Oil Market Awaits Crucial Trump-Putin Meet as Prices Drift Lower

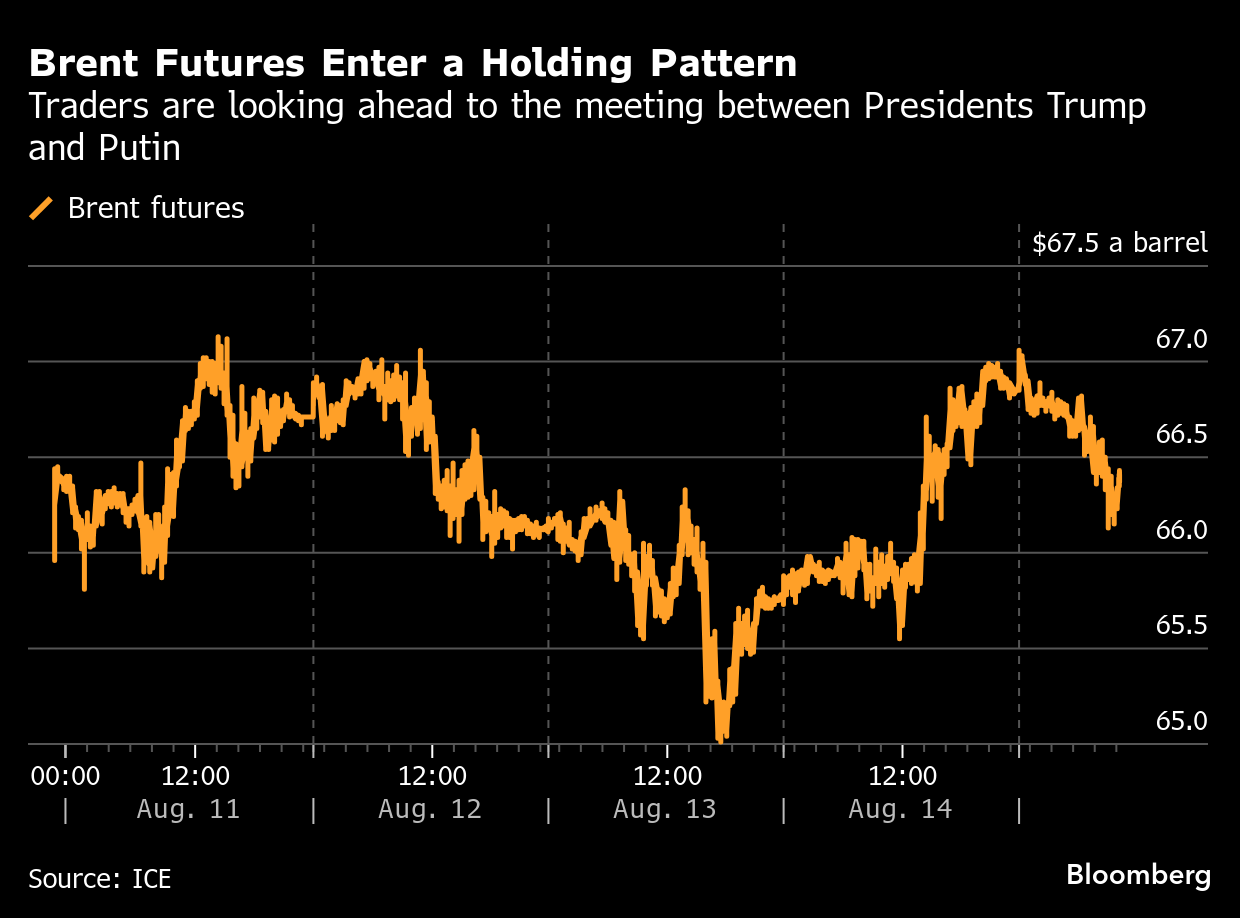

(Bloomberg) -- Oil drifted lower, settling below $66 a barrel, as investors awaited a face-to-face summit between Donald Trump and Vladimir Putin later Friday, an encounter with the potential to reshape crude flows from one of the world’s largest producers.

Putin stepped up his charm offensive, praising Trump’s efforts to broker an end to the war in Ukraine. The US president downplayed hopes for a breakthrough in the more than three-year-old conflict, saying there’s a 25% chance the meeting won’t succeed.

Any signs of progress toward peace would remove a layer of geopolitical risk from an oil market that’s expected to be heavily oversupplied in coming months. Before the summit was arranged, Trump threatened Moscow’s largest oil buyers with secondary tariffs, putting at risk flows that have remained robust since the war began.

Russia is the world’s largest crude exporter after Saudi Arabia, and has become reliant on buyers in China and India eager to purchase oil at a discount to international benchmarks.

Trump announced a doubling of tariffs on Indian goods to 50% last week as a penalty for the nation’s purchases of Russian crude, and has mulled further crackdowns on the so-called “shadow fleet” that transport Moscow’s supplies. However, he has so far avoided targeting China — possibly because of concerns a total blockade would send oil prices skyrocketing and hurt US consumers.

On Thursday, Trump warned he would impose “very severe consequences” if Putin didn’t agree to a ceasefire. He also said he hoped to use the summit to set up a “quick second meeting” with Ukrainian leader Volodymyr Zelenskiy after being pressed by allies.

“We judge that tonight’s meeting is unlikely to deliver significant results,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “In the near term, new US sanctions are unlikely; a relaxation cannot be ruled out unless the meeting collapses.”

Oil prices have lost about 10% this year on concerns about the demand implications of Trump’s trade policy and the rapid return of OPEC+ barrels. Expectations for a record glut in 2026 are weighing on the market.

©2025 Bloomberg L.P.