Oil Gains After Trump Orders Blockade of Tankers Off Venezuela

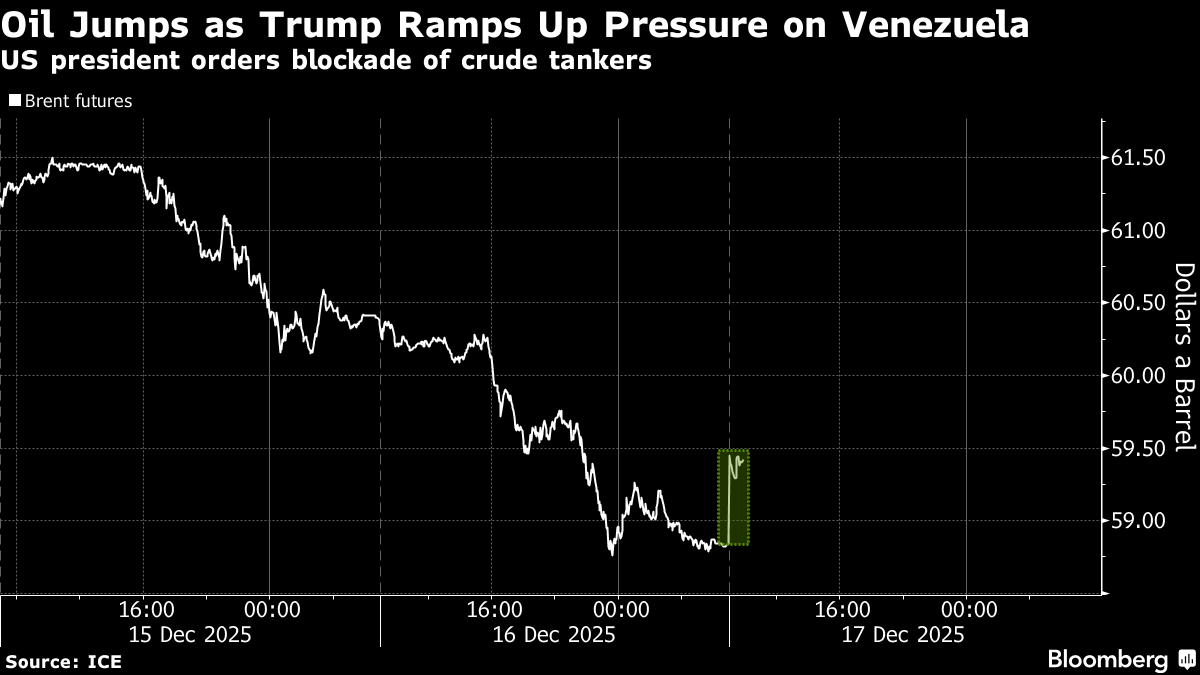

(Bloomberg) -- Oil advanced from the lowest level since 2021 after President Donald Trump ramped up pressure on Venezuela by ordering a blockade of sanctioned tankers off the South American nation.

Brent climbed toward $60 a barrel after losing more than 5% over the previous four sessions on concerns over a swelling global glut. West Texas Intermediate was near $56. Trump said he was ordering a blockade of crude carriers going into and leaving Venezuela, according to a social media post on Tuesday.

The move is a major escalation and follows the seizure of an oil tanker last week by US forces off Venezuela. The regime of President Nicolas Maduro said the latest action was intended to steal the country’s resources.

Venezuela’s oil production has increased since hitting a low in 2020, but is far from where it was decades ago. Tankers loaded almost 590,000 barrels a day for export last month, compared with global consumption of more than 100 million barrels a day. Most of the country’s crude goes to China.

The OPEC producer’s flagship Merey crude is often used to make bitumen to pave roads in China. Bitumen futures in Shanghai surged as much as 2.8% on Wednesday, the biggest increase since late October.

A hoard of the Venezuelan oil stored in tankers across Asia will cushion Chinese buyers from any immediate hit, but any prolonged disruption to exports could force refiners to seek more expensive alternatives. Suitable substitutes may include Iranian grades and Canadian Access Western Blend.

Venezuela’s state oil company works with a handful of international partners including Chevron Corp. to drill in many parts of the country. The Houston-based company, which has a license from the US Treasury exempting the producer from US sanctions, said its operations are continuing as normal.

“The oil market has generally taken supply risks in its stride recently, given the scale of the surplus that is expected through 2026,” said Warren Patterson, Singapore-based head of commodities strategy at ING Groep NV. The scale of the price move indicates that the market “is not too worried,” he added.

Oil remains on track for a yearly loss due to the glut, which is being driven by OPEC+ returning idled output at a rapid rate and other producers pumping more, along with tepid demand. Signs of market weakness are emerging from the US to the Middle East, as investors brace for a surplus that the International Energy Agency predicts will be the biggest since the pandemic.

Traders are also weighing the odds of a possible peace deal in Ukraine, which could pave the way for fewer restrictions on Russian crude exports.

©2025 Bloomberg L.P.