Oil Holds Decline With Trade Talks, Russia Energy Curbs in Focus

(Bloomberg) -- Oil was little changed after its first weekly drop this month, with the focus on US trade deal progress — including with the European Union — and the bloc’s efforts to curb Russian energy exports.

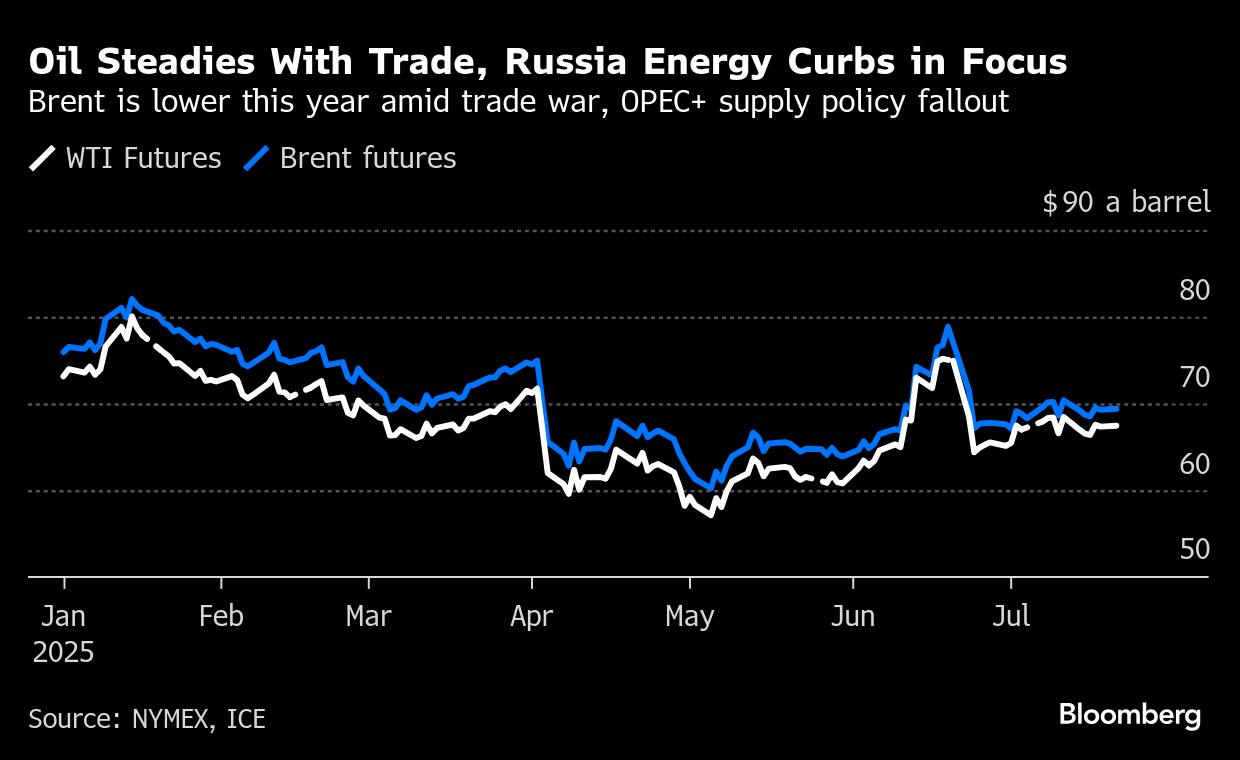

Brent crude held near $69 a barrel after falling 1.5% last week, while West Texas Intermediate was above $67. EU envoys are set to meet as early as this week to formulate a plan for measures to respond to a possible no-deal scenario with US President Donald Trump, whose tariff negotiating position is seen to have stiffened ahead of an Aug. 1 deadline.

Late last week, the 27-nation bloc agreed to a lower price cap for Moscow’s crude as part of a package of sanctions against Moscow. The measures include curbs on fuels made from Russian petroleum, additional banking limitations and a ban on a large oil refinery in India and a few Chinese entities. The UK joined the EU efforts.

Beijing on Monday protested the EU sanctions and said it will take necessary measures to resolutely “safeguard the legitimate rights and interests of Chinese firms and financial institutions.”

China and India became the main buyers of Russian crude when global flows were reshaped following Moscow’s 2022 invasion of Ukraine. The shipments have so far not been impeded by western restrictions on supplies from Moscow.

“The fact that the US has yet to support the new EU price cap will obviously make it hard to enforce,” said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp. “However, Friday’s EU ban on imports of petroleum products made from Russian crude will add to the tightness in product in the West.”

Oil has trended higher since early May, but Brent is still down about 7% this year as Trump ratchets up his trade war and OPEC+ relaxes supply curbs. Prices have been jolted by developments in the Middle East, as well as sanctions on crude from producers including Russia and Iran.

Diesel’s price relative to crude in Europe, a gauge for profitability of producing the fuel, was near the highest since March 2024 while its prompt time spread — the difference between its closest two contracts — also rallied on Friday, widening its bullish backwardation structure.

©2025 Bloomberg L.P.