Oil Dips as Traders Take Stock of US Tariffs and OPEC+ Shift

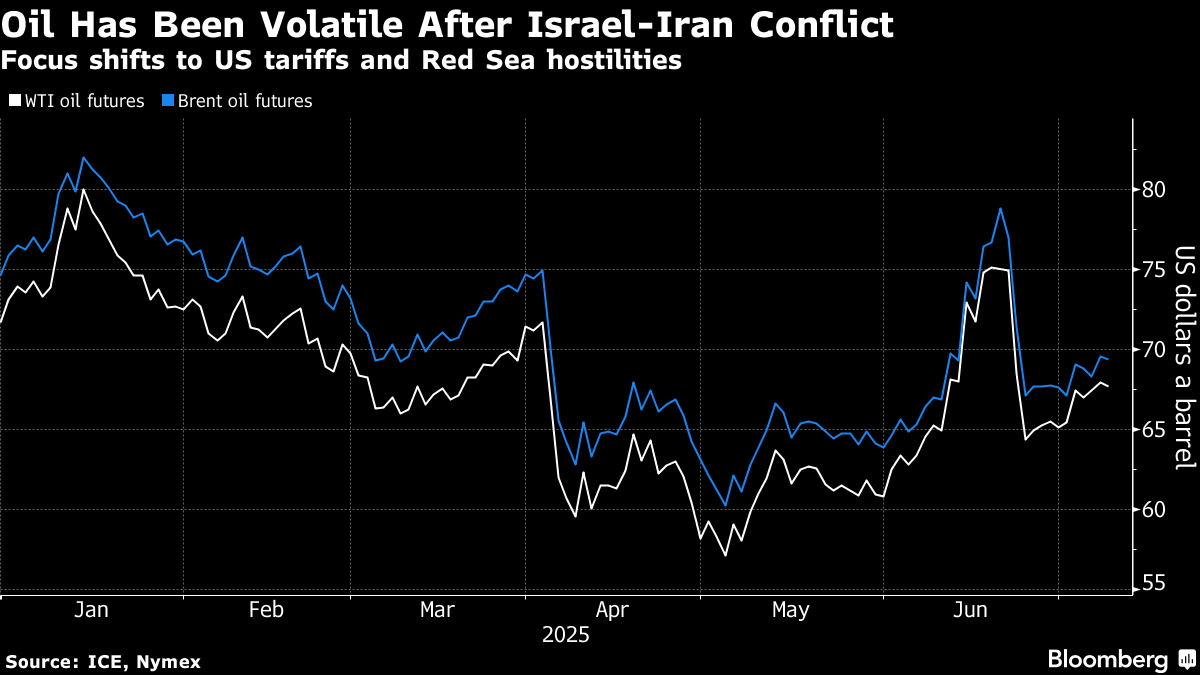

(Bloomberg) -- Oil slipped for the third time in four days as investors focused on the fallout from a wave of US trade levies and a decision by OPEC+ to restore more of the group’s idled capacity.

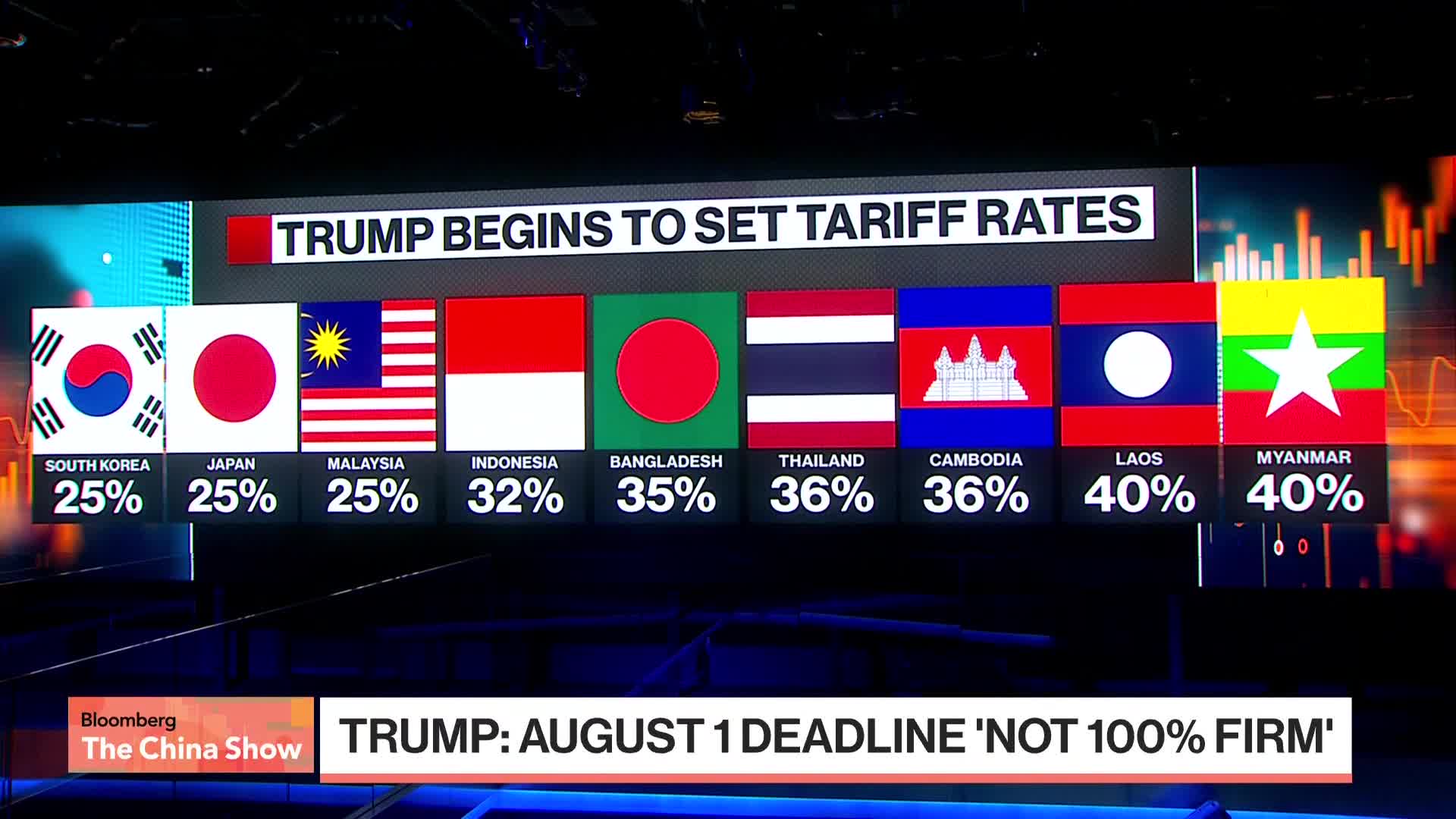

Brent dipped toward $69 a barrel and West Texas Intermediate was below $68. President Donald Trump threatened new tariff rates on trading partners, while suggesting that he was still open to negotiations. The duties on countries including Japan and South Korea won’t take effect until at least Aug. 1.

“Traders are watching Trump’s new tariff threats and global growth risks, which could soften demand,” said Haris Khurshid, chief investment officer at Karobaar Capital LP. “Looking ahead, we should be paying attention to any new OPEC+ signals about extending or adjusting supply cuts.”

Oil closed higher on Monday after sliding at the open following a decision by OPEC+ to boost output more than expected in August. The group cited summer demand as one reason for their optimism that the barrels could be absorbed, and Saudi Arabia raised the price of its main crude grade to Asia.

The oil market has been volatile in recent weeks after the war between Israel and Iran, with a fragile truce now in place, but tensions in the Middle East are starting to rise again following fresh attacks in the Red Sea. A second vessel was targeted near Yemen on Monday, hours after Iranian-backed Houthis claimed responsibility for an earlier attack on a ship in the same area.

“These attacks raise supply-chain costs and insurance premiums for oil cargoes,” said Khurshid. “But unless there’s a major supply disruption, the impact stays mostly at the margins.”

Elsewhere, there are signs of tightness showing in the diesel market, as traders grapple with a summer supply squeeze. US stockpiles are at the lowest seasonally since 1996, while Europe benchmark futures signal a tighter market than during the height of the recent Israel-Iran conflict.

©2025 Bloomberg L.P.