Oil Rally Builds as Middle East Tensions Deepen: Markets Wrap

(Bloomberg) -- Oil extended its recent gains amid concern escalating tensions in the Middle East will trigger more direct US involvement. Asian stocks were mixed before a Federal Reserve monetary policy decision.

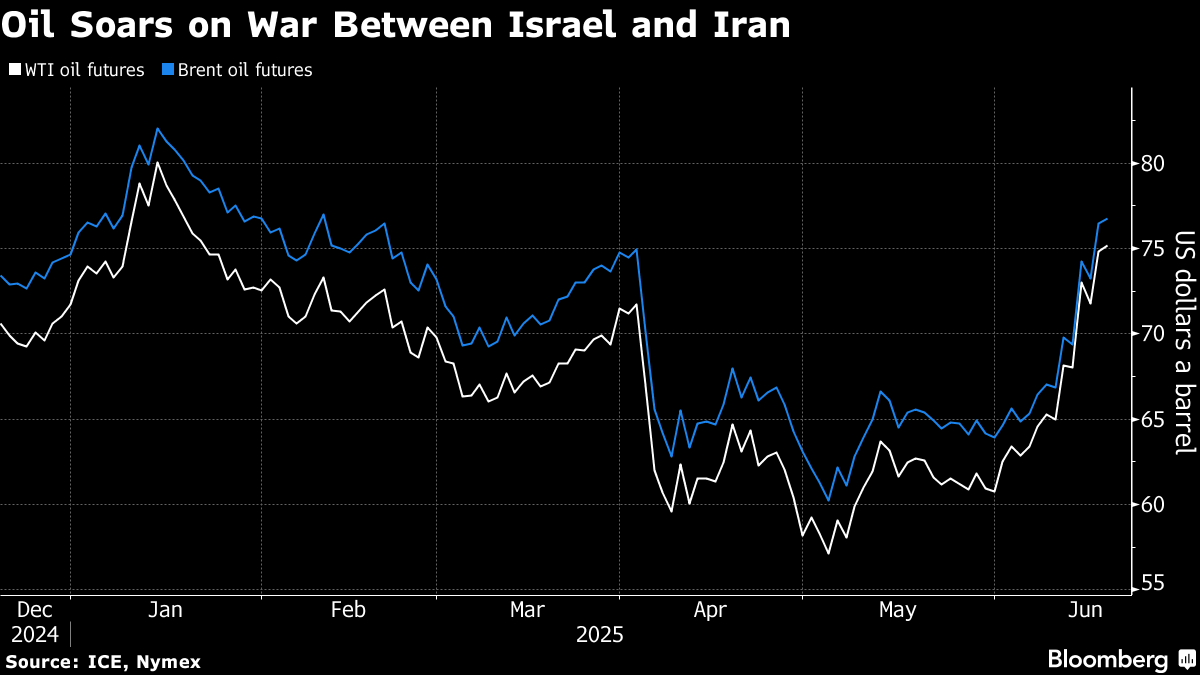

West Texas Intermediate crude climbed as much as 1.1% in Asia after settling at the highest level in almost five months on Tuesday. Shares slipped in Hong Kong but gained in Japan after the S&P 500 closed 0.8% lower in New York. Weaker-than-forecast US economic data on Tuesday added to the equity decline and boosted bonds.

Treasuries edged lower in Asia but still held the bulk of their gains from Tuesday that were driven by geopolitical risks and tepid reports on retail sales, housing and industrial output. Bloomberg’s index of the dollar was little changed after rising the most in a month in the US session.

Oil extended its advance over the past week to about 10% after President Donald Trump on Tuesday demanded Iran’s “UNCONDITIONAL SURRENDER” and warned of a possible strike against the country’s leader — Ayatollah Ali Khamenei — in a social media post. US weapons are seen as crucial to achieving a more complete destruction of the Islamic Republic’s atomic program than anything Israel can do alone.

“Conflicts in the Middle East raise risk premiums, which is a further reason why global equity markets have dipped,” Stephen Dover, chief market strategist and head of Franklin Templeton Institute, wrote in a client note. “But as long as the conflict does not escalate significantly further, we believe risk premiums and oil prices should return to lower levels.”

US retail sales slid for a second month in May, suggesting anxiety over tariffs and their finances prompted consumers to pull back after an early-year spending rush. Industrial production dropped and confidence among homebuilders hit the lowest since December 2022.

“Investors should still expect some volatility in economic data due to lingering effects of trade policy,” said Bret Kenwell at eToro. “The economy and the consumer are holding up for now, but there are signs of vulnerability.”

With Fed officials convening for a two-day meeting in Washington, traders continued to wager on just shy of two quarter-point rate cuts this year — with the first move fully priced in for October. The Fed is expected to keep rates on hold in June and July, but may telegraph its intentions via revised economic and rate forecasts on Wednesday.

A fourth straight meeting without a cut may provoke another tirade from President Trump. But policymakers have been clear: Before they can make a move they need the White House to resolve the big question marks around tariffs, immigration and taxes. Israel’s attacks on Iranian nuclear sites have also introduced another element of uncertainty for the global economy.

“While there has been a strong buy-the-dip mentality with investors having been rewarded for fading negative news this year, we think it’s best to pull back on risk,” said Andrew Tyler, head of global market intelligence at JPMorgan Chase & Co. “Positioning indicates that irrespective of Israel-Iran, the market was setting up for a pullback,” he told clients this week.

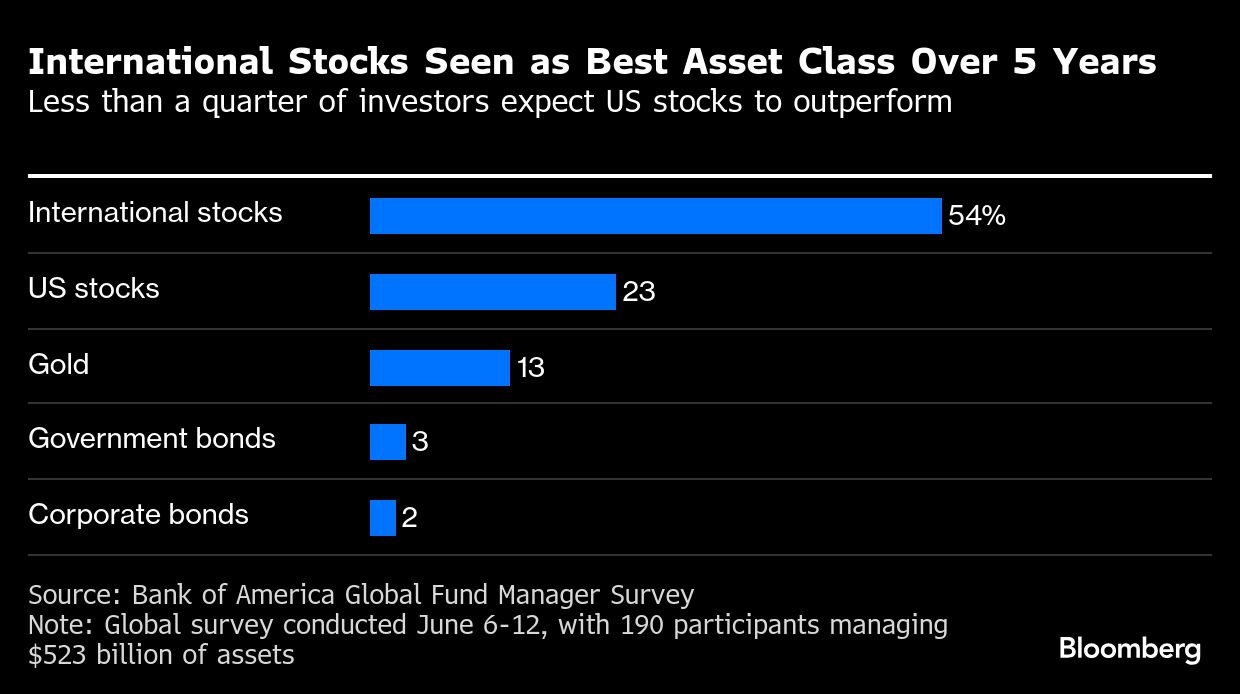

Global stocks will beat US equities over the next five years, according to Bank of America Corp.’s latest fund manager survey, supporting the view that investors increasingly see America’s market dominance as coming to an end.

Some 54% of asset managers expect international stocks to be the top asset class, while 23% picked US equities, according to the survey. Only 13% said gold will deliver top returns, and 5% are betting on bonds. It’s the first time that Bank of America’s survey asked investors to predict which asset class will perform best over a five-year horizon.

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:01 p.m. Tokyo time

- Nikkei 225 futures (OSE) rose 0.7%

- Japan’s Topix rose 0.6%

- Australia’s S&P/ASX 200 was little changed

- Hong Kong’s Hang Seng fell 1.2%

- The Shanghai Composite fell 0.2%

- Euro Stoxx 50 futures fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $1.1498

- The Japanese yen rose 0.1% to 145.08 per dollar

- The offshore yuan was little changed at 7.1890 per dollar

Cryptocurrencies

- Bitcoin rose 0.7% to $105,160.67

- Ether rose 0.7% to $2,528.24

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.40%

- Japan’s 10-year yield declined two basis points to 1.455%

- Australia’s 10-year yield declined one basis point to 4.24%

Commodities

- West Texas Intermediate crude rose 0.5% to $75.25 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.