Oil Holds Decline With Focus on Trump-Putin Meeting on Ukraine

(Bloomberg) -- Oil was steady after dropping in thin trading on Tuesday, with investors looking to talks between the US and Russian leaders on Friday for fresh impetus.

Global benchmark Brent traded above $66 a barrel after slipping 0.8% in the previous session while West Texas Intermediate was near $63. US Secretary of State Marco Rubio spoke with his Russian counterpart Sergei Lavrov to prepare for the summit between Donald Trump and Vladimir Putin, even as he reiterated the meeting may not lead to a breakthrough in the Ukraine conflict.

Ukrainian President Volodymyr Zelenskiy said he won’t cede the eastern region of Donbas to Russia — a condition demanded by Putin to unlock a ceasefire — and pushed for Kyiv to be included in the talks.

Oil traders are tracking preparations for the talks, given that they may result in an easing of US sanctions on OPEC+ member Russia that could see more supply come into the market. Prices have fallen this year as the producer group accelerated output hikes despite the prospect of a glut forming as US tariff moves pressure global demand.

“Without the European Union and Ukraine at the negotiating table, a ceasefire deal will be difficult,” said Gao Jian, a Shandong-based analyst at Qisheng Futures Co. “Even if no agreement is reached soon, the market just needs a clear direction — deescalation is progressing — to weaken the potential support for prices.”

The US Department of Energy increased its forecast for this year’s global oversupply to 1.7 million barrels a day on Tuesday, with the International Energy Agency due to release its estimates later Wednesday. The Organization of the Petroleum Exporting Countries, meanwhile, maintained a more bullish outlook — forecasting a tighter global oil market than previously projected next year.

Meanwhile, a US industry report showed nationwide stockpiles increased slightly last week. Official data will be published later Wednesday.

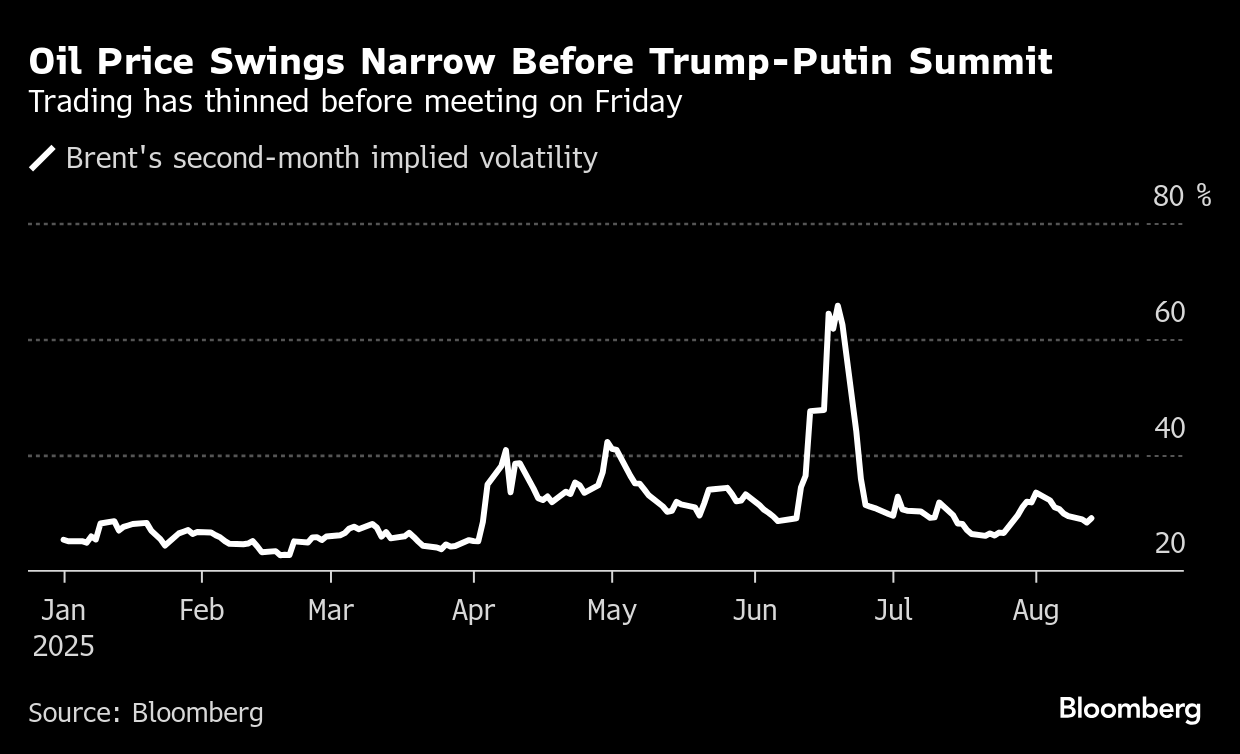

The aggregate volume of Brent futures traded was below the daily average in early Asian trading hours after relatively muted sessions on Monday and Tuesday. Meanwhile, the second-month implied volatility for the benchmark was near a two-week low.

©2025 Bloomberg L.P.