Russia's Surging Oil Exports Stuck at Sea as Curbs Slow Delivery

(Bloomberg) -- Moscow is struggling to deliver crude cargoes in the face of US sanctions, with volumes at sea increasing by a fifth in three months.

While Russia has maintained shipments comfortably above 3 million barrels a day, offloading cargoes has proved more difficult. The average voyage time, from loading to discharge, for the flagship ESPO crude grade from Kozmino on the Pacific coast to Chinese ports rose to more than 12 days for ships loading in November. That was up from an average of just over eight days for tankers making the trip in August.

The delays have led to a sharp increase in the amount of Russian oil on tankers at sea, which topped 180 million barrels at the end of November, up by 21% over the past three months. In addition to vessels idling for long periods, some are taking longer routes. At least two Urals-filled tankers are rounding the Cape of Good Hope toward Asian destinations, rather than taking the shorter route through the Red Sea. Others have diverted from their initial destinations on the west coast of India, lengthening journeys and keeping cargoes on the water for longer.

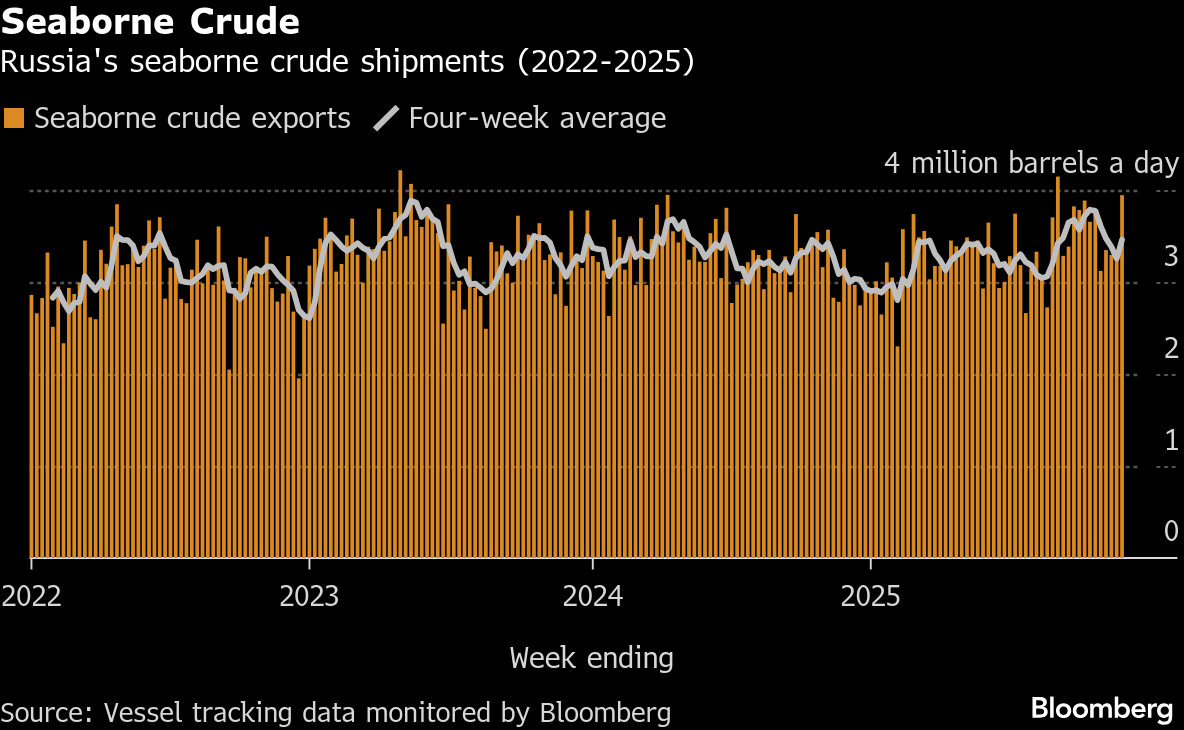

The build-up in Russia’s crude at sea comes as seaborne crude flows rose for the first time in six weeks. Moscow shipped 3.46 million barrels a day in the four weeks to Nov. 30, according to vessel-tracking data compiled by Bloomberg, up by about 210,000 from the period to Nov. 23. It was the first increase since the US announced sanctions on production giants Rosneft PJSC and Lukoil PJSC in mid-October.

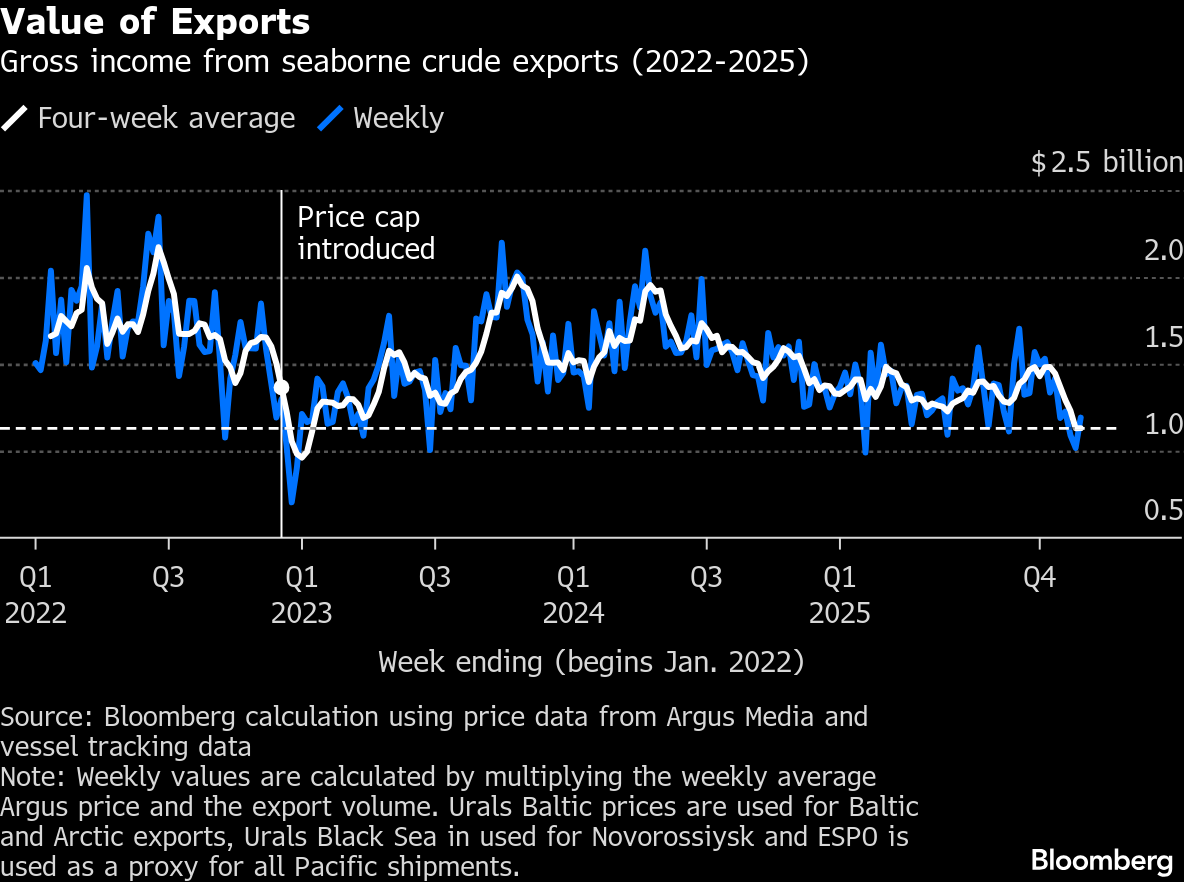

The surge in flows was offset by the ninth straight drop in crude prices to leave the value of Moscow’s seaborne exports unchanged at the lowest since January 2023.

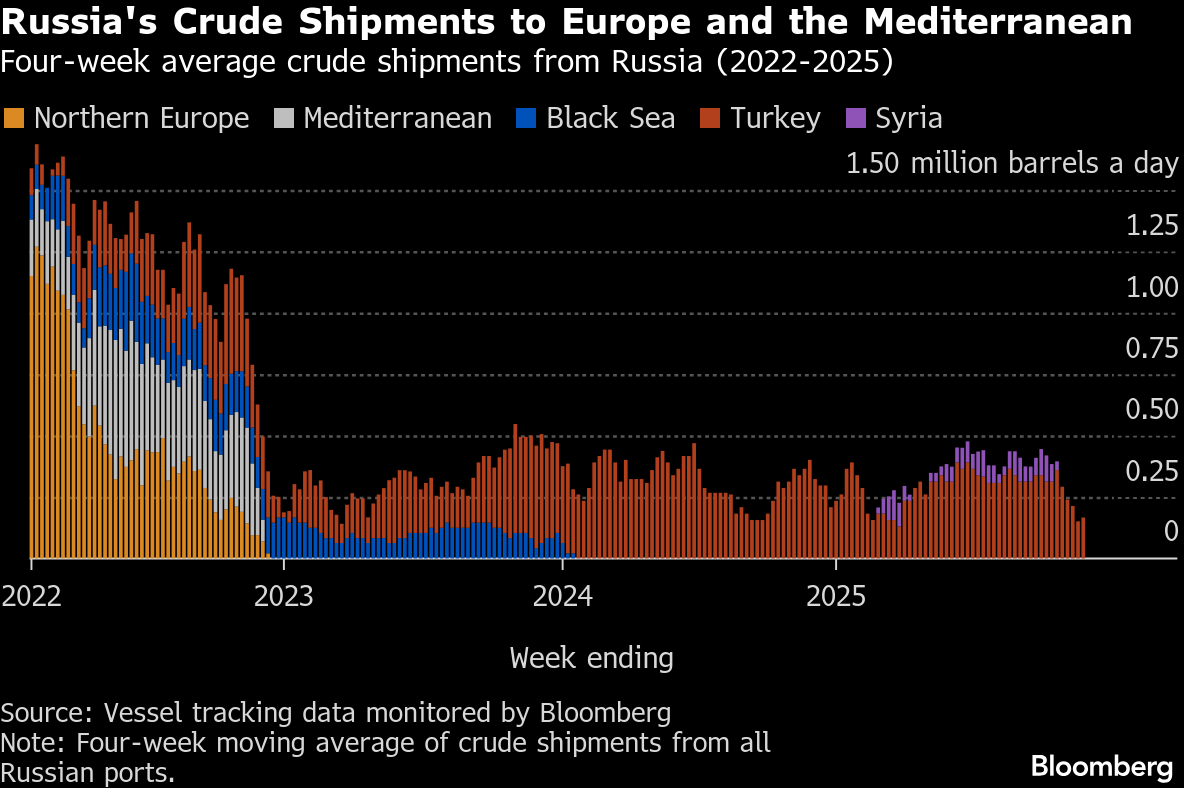

Separately, Russia-linked ships operating in the Black Sea have come under attack from Ukraine, which has also hit one of the loading buoys at the CPC export terminal near Novorossiysk. Those attacks, which began on Friday, haven’t yet impacted crude flows from Novorossiysk.

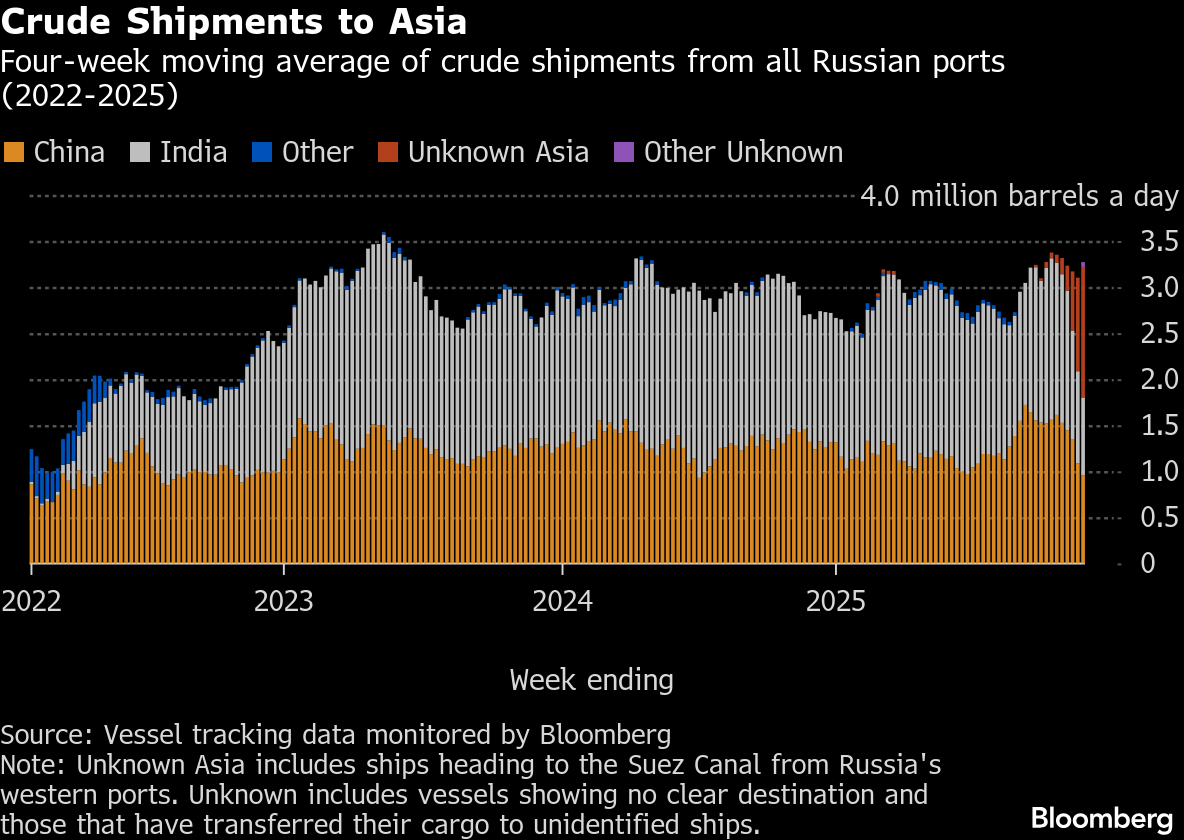

Crude Shipments

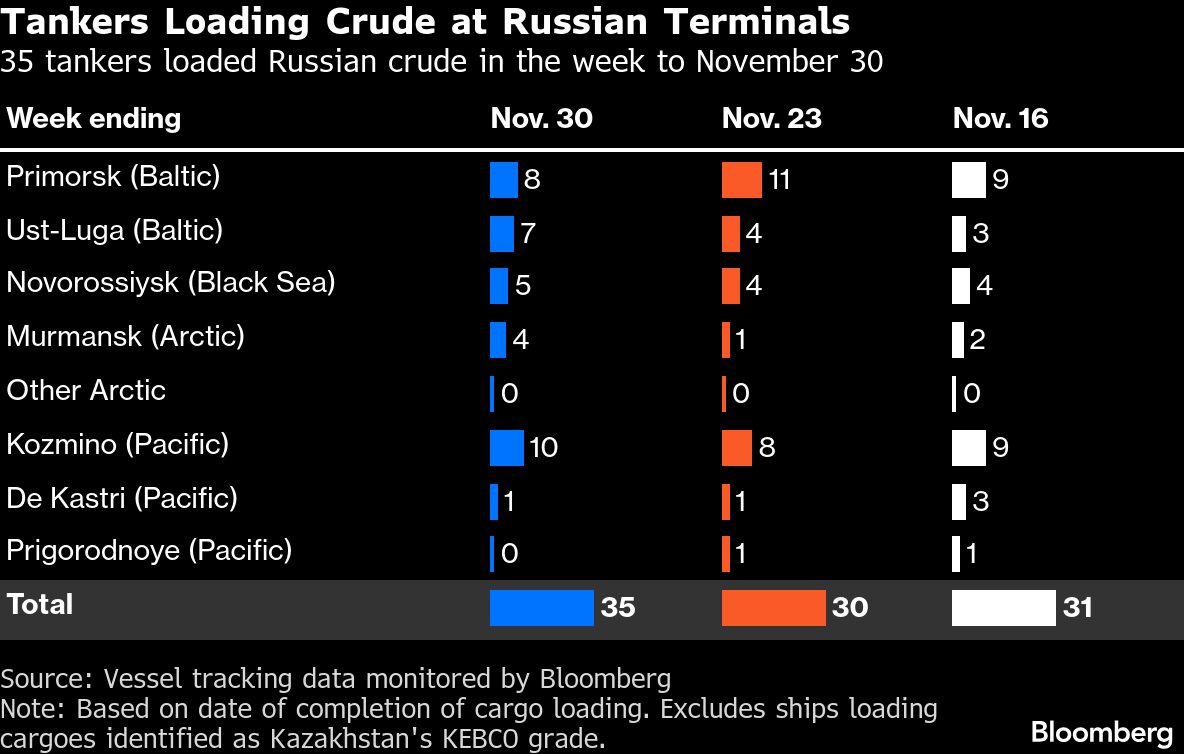

A total of 35 tankers loaded 27.61 million barrels of Russian crude in the week to Nov. 30, vessel-tracking data and port-agent reports show. The volume was up from a revised 22.78 million barrels on 30 ships the previous week.

On a daily average basis, shipments in the week to Nov. 30 jumped to 3.94 million barrels a day, up by about 690,000 barrels a day from the previous week to the most in almost three months. Separately, one cargo of Kazakhstan’s Kebco grade was shipped from Novorossiysk during the week.

In the Pacific, shipments from the port of Kozmino rebounded to a more normal level, while flows from the Sakhalin 1 project terminal at De Kastri remained low, with a single tanker loading during the most recent week. Arctic shipments from Murmansk rebounded strongly following several weeks of unusually low activity. Combined shipments of Urals crude from the Baltic and Black Sea also rose.

Export Value

On a four-week average basis, the gross value of Moscow’s exports was unchanged at $1.13 billion a week in the 28 days to Nov. 30, with higher export quantities offsetting the ninth straight drop in average prices.

Using this measure, the export prices of Russia’s Urals from the Baltic fell by about $2.80 a barrel to $43.52, while prices for Black Sea cargoes were down by $3.60 a barrel to $41.12. The price of Pacific ESPO crude dropped by $1.90 to average $53.92 a barrel. Delivered prices in India also fell, down by $1.40 to $58.66 a barrel, a new low for the period since March 2023. All prices are according to numbers from Argus Media.

On a weekly basis, the value of exports averaged about $1.19 billion in the 7 days to Nov. 30, up by 17% from the period to Nov. 23, as the jump in exports more than offset another drop in prices.

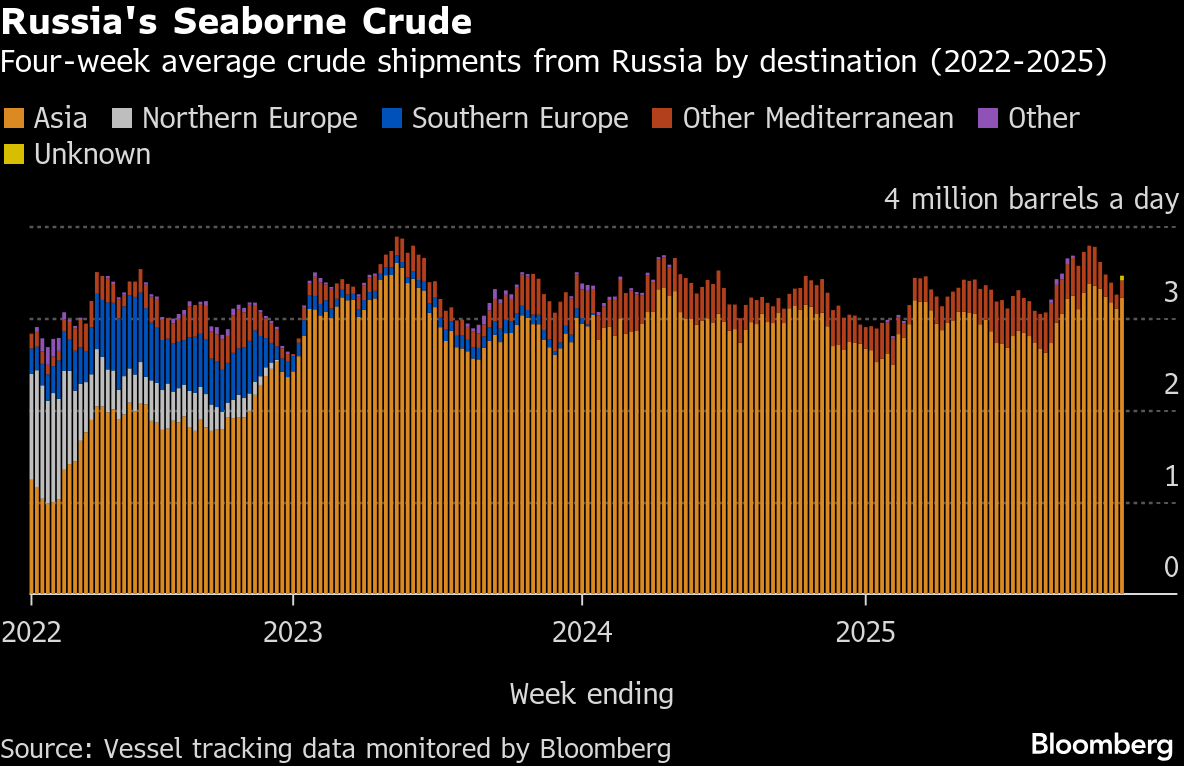

Flows by Destination

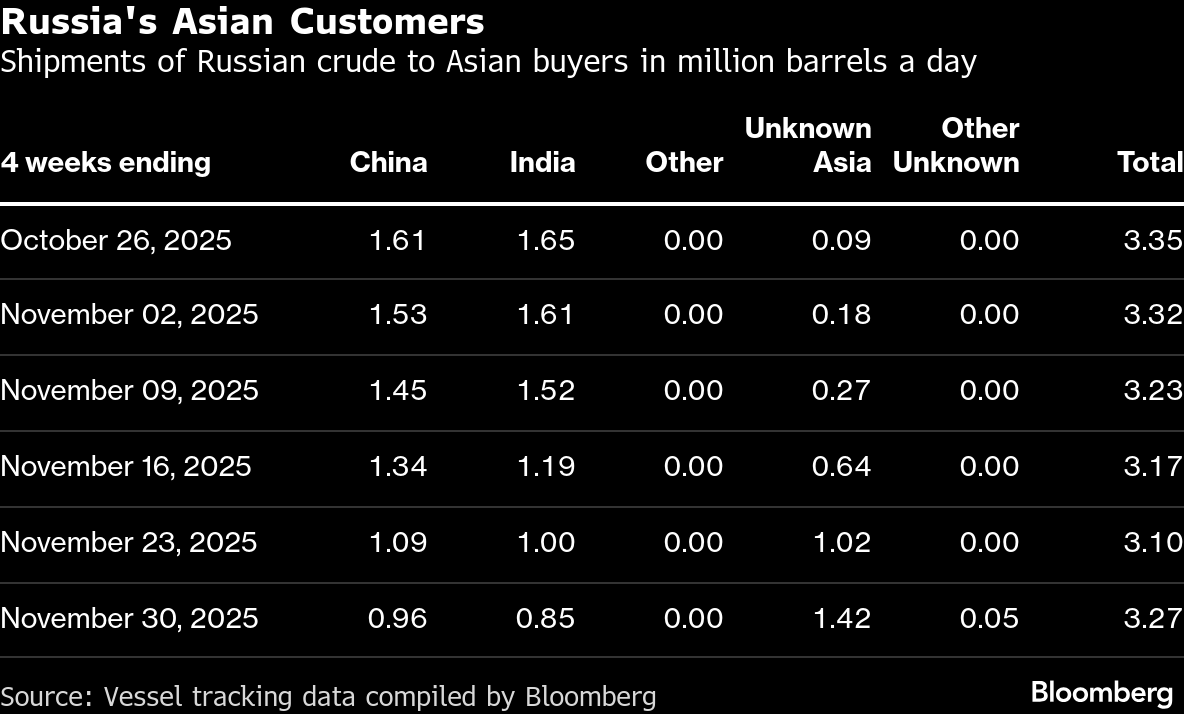

Observed shipments to Russia’s Asian customers, including those showing no final destination, rose to 3.27 million barrels a day in the 28 days to Nov. 30, up from a revised 3.1 million in the period to Nov. 23.

While the amount of Russian crude heading to both China and India appears to be falling sharply, that’s mostly being offset by growing quantities on vessels yet to show a final destination, allowing for much of that pattern to be reversed. Tankers are increasingly showing no final destination until they are well across the Arabian Sea, while some never show a final calling point, even after mooring to discharge.

Vessels are also spending longer at sea, with several tankers diverting from initial destinations on the west coast of India or in Turkey. They are also getting held up waiting to discharge at Chinese ports, with at least one ESPO-filled tanker idling for more than three weeks.

There is now more crude on tankers yet to show a final destination than there is on ships signaling that they are heading to China, India or Turkey.

Flows on tankers signaling Chinese ports stood at 960,000 barrels a day in the four weeks to Nov. 30, down from a revised 1.09 million for the period to Nov. 23. The amount destined for India fell to 850,000 barrels a day from a revised 1 million in the period to Nov. 30. But there is the equivalent of 1.47 million barrels a day on vessels yet to show a final destination.

Of that, about 1.42 million barrels a day is on ships from Russia’s western ports showing their destination as Port Said or the Suez Canal, or those from Pacific ports with no clear delivery point, and a further 50,000 barrels a day is on tankers yet to signal a destination.

In the past, those cargoes have almost all ended up in India or China, but tougher US sanctions may keep that oil on the water unless, or until, workarounds can be found by the Russian sellers.

Flows to Turkey in the four weeks to Nov. 30 edged up to about 170,000 barrels a day. Shipments to Syria remained at zero. Tankers hauling Russian crude to the east Mediterranean nation rarely signal their destination and usually disappear from automated tracking systems when they’re south of Crete, making it difficult to estimate flows in advance of ships arriving off the port of Baniyas, where they can usually be picked up on satellite photos. The last Russian ship to discharge its cargo there left Murmansk at the end of September, arriving at the start of November.

NOTES

This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. The next update will be on Tuesday, Dec. 9.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are blended with crude of Russian origin to create a uniform export stream. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Bloomberg classifies ship-to-ship transfers as clandestine if automated position signals appear to be switched off or falsified — a tactic known as spoofing — to hide the two vessels involved coming together to make the cargo switch.

Vessel-tracking data are cross-checked against port-agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd. and satellite imagery covering Russian ports.

If you are reading this story on the Bloomberg terminal, click for a link to a PDF file of four-week average flows from Russia to key destinations.

©2025 Bloomberg L.P.