Oil Advances as OPEC+ Supply Boost Vies With Geopolitical Risk

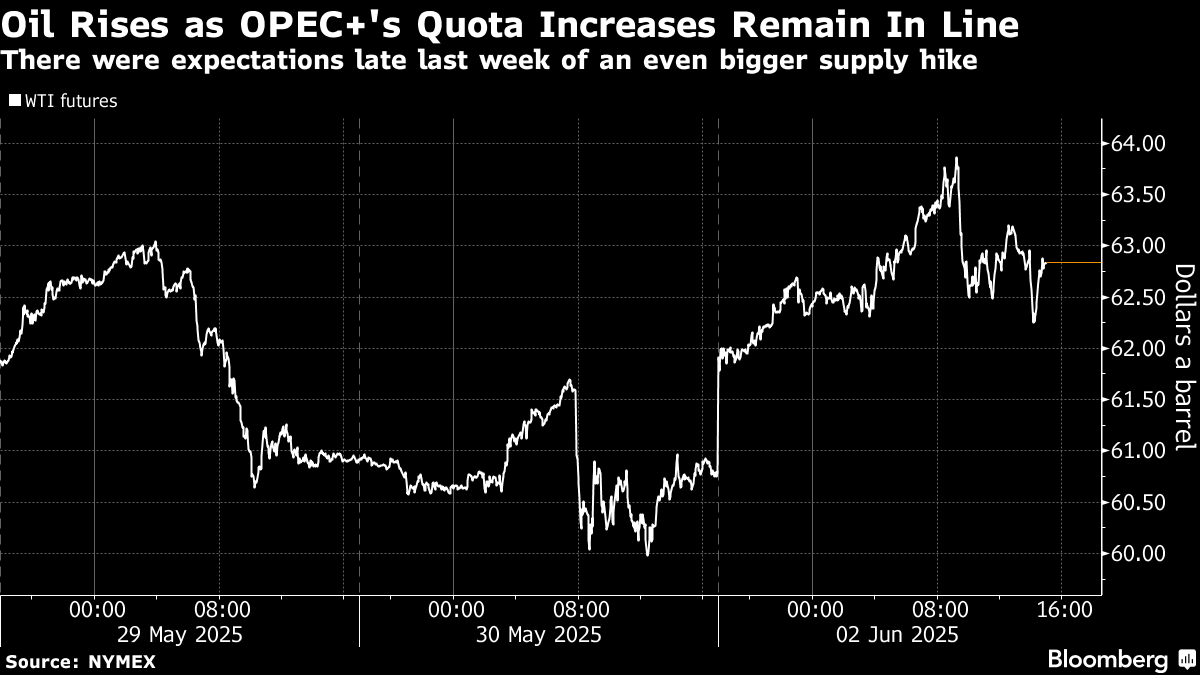

(Bloomberg) -- Oil climbed after OPEC+ increased production less than some had feared and geopolitical concerns flared in Ukraine and Iran.

West Texas Intermediate gained 2.8% to settle near $63 a barrel after the Organization of the Petroleum Exporting Countries and its allies agreed on Saturday to add 411,000 barrels a day of supply in July though some members objected, including Russia. With a handful of countries lobbying for a pause in July, banks are now split on how many more hikes will come in subsequent months.

Monday’s gain — US crude initially added as much as 5.1% before easing alongside broader markets — is also likely being aided by an unwinding of bearish bets made in advance of the decision. The group had been considering returning even more volume late last week, and speculative short positions in global benchmark Brent already were the highest since October prior to the meeting.

“The worst of the fears was laid to rest,” said Keshav Lohiya, founder of consultant Oilytics. “Brent shorts are now at the highest level in 2025, which makes sense given the bearish headlines coming out of OPEC. However, this is creating a recipe for a spike if spot healthy market fundamentals continue to roll on.”

Other bullish catalysts for crude are driving the advance, too. Ukraine struck air bases deep in Russia, while Iran criticized a report showing its growing stockpiles of enriched uranium, escalations that reduce the chances of more supply from the sanctioned OPEC+ members entering the market. Wildfires in Canada are also threatening output in the world’s fourth-largest producer.

US futures pierced the 50-day moving average, a technical marker had largely helped keep a lid on prices over recent weeks. Alongside OPEC+’s output hikes, oil has taken direction from the fortunes of the trade war between the US and China, which threatens to sap consumption this year.

Prices briefly pared gains late in the session after Axios reported that a recent version of Washington’s nuclear deal proposal would allow Tehran to continue enriching uranium.

©2025 Bloomberg L.P.