Oil Holds Losses as Risk Premium Recedes Before OPEC+ Decision

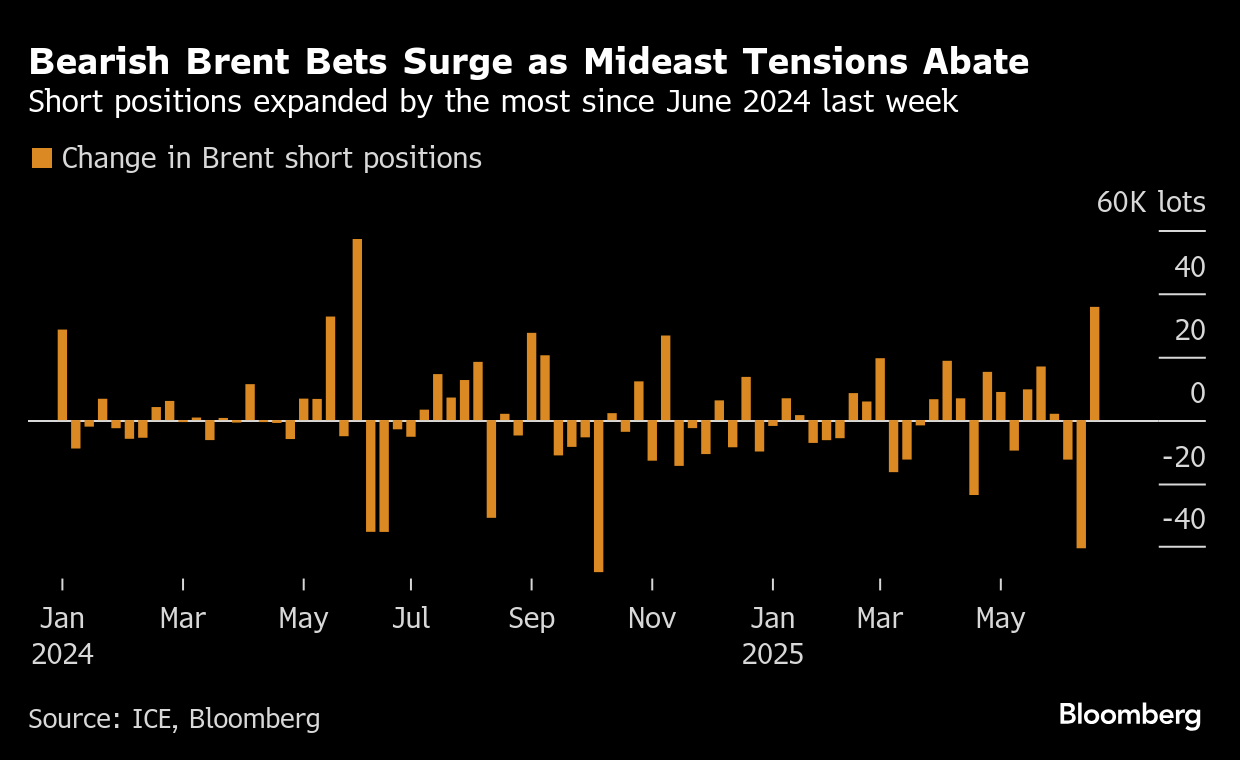

(Bloomberg) -- Oil held its biggest weekly loss in more than two years, as hedge funds piled into bearish bets after a fragile truce between Iran and Israel before a likely OPEC+ supply hike.

Brent traded above $67 a barrel after sliding 12% last week, while West Texas Intermediate was around $65. Iran said it remains skeptical that the US-brokered ceasefire with Israel will last, although President Donald Trump suggested he might back eventual sanctions relief for the Islamic Republic “if they can be peaceful.”

Key members of the Organization of the Petroleum Exporting Countries and its allies are ready to consider another 411,000 barrel-a-day increase for August when they meet on Sunday, according to several delegates. It would be the fourth month in a row the group agreed on such a bumper hike, triple the initially planned volumes.

“The trajectory of Iran’s oil exports and its impact on Brent oil futures will likely move to the background in coming days as markets re‑focus on the OPEC+ supply decision,” said Vivek Dhar, an analyst with Commonwealth Bank of Australia. OPEC+ likely has “an acceptance that a lower oil price will prevent further market share erosion.”

Oil is trading near where it started before Israel first attacked Iran on June 13, with futures on track for a 10% loss this quarter, as focus returns to supply and demand balances. Apart from the potential OPEC+ increase, which may worsen a glut forecast for later this year, investors will be focused on trade talks — with just 10 days until Trump’s country-specific tariffs are set to resume.

There were signs of progress in some negotiations, with Canada rescinding a tax to advance a trade arrangement and seeking a deal by July 21. Meanwhile, the oil demand outlook for China — the biggest crude importer — turned slightly less bearish after factory activity improved for a second month, although it still remained in contraction.

©2025 Bloomberg L.P.