Oil Holds Gain With Middle East Tensions, US Stockpiles in Focus

(Bloomberg) -- Oil steadied after a modest advance with tensions in the Middle East and US inventories in focus.

Brent crude traded near $67 a barrel after rising 0.6% on Tuesday, with West Texas Intermediate above $65. Iran is said to be cutting off communication with key United Nations watchdog officials, deepening uncertainty over its nuclear program and adding ambiguity to its diplomatic showdown with Washington. Meanwhile, US President Donald Trump said Israel had agreed to the conditions needed for a 60-day ceasefire in Gaza.

“Warfare is non-linear and any small action could prove a flash point eventually,” said June Goh, senior oil market analyst with Sparta Commodities in Singapore. “The Iran-Israel ceasefire may not last long and the market will be quick to react again following a return to conflict.”

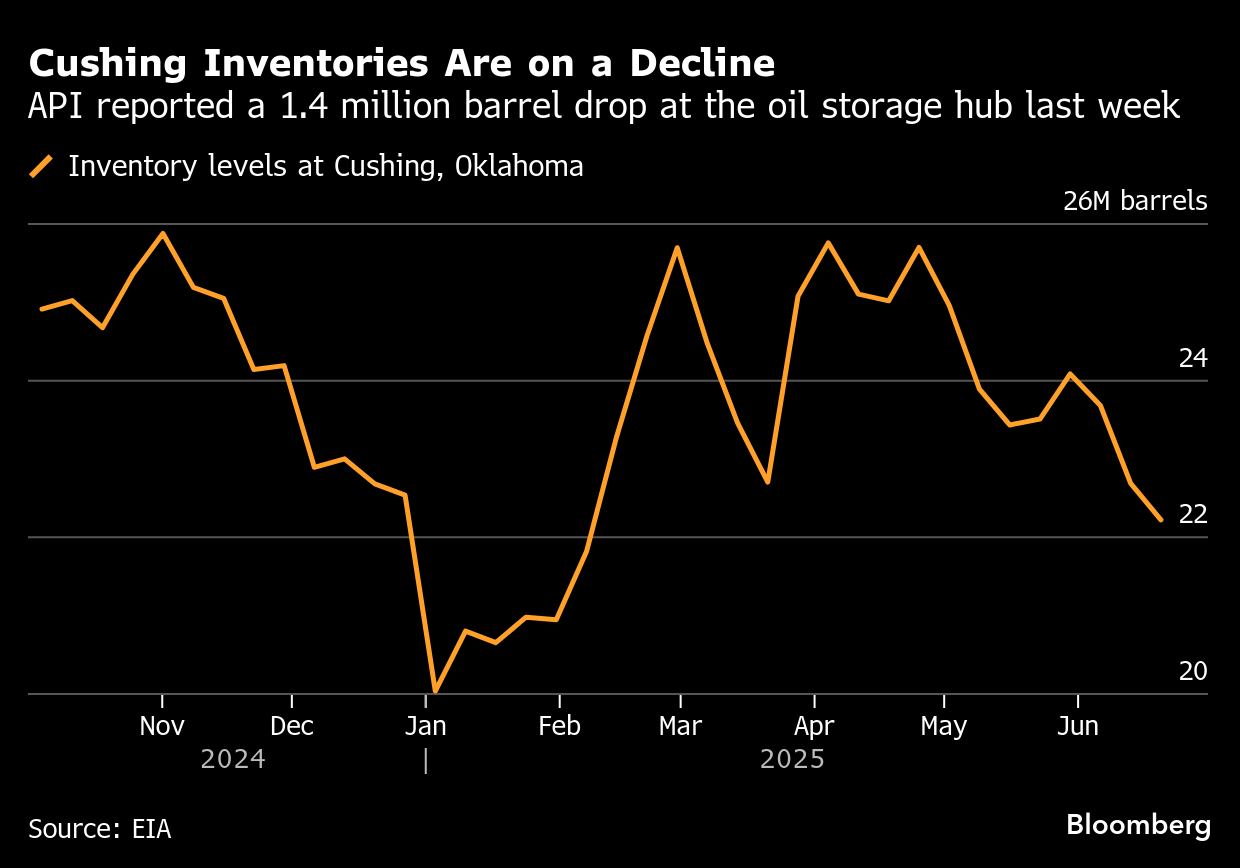

In the US, the American Petroleum Institute reported a 1.4 million barrel drop for last week at the Cushing oil storage hub — the pricing point for WTI — even as nationwide stockpiles increased slightly, according to people familiar with the data. The decline at Cushing would be the biggest since January if confirmed by official data due later Wednesday and would bring stockpiles at the hub to their lowest seasonal level since 2005.

Trading activity in crude futures has declined since the latest hostilities between Israel and Iran, with volatility returning to levels seen before the war. Concerns are likely to return to a glut forecast for later this year, with an OPEC+ meeting this weekend expected to deliver another substantial increase in production quotas.

©2025 Bloomberg L.P.