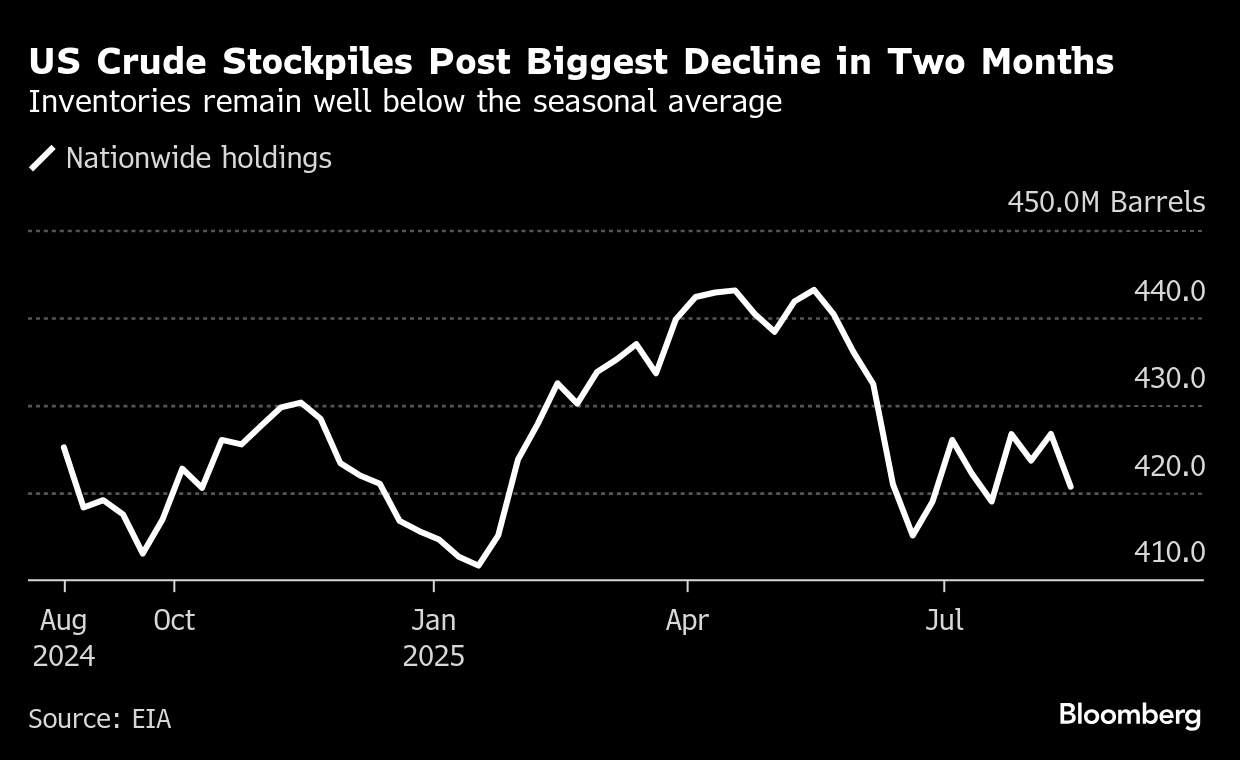

Oil Holds Gain After Biggest Drop in US Stockpiles in Two Months

(Bloomberg) -- Oil held a gain after US crude stockpiles shrunk the most since mid-June, keeping inventories well below the seasonal average.

Brent traded around $67 a barrel after climbing 1.6% on Wednesday, while West Texas Intermediate was near $63. Nationwide holdings fell by 6 million barrels last week, according to Energy Information Administration figures. Gasoline stockpiles also declined for a fifth straight week.

Oil is still down more than 10% this year on concerns about the fallout from US trade policies and as OPEC+ returns idled production, raising expectations for a glut once peak summer demand ends. Traders are also keeping an eye on progress toward a ceasefire for the war in Ukraine.

Moscow has largely kept its oil flowing despite an array of sanctions, with a large chunk going to India. However, the South Asian nation has been singled out for criticism by the US administration for buying Russia crude, with President Donald Trump threatening New Delhi with economic penalties.

Meanwhile, crude inventories at the key US storage hub at Cushing, Oklahoma, rose for a seventh week, according to the EIA. The delivery point for WTI futures has seen a recent surge in supplies from the Permian Basin.

“In the long run, you got to look at the fundamentals and expect that we’re going to be tumbling toward the downside up to at least the middle part of next year,” said John Driscoll, director and founder of Singapore-based consultant JTD Energy Services Pte.

©2025 Bloomberg L.P.