Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

(Bloomberg) -- Oil edged higher as OPEC+ considers delaying output increases and Kazakhstan’s crude exports through Russia were slowed by a Ukrainian drone attack.

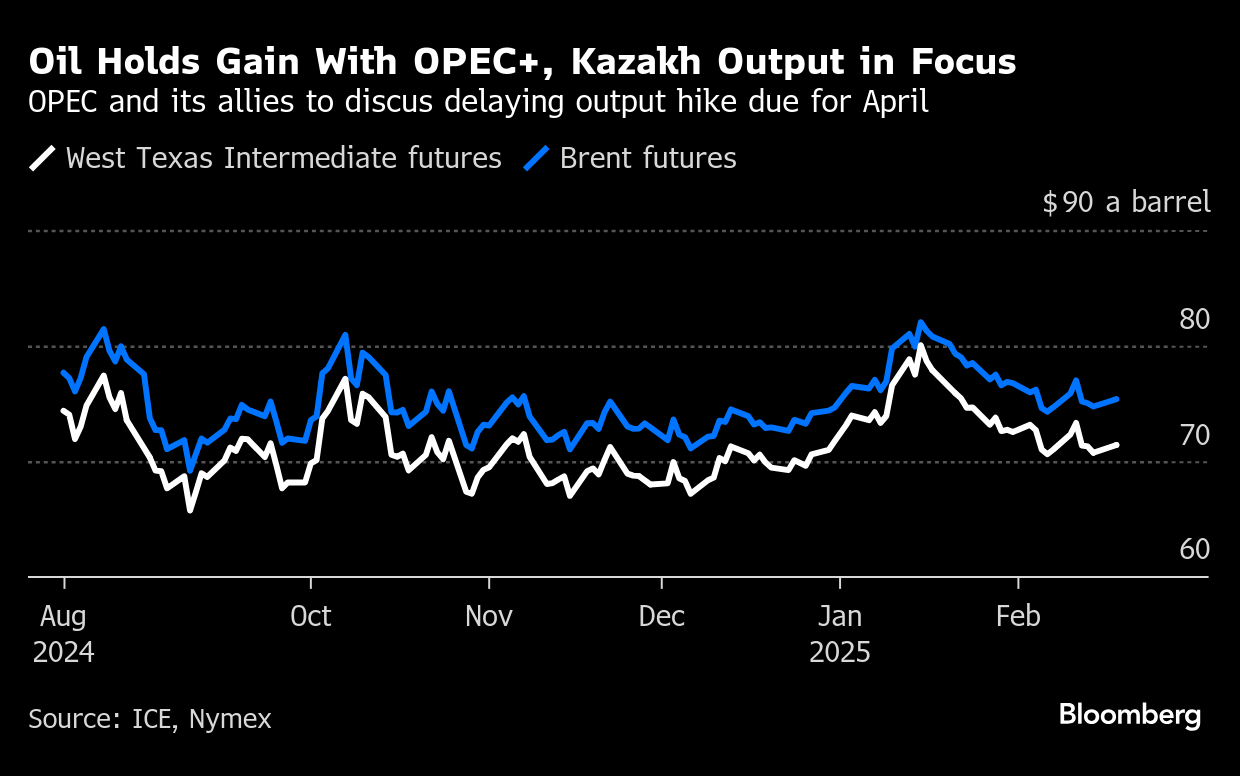

Brent futures traded above $75 a barrel after a modest gain on Monday. The alliance is considering pushing back a series of monthly supply increases due to start in April, according to delegates. Meanwhile, a strike on a pumping station in Russia reduced flows through the main pipeline from Kazakhstan.

Traders are also monitoring talks between top US and Russian officials that could pave the way for a meeting of presidents Donald Trump and Vladimir Putin on ending the war in Ukraine. Ukraine’s Volodymyr Zelenskiy has warned his country won’t recognize “any agreements about us without us.”

Postponing 120,000 barrel-a-day hike would mark the fourth time that OPEC+ has delayed plans to revive production halted since 2022. However, Russian Deputy Prime Minister Alexander Novak said OPEC and its allies hadn’t discussed any deferral, according to Tass.

“OPEC+ does not want prices to drop below the $70-$74 range and is willing to forgo further market share to maintain higher prices,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “The market was also supported by reports that Ukraine had struck a pumping station in Russia.”

Elsewhere, exports from Iraq’s semi-autonomous Kurdistan region could resume within a week, Iraqi Oil Minister Hayyan Abdul Ghani said. The pipeline, which runs to the Turkish port of Ceyhan, was halted in March 2023.

Crude has had a rocky start to the year, giving up all of its gains as President Trump’s use of tariffs threaten to slow global growth and energy demand. Market gauges including timespreads have also flashed signs of weakness, and net-bullish positions on crude have been reduced.

©2025 Bloomberg L.P.