AI, Manufacturing Reset Spell 2026 Boon for European Industrials

(Bloomberg) -- After a year marked by tariff uncertainty, Europe’s industrial giants are expecting a solid 2026 as the data center buildout continues, electrification demand accelerates and manufacturing activity recovers.

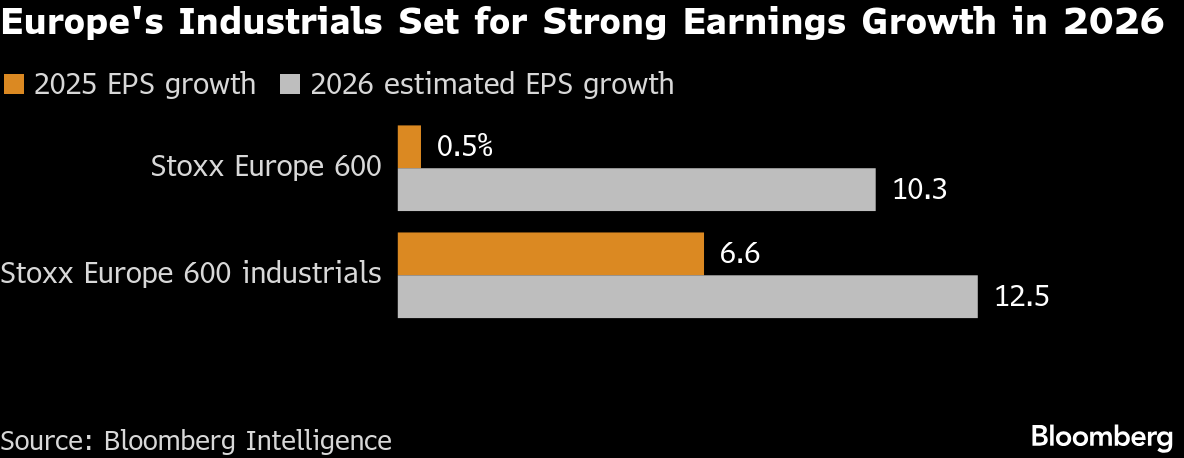

The Stoxx Europe 600 industrials index is expected to deliver earnings-per-share growth of almost 13% next year, compared to 6.6% growth in 2025, Bloomberg Intelligence data shows.

Expectations are particularly high for the companies exposed to artificial intelligence infrastructure – including France’s Schneider Electric SE, Germany’s Siemens Energy AG and Italy’s Prysmian SpA.

“Their power hardware and digital layers offer investors AI growth monetization that’s not tied to a specific tech firm, model or platform,” BI analysts Omid Vaziri and Pauline Eschbach said. That provides this group of power-exposed companies with the “strongest earnings visibility” in the sector, they added.

Schneider Electric’s recent outline of its 2030 strategy was received well by the market, and bodes well for 2026. Consensus expectations of organic sales growth of about 8% for next year look “too low,” according to Citigroup analyst Martin Wilkie, who expects about 10% growth.

Siemens Energy’s solid order book is also promising, BI’s Vaziri and Bhawin Thakker said, with about 85% of the company’s 2026 sales likely already covered by existing backlogs.

“This is a race for electricity as much as it is a race for AI, driving a multi-year investment cycle,” Deutsche Bank analyst Gael de-Bray said, adding that Schneider Electric and Siemens Energy will be key beneficiaries.

Germany’s fiscal stimulus, with €500 billion ($586 billion) allocated to infrastructure projects, will also be a major catalyst for 2026, while the ongoing theme of rearmament in Europe should translate into more orders for the likes of Rheinmetall AG, Leonardo SpA and Saab AB.

For companies not exposed to big structural drivers like power grids or defense, tailwinds still abound. Short-cycle industrial giants – including Swedish heavyweights SKF AB and Sandvik AB, which were held back by currency fluctuations and trade tensions this year – could see a recovery across their end markets as investment cycles resume.

“Unlike last year, all end markets are expected to see positive growth or be flat at the very least, including residential and trucks,” de-Bray said. Sandvik in particular could see growing demand for its mining equipment as gold and copper prices continue to rise.

Meanwhile, a likely rebound in the semiconductor industry would benefit vacuum solutions manufacturers VAT Group AG and Atlas Copco AB, while improvements in building activity could boost lockmaker Assa Abloy AB and measuring systems provider Hexagon AB, according to Thakker and Vaziri.

Some other end markets are weaker. Concerns over an oil glut are keeping a lid on crude prices, potentially limiting oil majors’ budget and hurting companies exposed to the sector. Firms with exposure to the automotive industry – including SKF, Atlas Copco, and Siemens AG – could also feel some pain as subdued demand and competitive pressures weigh on a sector that is just coming out of a particularly tough year.

Continued supply chain disruption and weak residential demand in China could also be a drag for companies exposed to construction markets like heat pump maker NIBE Industrier AB or elevator manufacturer Kone Oyj, as well as companies dependent on global trade activity like ship propeller supplier Wartsila Oyj.

But with trade tensions slowly easing and growth drivers looking increasingly solid, Europe’s industrials sector looks set for a good year. “We believe that the tide is turning for short-cycle businesses and that tariff uncertainties in 2025 will make way for potential positive margin surprises in 2026,” Deutsche Bank’s de-Bray said.

©2025 Bloomberg L.P.