Oil Market’s Focus Shifts to Demand as Trump Reignites Trade War

(Bloomberg) -- While US President Donald Trump’s chaotic tariff strategy has disrupted the oil market for months, his renewed attacks on trading partners this week have solidified consensus on at least one matter: The outlook for crude demand is set to worsen.

Investors in oil had largely overlooked trade news for weeks as the conflict in the Middle East commanded price action, but Trump’s recent barrage of tariff letters — containing some of the highest tax rates yet — is reviving concerns that a global trade war will reduce crude consumption.

The prospect of waning demand is dealing another blow to a market already suffering from widespread expectations of a glut later this year. In addition to the trade war, a dour economic outlook for top crude importer China is fueling concerns that the market will struggle to absorb extra supply in the second half of the year.

“All the focus is on demand and tariffs,” said Joe DeLaura, global energy strategist at Rabobank.

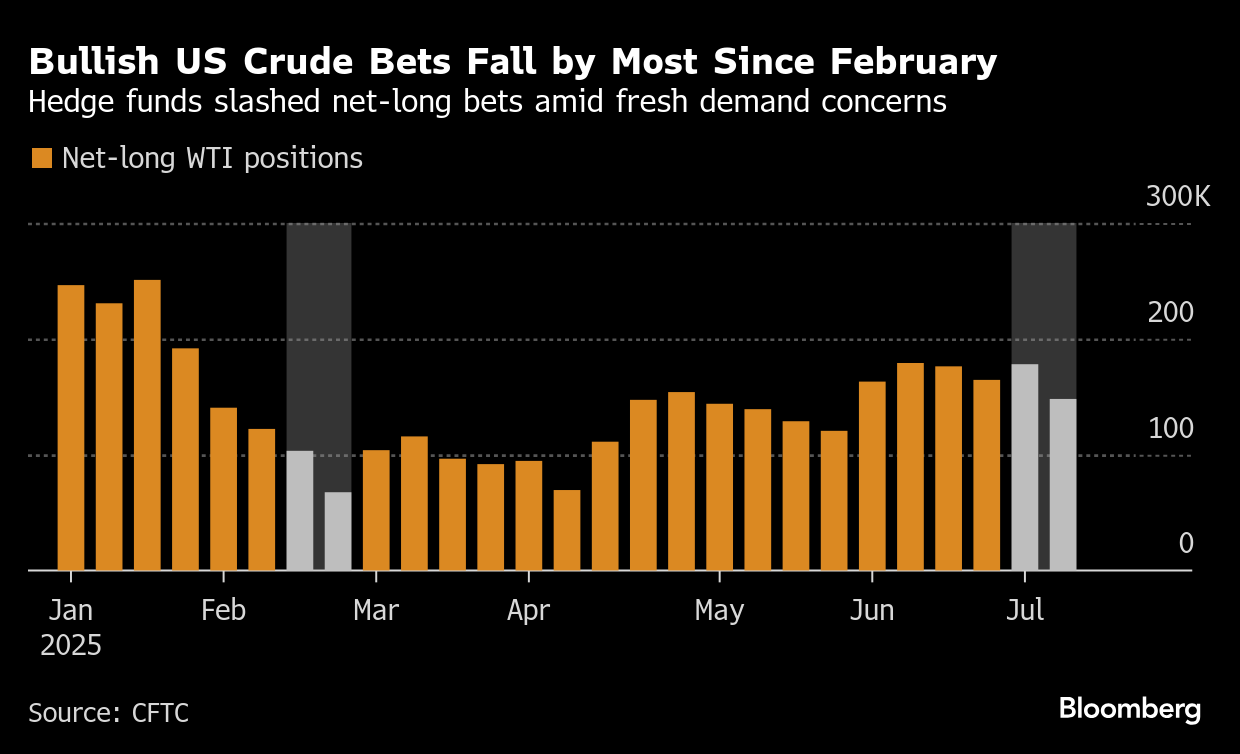

The rapidly weakening outlook triggered the sharpest drop in hedge fund sentiment on oil since February. Money managers slashed their bullish position in US crude by 29,994 lots to 148,106 lots in the week ended July 8, according to the Commodity Futures Trading Commission. Short-only bets rose to a five-week high, the figures show.

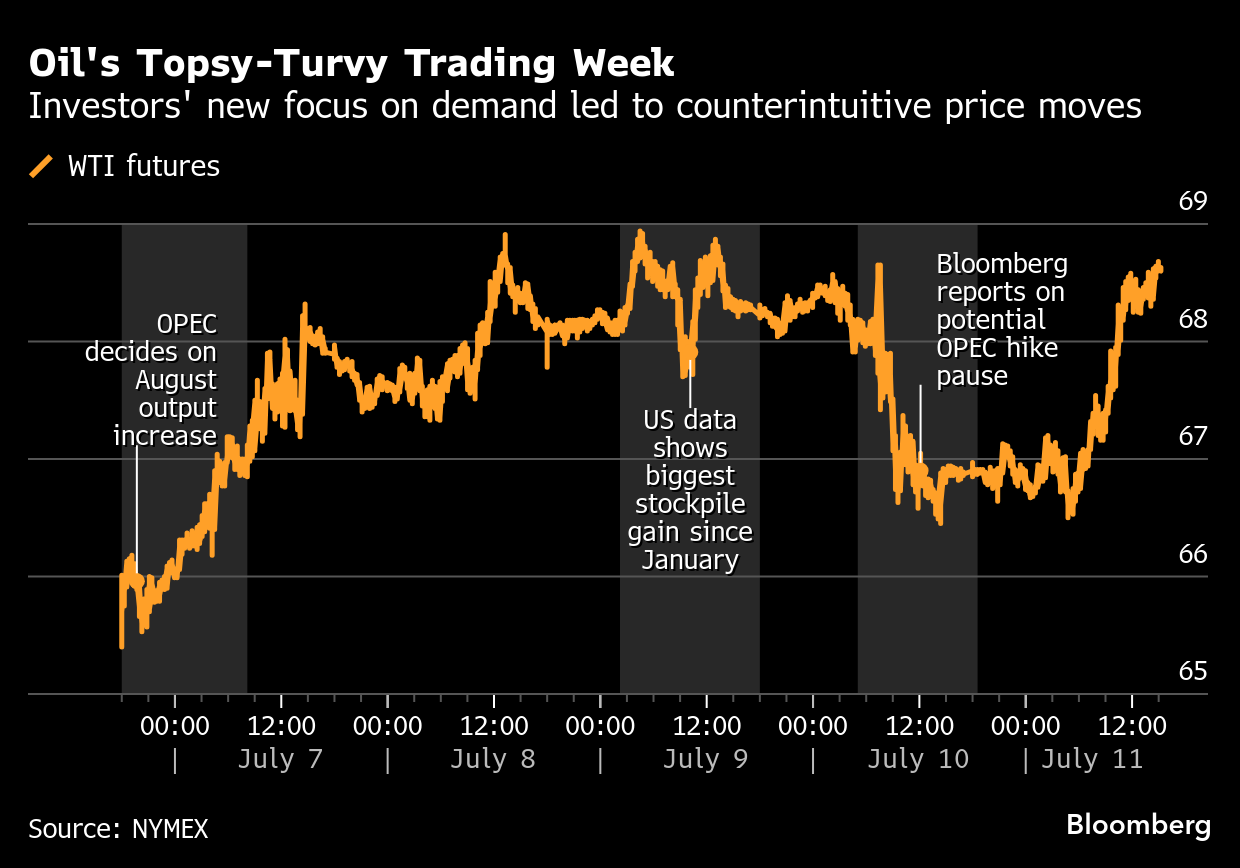

This week’s price moves also illustrate just how much demand concerns are driving the market. Oil futures shrugged off a decision by OPEC+ on Sunday to bring back more production than expected in August and instead rose after Saudi Arabia hiked prices for customers in Asia, which was viewed as a vote of confidence in demand.

The topsy-turvy trading continued on Wednesday, when UAE Energy Minister Suhail Al Mazrouei’s comments that the market needs more barrels pushed prices higher, even as data showed US crude inventories rose the most since January last week.

“If crude isn’t going to sell off from a bigger-than-expected OPEC production unwind and a 7 million-barrel crude build, what exactly is it supposed to sell off on?” said Jon Byrne, an analyst at Strategas Securities.

Crude did have one selloff last week, and again, it defied typical oil-market physics. Bloomberg reported that OPEC+ may halt output hikes, but instead of futures rising on the limit to supply, they fell 2.2% as investors interpreted the news as a sign of limited conviction that demand can keep up with output.

The shift in focus is complicating the cartel’s communications with the market, forcing traders to parse both overt supply messages and second-order demand signals every time the group makes a statement.

“Supply and demand balances have been challenging to track lately,” said Mark Malek, chief investment officer at Siebert. “You have all kinds of factors that we never had traditionally,” including a burgeoning gray market and a fast-evolving news cycle.

“You don’t see the clear patterns that you used to see in crude,” he added.

In the near term, the peak driving season in North America and healthy refiner margins are propping up consumption, while OPEC members have been hard-pressed to ramp up output to meet their 411,000-barrel production goal for July.

“When you really look at exports compared to imports, you see a relatively balanced market,” said Samantha Hartke, Americas head of market analysis at Vortexa. Still, “any indications of supply or demand weakness can easily tip the scale one way or another.”

But expectations of demand deterioration are spreading. The International Energy Agency on Friday projected that world oil consumption will grow by just 700,000 barrels a day in 2025, the slowest pace in 16 years outside of the 2020 pandemic slump. The largest quarterly contractions occurred in countries in the crosshairs of the trade war, including China, Japan, Korea, the US and Mexico, the agency said.

Trump’s tariffs threaten to exacerbate the situation, with levies including a 50% tax on imports from Brazil — a significant supplier of crude to the US — potentially upending flows.

Still, some lingering geopolitical tensions are preventing bearish sentiment from completely overtaking crude prices. Trump said he’ll make a “major statement” on Russia on Monday, raising speculation he’ll push to curtail Moscow’s oil exports. Meanwhile, deadly Houthi attacks in the Red Sea are maintaining concerns about key oil trade routes.

More importantly, the oil market may take its cues from several major economic reports scheduled for the coming weeks, including US consumer price index data that may sway the path of monetary policy in the world’s biggest economy.

“Prices are simply not justified,” said Scott Shelton, an energy specialist at TP ICAP Group Plc. “The outlook for crude oil prices appears bleak to me.”

©2025 Bloomberg L.P.