level it last closed above in 2021. Oil climbed.

The latest twists in Trump’s tariff agenda have fueled market angst, following mutual accusations between Washington and Beijing of breaching a trade deal. Trump and Xi Jinping are “likely” to speak this week, the White House said. Meantime, the European Union warned it may speed up retaliatory measures if Trump follows through on his threats.

“We continue to expect market volatility as investors digest fresh tariff headlines and incoming US economic data. Fiscal worries remain, and geopolitical tensions are heating up,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

Russia and Ukraine wrapped up a second round of talks in Istanbul that failed to bring the two sides closer to ending the war, but laid the groundwork for a new exchange of prisoners.

Corporate Highlights:

- Jamie Dimon said his retirement from the top post at JPMorgan Chase & Co. is “several years away,” but the decision is up the bank’s directors.

- Apple Inc. shares have struggled this year, but the iPhone maker offers a “significant” opportunity over the long-term, according to Bank of America Corp.

- Walt Disney Co. is laying off several hundred employees across its film and TV businesses, cuts that underscore the tough times in Hollywood are far from over.

- Bristol-Myers Squibb Co. will pay BioNTech SE as much as $11.1 billion to license a next-generation cancer drug, as competition intensifies in an area of oncology that seeks to harness the immune system to attack tumors.

- General Electric Co. is exercising some cost increases to pass on additional charges caused by tariffs, as the world’s largest aircraft engine maker advocates for a return to a duty-free regime that long underpinned the industry.

- Moderna Inc. gained US approval for a new Covid vaccine for a narrower group of people, in the latest sign that regulators are restricting access to immunizations under the leadership of Health and Human Services Secretary Robert F. Kennedy Jr.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.2% as of 2:34 p.m. New York time

- The Nasdaq 100 rose 0.6%

- The Dow Jones Industrial Average was little changed

- The MSCI World Index rose 0.3%

- Bloomberg Magnificent 7 Total Return Index rose 0.4%

- The Russell 2000 Index was little changed

- Philadelphia Stock Exchange Semiconductor Index rose 1.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.5%

- The euro rose 0.7% to $1.1430

- The British pound rose 0.5% to $1.3529

- The Japanese yen rose 0.8% to 142.90 per dollar

Cryptocurrencies

- Bitcoin fell 0.5% to $104,477.26

- Ether rose 1.2% to $2,555.93

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 4.47%

- Germany’s 10-year yield advanced two basis points to 2.52%

- Britain’s 10-year yield advanced two basis points to 4.67%

Commodities

- West Texas Intermediate crude rose 3.1% to $62.67 a barrel

- Spot gold rose 2.5% to $3,372.08 an ounce

©2025 Bloomberg L.P.