Oil Heads for Weekly Surge on Venezuela Blockade, Nigeria Strike

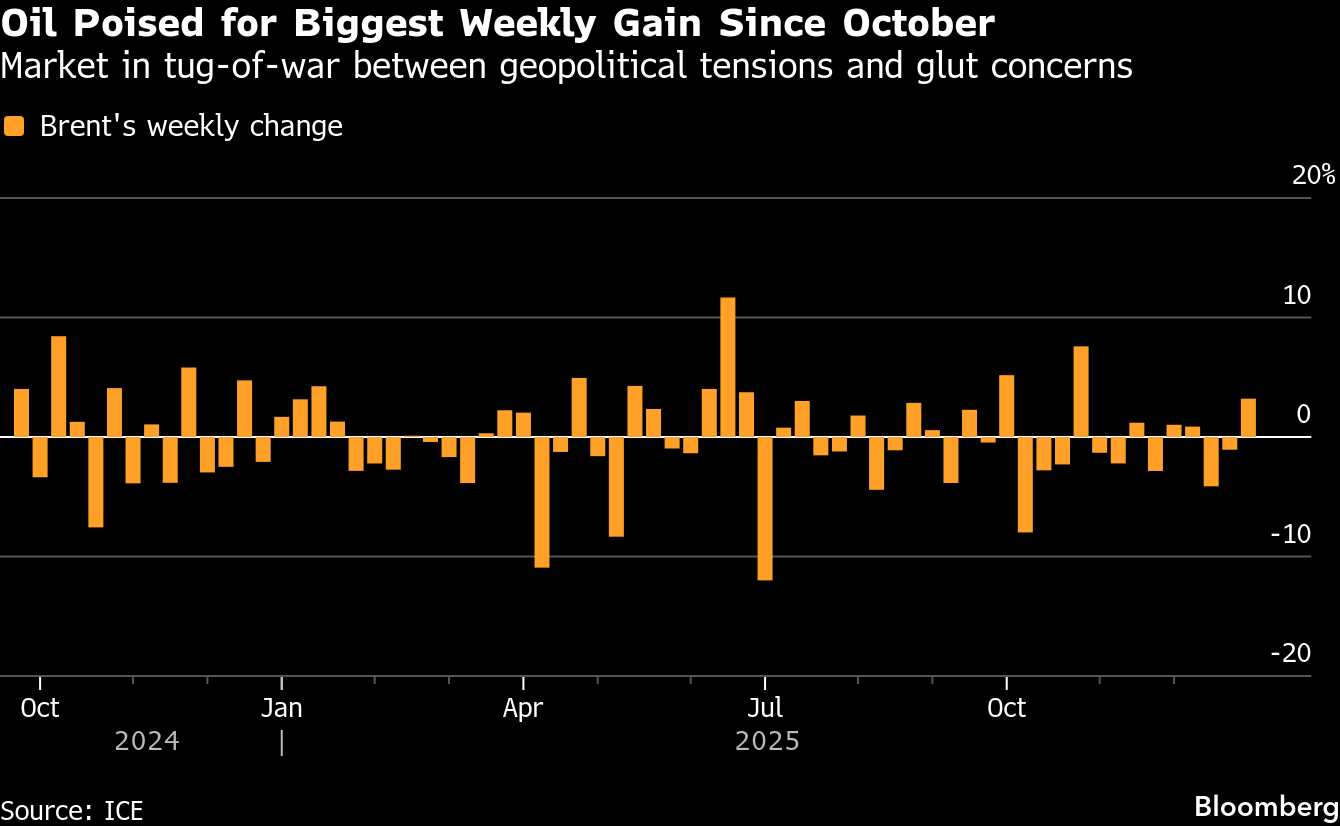

(Bloomberg) -- Oil headed for the biggest weekly gain since late October, as traders tracked a partial US blockade of crude shipments from Venezuela and a military strike by Washington against a militant group in Nigeria.

Global benchmark Brent traded above $62 a barrel, more than 3% higher this week, while West Texas Intermediate was near $58. On Venezuela, a sanctioned tanker pursued by US forces turned away from the South American nation, as the Trump administration piled pressure on Caracas.

The White House has ordered commanders to concentrate for the next two months on quarantining Venezuelan oil, according to a person familiar with the matter. The person, who requested anonymity, said US forces were focused almost exclusively on the blockade, rather than military options.

Brent crude remains on track for the biggest annual decline since 2020 after slumping 16%. The drop has been driven by expectations for a surplus, with virtually all of the world’s major crude traders foreseeing a global glut next year after producers in and outside OPEC+ increased supplies. Still, the intensifying geopolitical flareups have helped keep a floor under prices.

In Africa, President Donald Trump said that the US launched a “powerful and deadly strike” against Islamic State targets in Northwest Nigeria, according to a social-media post. The country, an OPEC member, produced about 1.5 million barrels a day in November, according to data from the cartel.

US Defense Secretary Pete Hegseth threatened there would be “more to come” if Islamic State did not stop going after “innocent Christians in Nigeria (and elsewhere)”. The White House did not respond to a request for more details on the strike, including those impacted or the weaponry used.

Commodities including crude also had support from a weakening US currency, a shift that makes raw materials cheaper for most buyers. The Bloomberg Dollar Spot Index has shed 0.8% this week, the most since June.

In Europe, meanwhile, Ukraine’s president, Volodymyr Zelenskiy, said Thursday he had “a very good conversation” with US envoys Steve Witkoff and Jared Kushner, aiming toward an end of Russia’s war. Among military moves, Kyiv attacked the Novoshakhtinsk refinery in the Rostov region.

“Investors should exercise caution,” said Huang Wanzhe, an analyst at Dadi Futures Co., referring to potentially higher volatility and jitters around the start of the new year. Traders should wait for the current wave of geopolitical risks to “play out” before factoring in the glut in the first quarter, she said.

©2025 Bloomberg L.P.