Oil Extends Gain as Israel-Iran Conflict Stokes Supply Concerns

(Bloomberg) -- Oil rose after Israel and Iran continued attacks on each other over the weekend, with the market bracing for an escalation that could disrupt supply from a region that produces around a third of the world’s crude.

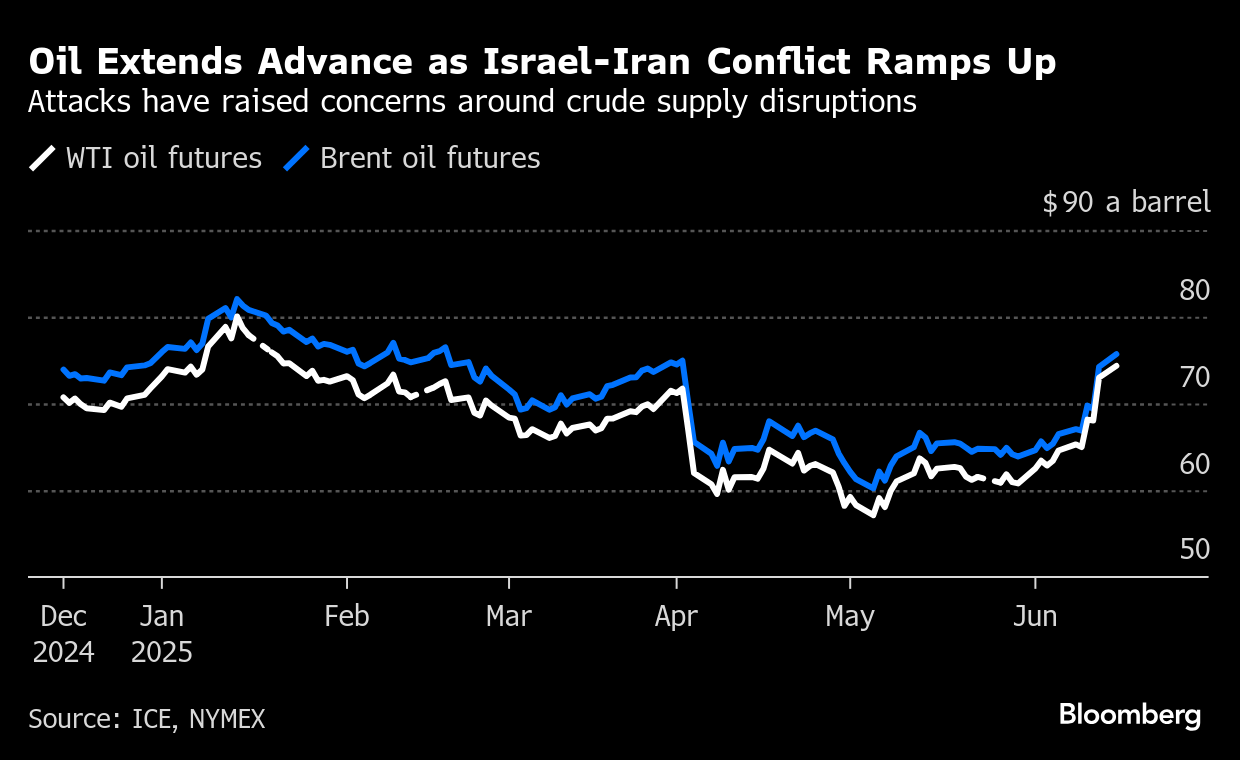

Brent jumped as much as 5.5% at the open before paring gains to trade around $75 a barrel, while West Texas Intermediate was near $74. Israel launched an attack on the South Pars gas field, forcing the halt of a production platform, after strikes on Iran’s nuclear sites and military leadership last week.

While an attack on Iran’s gas-producing infrastructure is a concern, the biggest fear for the oil market centers on the Strait of Hormuz. Middle East producers ship about a fifth of the world’s daily output through the narrow waterway, and prices could soar further if Tehran attempts to block the route.

“We don’t expect to see another significant leg higher in crude prices” unless there are attempts to close the Strait of Hormuz or Iran-backed Houthis in Yemen target shipping, said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp. “We see Brent capped below $80.”

The flare up in tensions has rattled financial markets, with oil jumping more than 13% on Friday before easing, and investors seeking haven assets such as gold. Iran canceled nuclear talks that were scheduled with the US in Oman on Sunday following Israel’s attacks.

Israel’s strike on South Pars triggered a powerful explosion and fire at a gas-processing plant on Saturday, the semi-official Tasnim news agency reported. Iran’s gas is mainly for domestic use and is not widely exported, although a type of oil known as condensate is also produced and shipped overseas.

Iran’s biggest oil customer is China, and attempts to block the Strait of Hormuz would likely disrupt Tehran’s own exports, cutting valuable revenue. From an economic and political standpoint, shutting the waterway doesn’t make sense, according to Muyu Xu, an analyst at Kpler.

So far, Iranian oil export infrastructure remains unscathed, but the hostilities have led to prices clawing back all their losses for the year. Concerns over the fallout from President Donald Trump’s trade policies, and the rapid increase of production quotas by OPEC+ had weighed on futures.

Widely watched market metrics are pointing to fears over prompt supply risks, as well as growing concerns of a protracted conflict in the Middle East. The gap between the grade’s two nearest December contracts — a key indicator on long-term balances — rose by as much as $1.29 a barrel to $3.48.

Options markets are also flashing warning signs, with skews remaining in a bias toward bullish calls in the Asian session as volatility remains high. Volumes were also far higher than usual.

Trump said he believed it’s possible Israel and Iran could reach a deal to end the conflict, but may need to continue fighting before coming to an agreement. “Sometimes they have to fight it out, but we’re going to see what happens,” he told reporters at the White House on Sunday.

“A potential blockage of the Strait of Hormuz by Iran remains the most important market-moving event to watch for, which could tip oil markets into unprecedented territory,” Rystad Energy AS Analyst Mukesh Sahdev said in a note. “There are no signs yet that such a scenario is on the cards.”

©2025 Bloomberg L.P.