Oil Holds Gain as Trump Maintains Iran Pressure, Stockpiles Fall

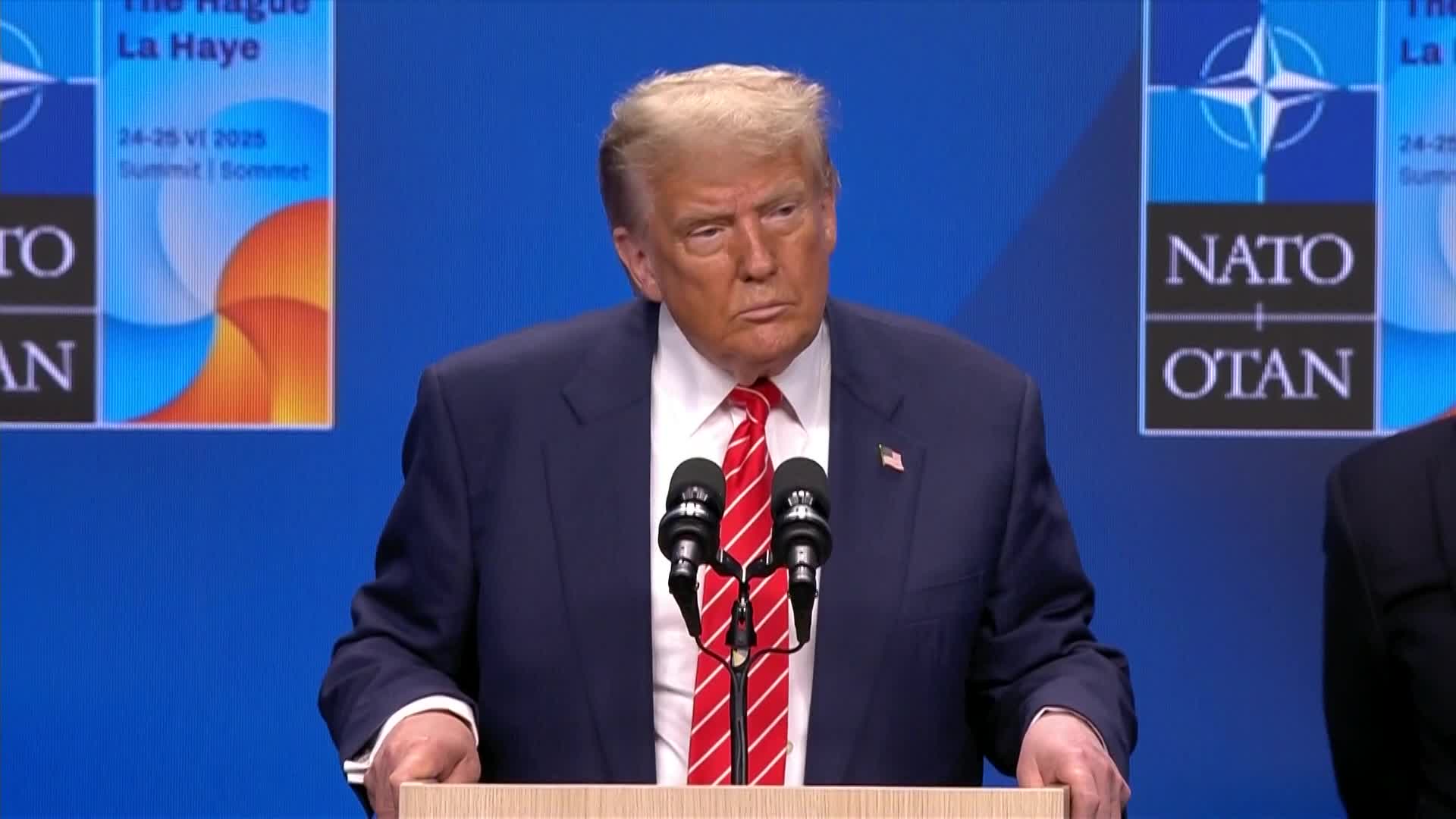

(Bloomberg) -- Oil held a gain after US President Donald Trump said his maximum pressure campaign on Iranian oil will continue, and a government report showed another large decline in American crude stockpiles.

Brent traded near $68 a barrel after closing 0.8% higher on Wednesday, and West Texas Intermediate was above $65. Trump said he’s “not giving up” on the strategy targeting Tehran’s petrodollars, after his comments appeared to undermine the plan. He also flagged talks with Iran next week.

Oil capped the biggest two-day decline since 2022 at the start of the week after Israel and Iran agreed to a truce, easing concerns over potential disruptions to energy supplies from the Middle East. Trump said the conflict was effectively “over” following the US bombing of Iranian nuclear sites.

At a press conference on Wednesday, Trump indicated that US financial penalties are doing little to stop China from buying Iran’s supplies. “If they’re going to sell oil, they’re going to sell oil,” he said. “China is going to want to buy oil. They can buy it from us. They can buy it from other people.”

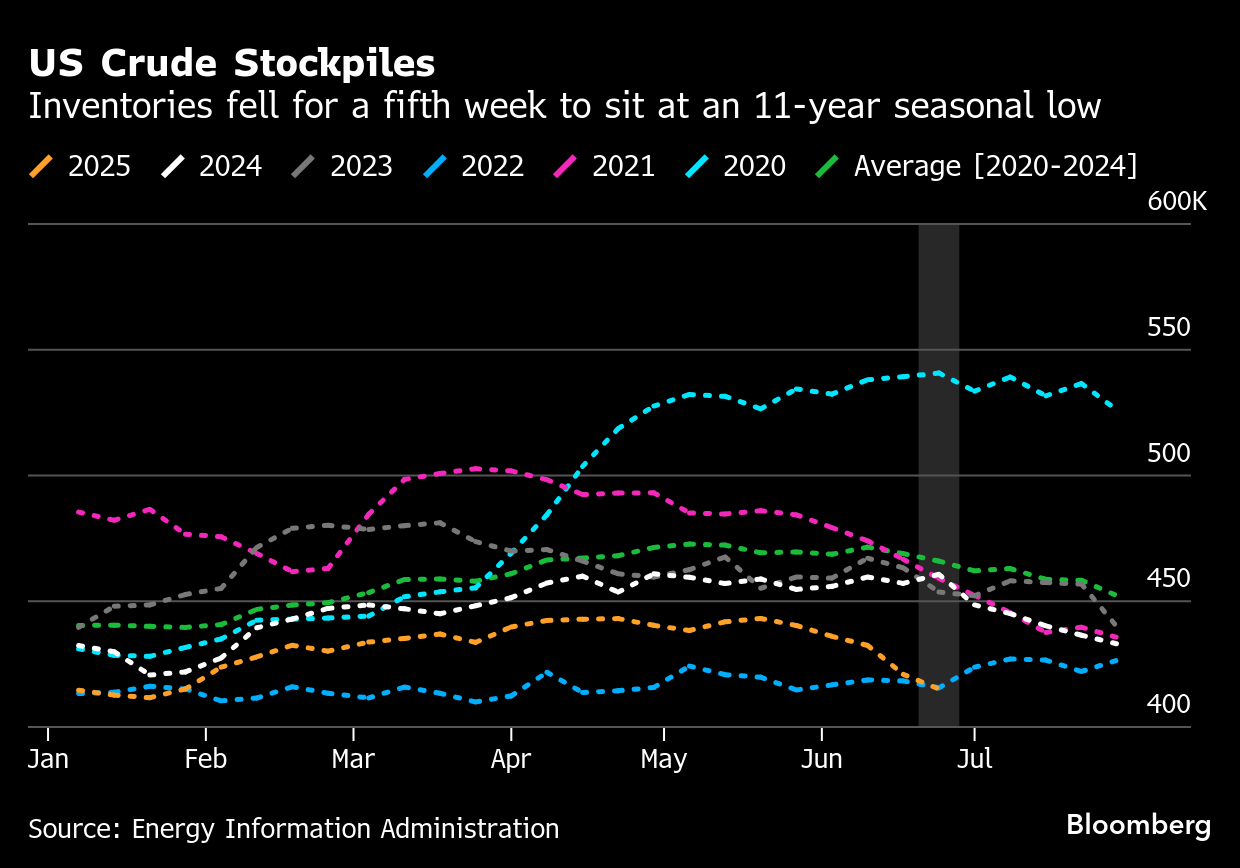

US government data, meanwhile, showed crude inventories dropped for the fifth straight week, shrinking by 5.84 million barrels to an 11-year seasonal low. Stockpiles at the storage hub at Cushing, Oklahoma, also declined, slipping for a third week to the lowest level since February.

US refiners are using more crude to make fuels as Americans hit the roads, taking advantage of low pump prices. Demand for gasoline rose to the highest level since December 2021 last week, according to government figures.

The market will now likely switch its attention to an upcoming OPEC+ meeting on July 6 that will decide on production policy for August. Russia is open to another output hike if the alliance deems an increase to be necessary, according to a person familiar with the matter.

“Near-term seasonal tightness and low inventories may delay a sustained downward trend” in oil prices, said Zhou Mi, an analyst at a research institute affiliated with Chaos Ternary Futures Co. However, with geopolitical risks easing, the focus will turn to OPEC+ hikes and demand headwinds, he said.

©2025 Bloomberg L.P.