Brazil Oil Output Rebounds After Platform Outages Cut Production in November

(Bloomberg) -- Brazilian oil output is rebounding from outages that removed more than 300,000 barrels a day last month, highlighting how Latin America’s largest crude producer can confound OPEC efforts to micromanage the market.

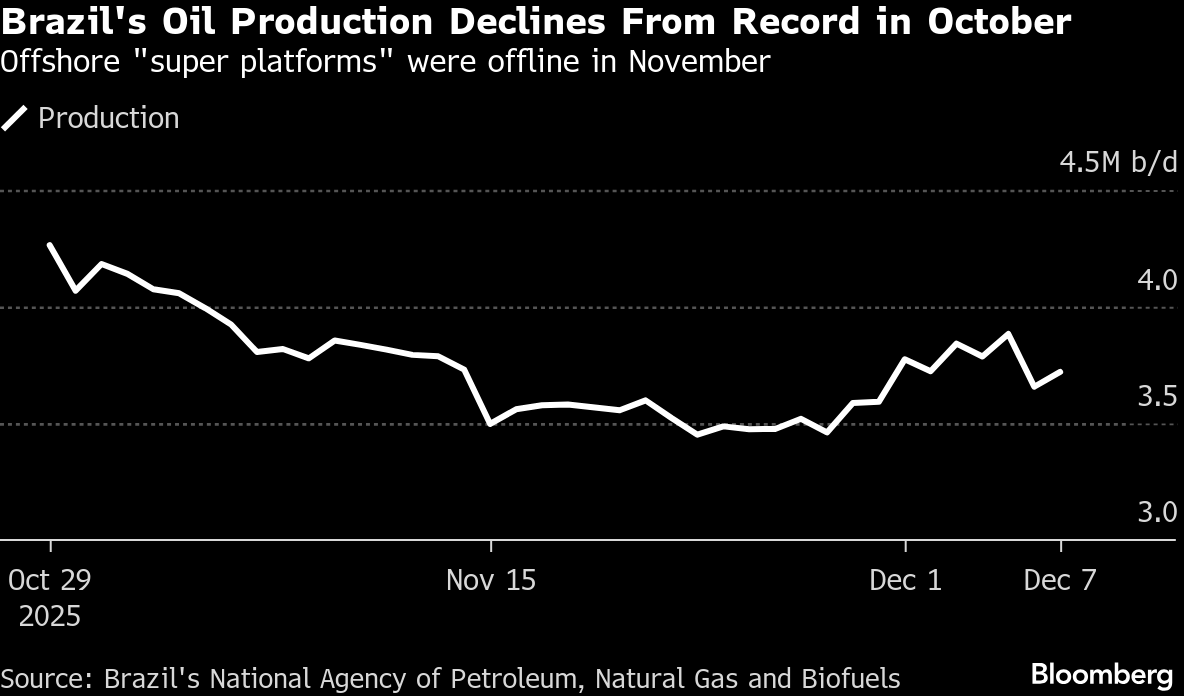

Brazil’s daily oil production slid roughly 8% to an average of 3.696 million barrels in November, according to Bloomberg calculations based on preliminary figures from oil regulator ANP. The drop from an all-time high the previous month stemmed from platform outages at offshore fields such as the mammoth Buzios.

The volatility in output from a key non-OPEC oil producer highlights the challenges involved in assessing global crude-supply trends. The Saudi-led group of heavyweight oil nations is preparing to boost volumes early next year, and on Thursday predicted a balanced global crude market in 2026.

OPEC’s outlook differs markedly from the likes of the International Energy Agency and influential traders such as Trafigura Group that are warning of an imminent supply glut.

In Brazil, the data indicate that at least some of the affected platforms came back online in recent weeks. About one-fifth of last month’s lost production had been restored by late last week, according to the most recent ANP figures. The agency’s data is subject to subsequent adjustments.

The November drop highlights how Brazil’s shift to “super platforms” that can pump more than 200,000 barrels a day each leaves the nation’s output vulnerable to sharp fluctuations, said Marcelo De Assis, a Rio de Janeiro-based independent oil consultant.

The temporary blip, however, won’t derail the longer-term upward trend for Brazil and regional giants Guyana and Argentina, he said.

Although the IEA trimmed estimates for a global oil surplus on Thursday, the agency is still expecting world supplies to exceed demand by 3.815 million barrels a day in 2026.

©2025 Bloomberg L.P.