Saudis Ask OPEC Watchers for Data Change to Meet Quota

(Bloomberg) -- Saudi Arabia is asking the companies that OPEC uses for independent analysis of oil-production levels to submit a lower figure for the kingdom’s June output, according to people familiar with the matter.

Riyadh is arguing that the standard practice — measuring oil production — wasn’t appropriate for the month, and that they should instead adopt a different metric called supply-to-market, said several people at the firms, who asked not to be identified as the process is private.

Such requests are unusual and would allow Saudi Arabia to stay within output quotas that Riyadh encourages other producer nations to stick to. The metric they’re being asked to use would give a figure that’s about 400,000 barrels a day lower over the month, one of the people said.

Saudi Arabia’s energy ministry said on X that it complied fully with its OPEC quota in June, citing a marketed-supply figure of 9.352 million barrels a day. The kingdom “briefly” pumped more than it supplied, amid heightened geopolitical tensions at the time, it said.

The International Energy Agency — which OPEC dropped as a secondary source in 2022 — reported on Friday that the Saudis surged production by 700,000 barrels a day in June to 9.8 million, as the country led a rush by Gulf nations to export barrels out of the region during the Israel-Iran conflict. That would be in excess of their current quota.

Output swings from the world’s biggest crude exporter can gyrate prices, and have grown especially critical in recent months as Riyadh leads OPEC+ in reviving supplies while chastising group members who exceed their targets.

The Organization of the Petroleum Exporting Countries assesses members’ output using an average of external firms — made up of consultants and media outlets — known as secondary sources, and publishes these in a monthly report that is closely watched by traders.

The difference between supply-to-market and production is that the former captures what customers really took whereas the normal measure is what gets pumped out of the ground.

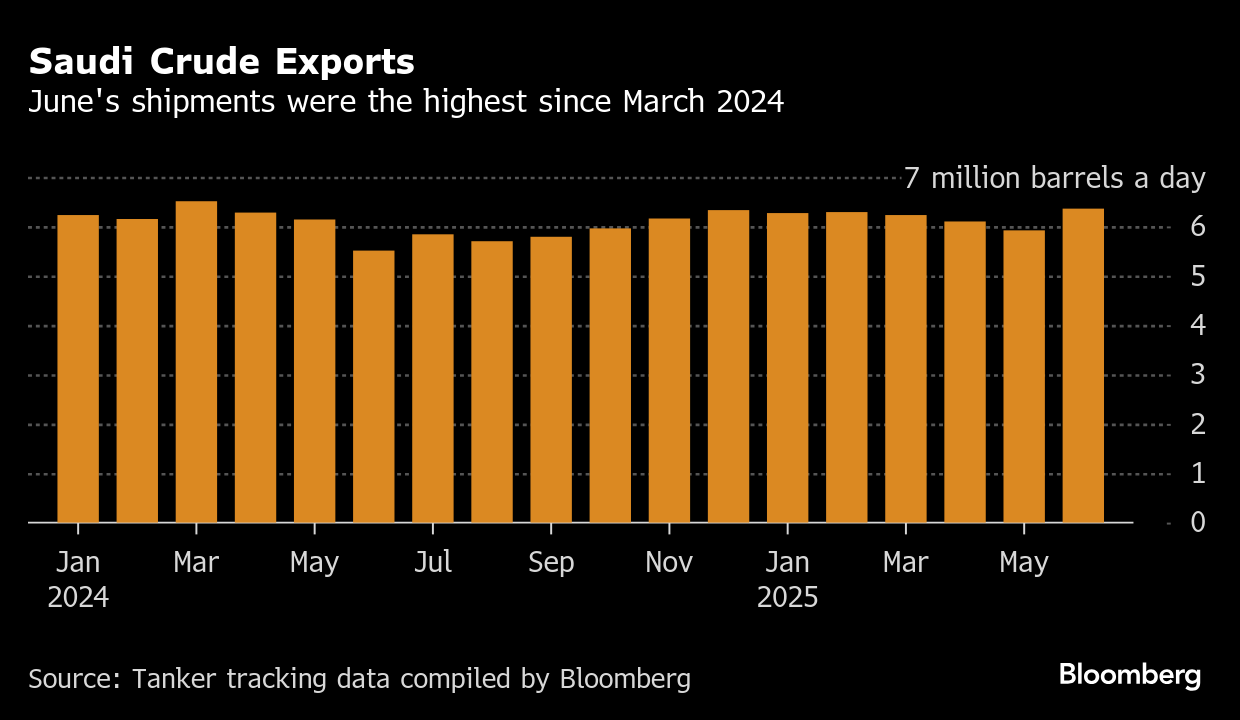

Tanker-tracking data had already pointed to a sharp jump in Saudi crude exports last month, prompting speculation that the kingdom and other Gulf nations had sought to re-position supplies outside the region during the conflict. The IEA report is the first clear evidence that the flood of shipments translated into a major jump in production.

Last month’s military confrontation between Israel and Iran heightened the risk of a disruption in the Strait of Hormuz, a vital choke-point from Middle East oil, and a surge in shipping flows.

Saudi Arabia pushed more barrels into domestic storage and also to storage locations overseas, it said in the statement on X. The increase also enabled the country to “optimize” the flow of crude between the eastern and western hemispheres, it said.

State oil company Saudi Aramco has strategic international delivery points located in the Netherlands, Egypt, Japan and South Korea.

Shipments toward the Sumed pipeline in Egypt, where oil can be stored for onward delivery to Europe and North America, rose by about 5 million barrels, or 170,000 barrels a day, last month, tanker-tracking data compiled by Bloomberg show.

The supply—to-market figure excludes changes in stockpiles and would be closer to the kingdom’s agreed OPEC+ quota for June of 9.37 million barrels a day, the people said.

Riyadh’s Frustration

Riyadh’s frustration with fellow members of the OPEC+ alliance that have flouted their quotas, such as Kazakhstan, has reached boiling point this year.

The kingdom’s decision to steer the Organization of the Petroleum Exporting Conuntries to quickly revive oil production over the past few months was driven in part by impatience at shouldering much of the burden for balancing markets while the Kazakhs and others disregarded their own targets, delegates have said.

OPEC+ plans to complete the reversal of a 2.2 million-barrel cutback with a final monthly hike of about 548,000 barrels in September, officials have said, despite warnings from the IEA and others that global oil markets are headed for a surplus.

The agency said in its monthly report on Friday that supplies outside OPEC+, led by the US, Guyana and Canada, will swell by 1.4 million barrels per day this year, roughly double the pace of growth in world oil consumption. Brent crude futures traded near $69 a barrel.

(Updates with Saudi comments from fourth paragraph.)

©2025 Bloomberg L.P.