S&P 500 Rally Takes a Break as Bond Yields Climb: Markets Wrap

(Bloomberg) -- Stocks slid from all-time highs as Donald Trump intensified his trade offensive, sending the dollar higher. Concerns about the potential inflationary impacts of tariff hikes weighed on the Treasury market. Oil rallied as traders braced for fresh US efforts to crimp Russian energy exports.

Following a rally that drove the S&P 500 to its fifth record in nine trading days, equity bulls took a breather. While about 400 shares in the benchmark retreated, Nvidia Corp. led a rebound in big tech, pushing the market away from session lows. Kraft Heinz Co. jumped as the Wall Street Journal reported the company is preparing to break itself up. The six biggest US banks are set to report earnings next week, with analysts predicting trading-revenue increases.

Trump threatened a 35% tariff on some Canadian goods and raised the prospect of increasing levies on most other countries, ramping up his trade rhetoric. The US president told NBC News he’s also eyeing blanket tariffs of 15% to 20% on most trading partners. The current global baseline minimum tariff rate for nearly all US trading partners is 10%.

“The stock market is looking lower due to President Trump’s more hawkish stance on tariffs,” said Matt Maley at Miller Tabak. “With the market overbought and very expensive, the market is getting ripe for some sort of a pullback.”

Bond declines were led by longer-dated debt. The greenback rose against most major currencies. The pound saw its longest losing streak this year amid UK growth concerns. Bitcoin topped $118,000 for the first time.

While negative trade headlines and tariff threats may multiply in the coming weeks, US trade policy will likely move toward greater stability in the second half of the year, according to Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

“Our base case is that the effective US tariff rate will land near 15% by year-end, slowing the US economy over the next six months but not causing a recession,” she said. “Many of the most heavily weighted US equities in the S&P 500 are fairly insulated from tariff risk, in our view, and we think the index can climb to 6,500 by June next year despite periodic volatility.”

The gauge closed Thursday on the edge of 6,300.

Investors are counting on US stocks to rally on the back of a robust earnings season, before the market loses steam toward year-end, according to Bank of America Corp. strategists. Client feedback suggests “no one” is worried about the economy or equity valuations, strategist Michael Hartnett wrote in a note.

Meantime, Citigroup Inc. strategists led by Beata Manthey said gins in global equities will slow over the coming 12 months, adding that earnings expectations appear relatively optimistic given the “highly uncertain” outlook.

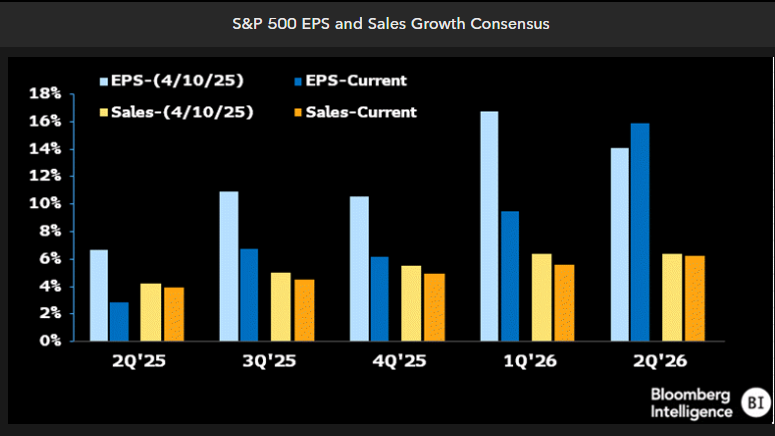

Wall Street expects very little from S&P 500 companies this earnings season, with analysts projecting S&P 500 profits to rise 2.8% year over year — the slowest growth rate since 2023, according to data compiled by Bloomberg Intelligence. That would be a sharp slowdown after a 14% jump in the previous quarter.

“We believe second quarter earnings will be good, but not as good as first quarter,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “Much of the second quarter was marked with tariff and trade issues and that may have caused some dislocations in earnings for certain industries as their customers may have been in a holding pattern.”

That said, Landsberg noted that he believes expectations “are a bit low” for S&P 500 earnings.

“While we do acknowledge the volatility and the unknown picture the tariffs have brought, we think earnings will be better overall than current projections. This low bar, if cleared, should be a positive for market performance,” he added.

While bulls and bears may debate the rally’s sustainability, the recent steadying of corporate profit estimates suggests the earnings season could serve as the ultimate factor in determining whether stocks can extend gains or transition into a more protracted, choppy consolidation phase,” according to Mark Hackett at Nationwide.

“What is clear, however, is that bears are on their heels and are hesitant following a barrage of whipsaws this year,” he noted.

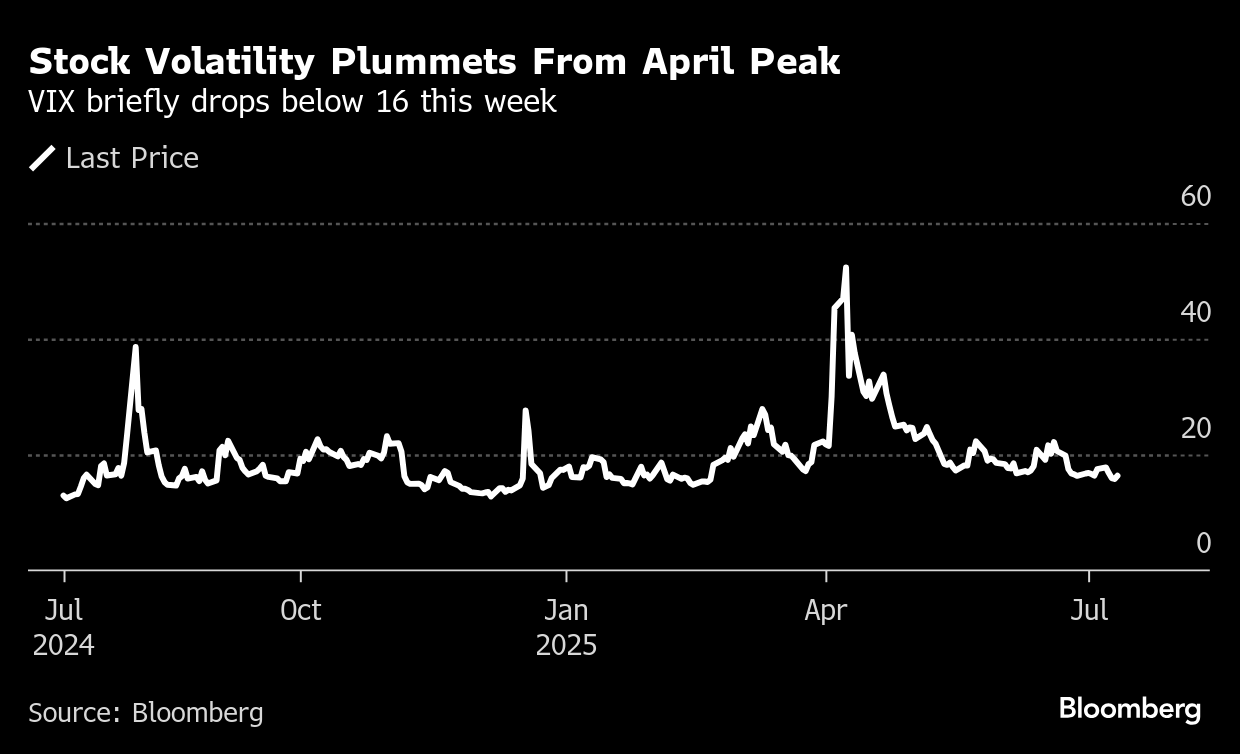

Historically, when the S&P 500 has surged more than 20% in two months or less — as it did in the second quarter — it has consistently been higher a year later in all 10 prior instances, with an average gain greater than 15%, Hackett said. Meantime, volatility has collapsed, with the VIX falling below 16 earlier this week.

“Wall Street strategists continue to capitulate on their bearish shift from April, with several upgrades this week to year-end price targets,” he added. “Sentiment and positioning are no longer pessimistic, though there are few signs of complacency, and retail and institutional buying show no signs of fading.”

Sellers are growing scarce in the US stock market, a potentially ominous sign of overconfidence. When stocks do decline, there appears to be little conviction behind the moves: Trading volume for stocks that are falling has accounted for just 42% of total turnover on US exchanges over the past month, on average. That’s the least since 2020, according to data compiled by Thrasher Analytics.

The phenomenon is a signal that investors may have grown overly exuberant during the market’s blistering rebound, said Andrew Thrasher, the firm’s co-founder. It has preceded past pullbacks in stocks, with the S&P 500 dropping at least 5% in the last three instances, which occurred in 2020, 2019 and 2016, Thrasher’s data showed.

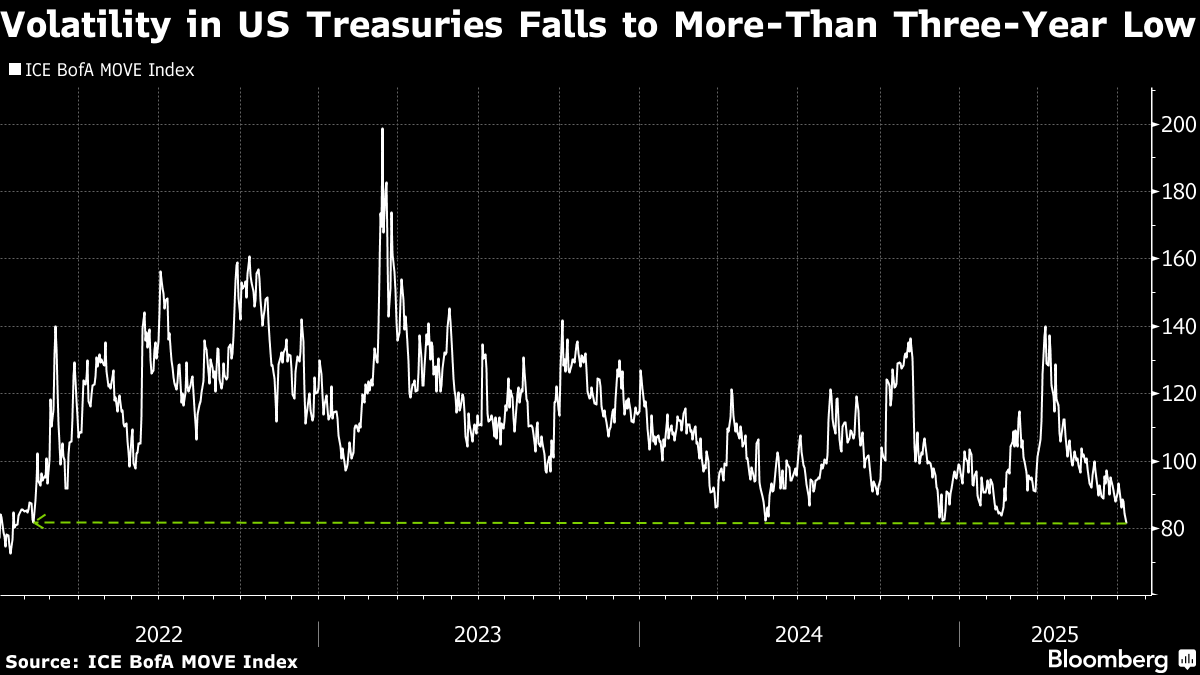

The ICE BofA MOVE Index, a measure of expected fluctuations in yields, closed at its lowest level since early 2022 on Thursday. In another sign of optimism, auctions this week for US 10-year and 30-year government bonds received ample demand.

Strategists at RBC Capital Markets pushed back their forecast for the Federal Reserve to resume easing to December from September, saying policymakers need more time to assess inflation and labor market conditions.

“‘Wait-and-see’ mode is only going to be broken by some evidence that tariff-related inflation has topped out and remains relatively contained (i.e. not spilling over into non-tariffed goods or services or impacting longer-run inflation expectations), and some further softening in labor markets,” Blake Gwinn and Izaac Brook wrote in a note Friday. “Neither one of these is likely to be enough on its own.”

Trader attention will shift next week to inflation, with the June consumer price index due Tuesday.

“We think June will show more evidence of tariff pass-through, but the overall push remains mild with some heavily tariffed goods still showing weakness,” said Morgan Stnaley economists led by Michael Gapen. “We forecast a more meaningful tariff-related acceleration in July and August.”

Corporate Highlights:

- AMC Entertainment Holdings Inc. jumped after Wedbush upgraded the movie-theater operator to outperform, saying the company “is poised to benefit from a more consistent release slate over the next several quarters.”

- Capricor Therapeutics Inc. tumbled after US regulators rejected the company’s treatment for a deadly muscle disorder.

- Levi Strauss & Co. climbed after raising its revenue outlook, with the maker of 501 jeans expecting sales growth to outweigh the effect of President Donald Trump’s tariffs.

- Texas Instruments Inc. was upgraded to buy at TD Cowen, which said the chipmaker is uniquely positioned as industry cycle improves.

- Tesla Inc. will open its first showroom in India on Tuesday and begin deliveries as early as next month, according to people familiar with the matter, as the Elon Musk-led electric vehicle maker looks to tap potential demand in the third-largest automobile market to counter slowing sales elsewhere.

- A group of Microsoft Corp. investors is pressuring the company to assess how effectively it identifies customers who misuse its artificial intelligence tools, a push that follows reports detailing

- Delta Air Lines Inc. has been cannibalizing new Airbus SE jets in Europe by stripping off their engines and using them to get grounded planes in the US back into service, as it seeks to overcome a shortage and avoid aircraft import tariffs.

- Exxon Mobil Corp. is tapping oil inventories stashed in US emergency reserves as the nation’s refiners grapple with quality issues in crude supplies coming from the Gulf of Mexico.

- BASF SE warned that earnings will come in lower than previously expected this year as US tariffs and geopolitical uncertainties crimp demand.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.3% as of 2:11 p.m. New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average fell 0.6%

- The MSCI World Index fell 0.4%

- Bloomberg Magnificent 7 Total Return Index rose 0.5%

- The Russell 2000 Index fell 1.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.1690

- The British pound fell 0.5% to $1.3512

- The Japanese yen fell 0.8% to 147.41 per dollar

Cryptocurrencies

- Bitcoin rose 3.5% to $117,578.03

- Ether rose 6% to $2,990.55

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 4.42%

- Germany’s 10-year yield advanced two basis points to 2.72%

- Britain’s 10-year yield advanced three basis points to 4.62%

Commodities

- West Texas Intermediate crude rose 2.7% to $68.37 a barrel

- Spot gold rose 0.9% to $3,355.13 an ounce

©2025 Bloomberg L.P.