Oil Traders Brace for Turmoil as Iran Crisis Imperils Supply

(Bloomberg) -- Oil-watchers are bracing for a further price rally after Israeli strikes on Iranian energy assets heightened the risk to Middle East supplies.

Israel temporarily knocked out a natural gas processing facility linked to the giant South Pars field, Iran’s biggest, in an attack on Saturday, and targeted fuel storage tanks during strikes as part of its campaign against Tehran’s nuclear program.

While the attack was concentrated on the Islamic Republic’s domestic energy system rather than exports to international markets, oil traders and analysts are preparing for more turmoil after prices surged the most in three years on Friday.

Despite US sanctions, Iran remains the third-biggest producer in the Organization of the Petroleum Exporting Countries. Its allies in Yemen, the Houthi militants, have harassed ships in the region and Tehran has in the past threatened to halt the Strait of Hormuz, a critical transit point in the Persian Gulf. It has, however, never blockaded the key maritime chokepoint.

“The escalating, likely prolonged, conflict and its expansion to economic targets with civilian casualties should build some more risk premium into crude early this week,” said Bob McNally, president and founder of Rapidan Energy Advisers LLC and a former White House energy official.

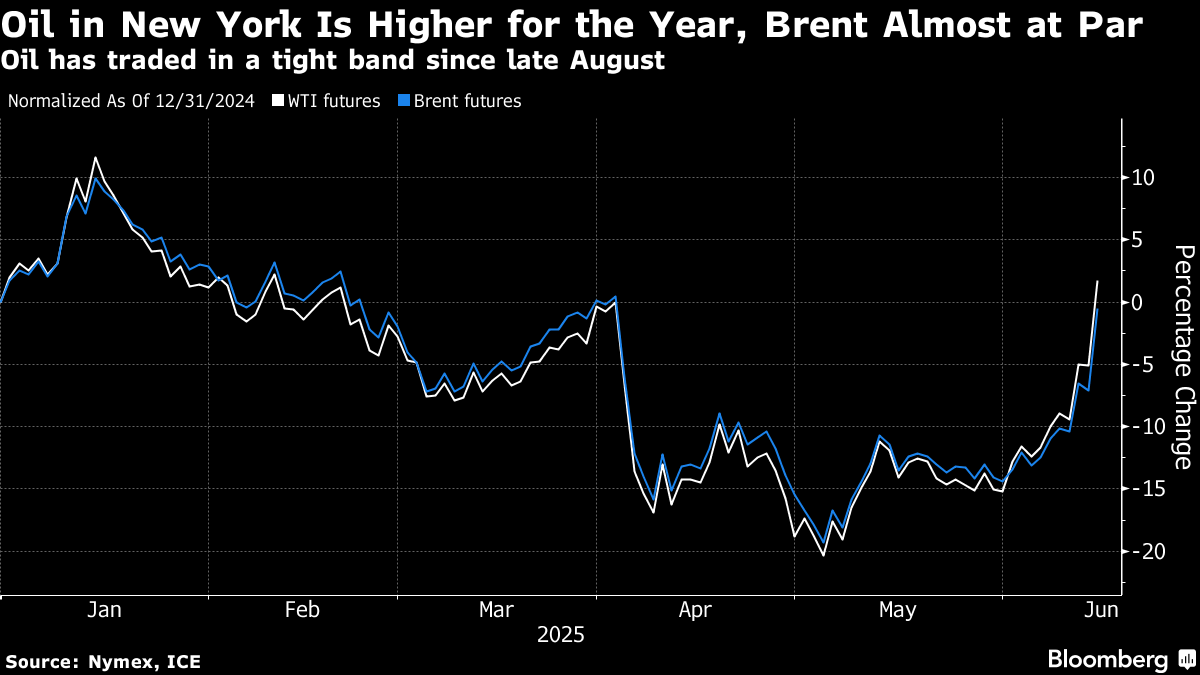

West Texas Intermediate futures, the US benchmark, rallied as much as 14% on Friday before settling near $73 a barrel. A closure of Hormuz could propel international prices to as high as $130, JPMorgan Chase & Co. has predicted. A jump in oil would add to inflation pressures around the world.

Israel’s strike on Saturday triggered a powerful explosion and fire at the onshore Phase 14 gas processing plant and forced the shut down of a production platform at the South Pars field, according to a report from the semi-official Tasnim news agency.

“Now that threshold has been crossed, there will be questions about whether Israel is going to target more Iranian energy infrastructure,” said Richard Bronze, head of geopolitics at consultant Energy Aspects Ltd. “We appear to be in an escalatory cycle.”

If oil supplies are disrupted, President Donald Trump will likely call on the OPEC+ alliance led by Saudi Arabia to tap its considerable spare production capacity, Helima Croft, head of global commodity strategy at RBC Capital Markets LLC, and a former CIA analyst, said in a note on Friday.

But it’s unclear whether the Organization of the Petroleum Exporting Countries could offset a severe and prolonged outage in Iran, which pumps around 3.4 million barrels a day.

The attempt alone could put the energy infrastructure of the Saudis and the United Arab Emirates into the cross-hairs. After Riyadh backed Trump’s earlier crackdown on Tehran during his first term, its critical oil-processing installation at Abqaiq was blown up by the Houthis in 2019.

“OPEC spare capacity could be brought online to offset a reduction in Iranian barrels,” said Clay Seigle, senior fellow at the Center for Strategic and International Studies in Washington DC. “But it would be politically dicey for Saudi Arabia and UAE to benefit in this way at Tehran’s expense.”

The fact that major oil facilities have so far been spared in the current tumult may offer markets some reassurance.

“We would probably need to see evidence of an intensifying war – with far more widespread damage and mass civilian casualties – for that expectation to change and the risk premium in crude to spike further,” said Vandana Hari, founder of Singapore-based energy consultancy Vanda Insights.

The International Energy Agency, the Paris-based watchdog set up by consuming nations, said that global oil markets are well supplied amid slowing fuel demand and recent production increases by OPEC+. The agency said it’s prepared to tap emergency stockpiles if necessary.

On Sunday, President Trump said in a Truth Social post that the two belligerent countries should and will make a peace deal. Trump had said before Israel’s attacks that he was dissatisfied with rising oil prices.

Fears over the Strait of Hormuz are probably excessive too, Hari added. Such an extreme step would cut off Iran’s own export route and alienate its biggest customer, China.

“Iran has never actually blocked the channel despite many threats to do so down the years and I don’t expect it will do so now,” she said.

©2025 Bloomberg L.P.