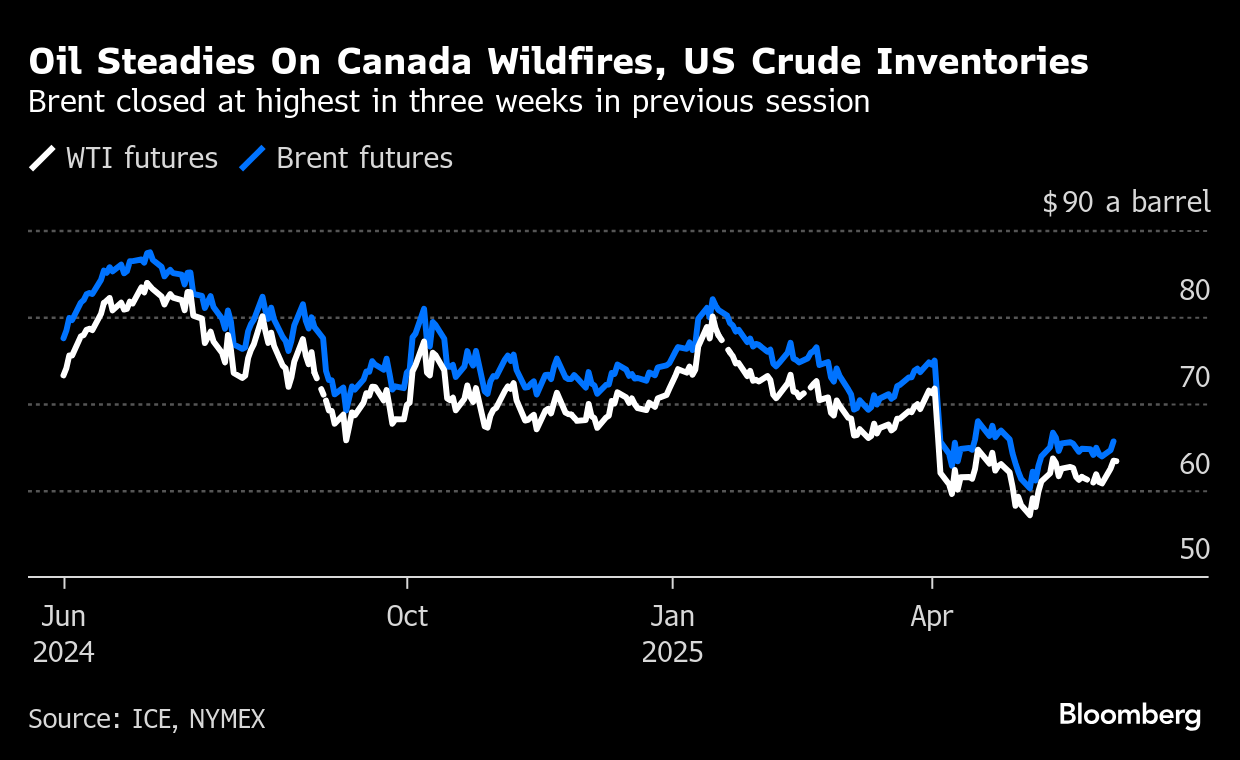

Oil Steadies With Focus on Canada Wildfires, US Crude Stockpiles

(Bloomberg) -- Oil steadied after a two-day gain as rains slowed the growth of some blazes which had disrupted Canadian crude production.

Brent traded around $65 a barrel after closing at a three-week high on Tuesday, while West Texas Intermediate was near $63. One Canadian operator restarted a site after shutting down last week, with wildfires halting about 7% of output at one stage in the world’s fourth-largest producer.

Separately, the American Petroleum Institute reported US crude inventories dropped by 3.28 million barrels last week, according to a person familiar with the figures. That would be the biggest draw since March if confirmed by official data later on Wednesday.

Oil rose at the start of the week after a decision by OPEC+ to raise production in July was in line with expectations, easing concerns over a bigger hike. However, prices are still down about 12% this year on fears around a looming supply glut, and worries that US-led trade wars could hurt demand.

“In the short term, the market shows a slightly bullish trend amid volatility,” said Gao Mingyu, Beijing-based chief energy analyst at SDIC Essence Futures Co. “But OPEC+’s rapid output increase makes it difficult for the supply-demand tightness that’s driven by seasonal and geopolitical factors to persist.”

Saudi Arabia led increases in OPEC oil production last month as the group began its series of accelerated supply additions, according to a Bloomberg survey. Nevertheless, the hike fell short of the full amount the kingdom could have added under the agreements.

The OECD, meanwhile, cut its outlook for global economic growth on Tuesday, with the US among the hardest hit. President Donald Trump is pushing ahead with his tariffs, signing a directive that doubles rates on steel and aluminum.

©2025 Bloomberg L.P.