Exxon, Chevron Surpass Estimates With Record Oil Production

(Bloomberg) -- Exxon Mobil Corp. and Chevron Corp. posted better-than-expected results after record oil production cushioned the impact of lower crude prices.

Exxon pumped more oil than it has in any second quarter since the historic Mobil takeover more than 25 years ago. Meanwhile, Chevron also lifted output to an all-time high of almost 4 million barrels a day.

The production bumps fed by booming output in the Permian Basin and elsewhere enabled the titans of the US energy sector to surpass Wall Street expectations even as oil prices slumped and the demand outlook darkened.

In the wake of the profit surprise, Exxon is keeping an eye out for more acquisitions just 16 months after its $60 billion takeover of Pioneer Natural Resources Co., said Chief Executive Officer Darren Woods.

He stressed, however, that Exxon wouldn’t pursue deals simply for the sake of output growth, saying any transaction need to make strong strategic sense and deliver on the idea of “one plus one equaling more than three.”

“There are opportunities out there for us,” Woods said during a call with reporters. “We’re working to see if we can’t bring some of those to fruition.”

Shares of both companies fell as crude and the broader stock market declined. Exxon declined as much as 2.5%. Chevron slipped 0.9%.

The quarter was marked by wild swings in oil prices as US President Donald Trump’s trade war and OPEC+ output increases confounded supply-and-demand outlooks.

International crude prices were almost $20 a barrel lower during the period on a year-over-year basis, forcing several US producers to slow output growth, particularly in the Permian Basin. But Exxon sees no reason to stop growing in US shale.

Exxon’s worldwide oil and natural gas output reached the equivalent of 4.6 million barrels a day, while Chevron lifted production more than 3% to 3.4 million.

The results come just two weeks after Chevron defeated an arbitration challenge by Exxon that had delayed the former’s $53 billion takeover of Hess Corp. for more than a year. The US supermajors joined Shell Plc in surpassing expectations.

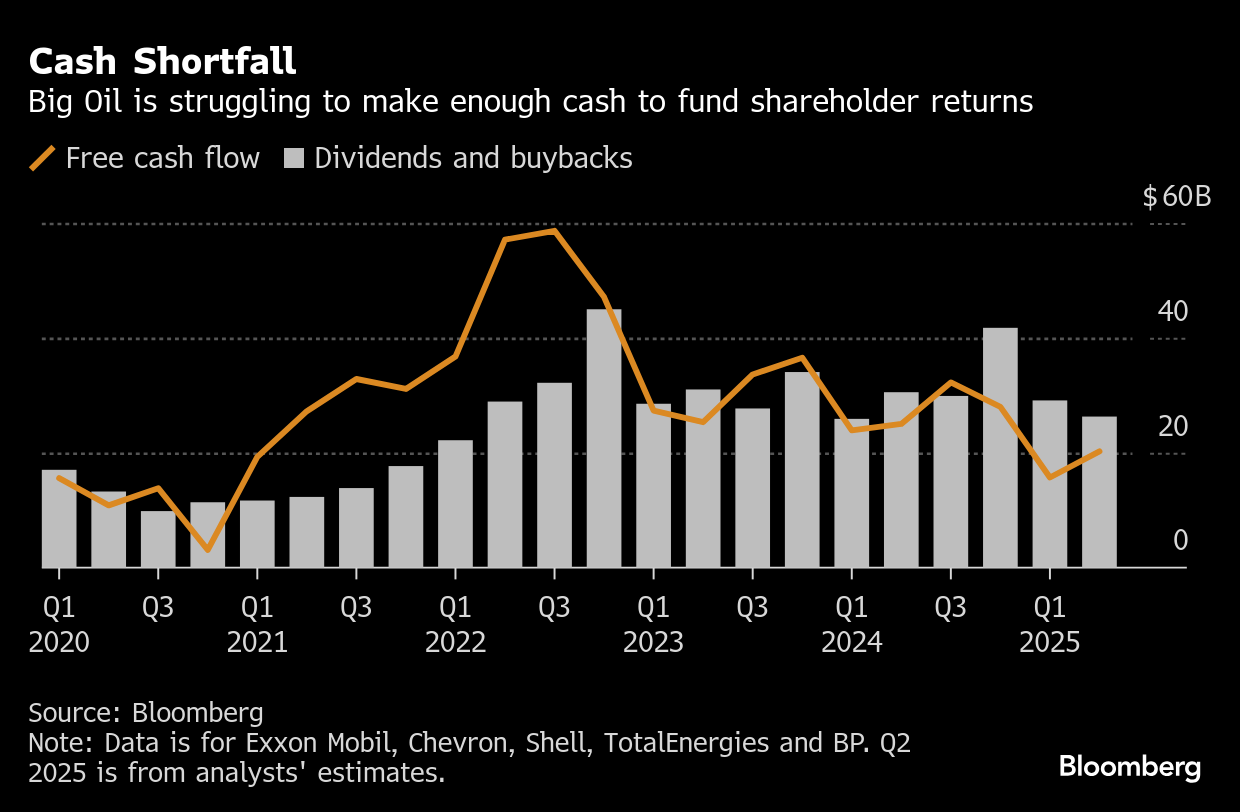

Exxon’s adjusted second-quarter profit of $1.64 a share was 8 cents higher than median forecast. The company maintained share buybacks at $20 billion a year, according to a statement Friday, reassuring investors increasingly concerned about Big Oil’s capacity to sustain shareholder returns amid weak commodity prices.

As for Chevron, adjusted profit of $1.77 a share was 6 cents higher than the median forecast. Although the driller reduced buybacks for the period by one-third, the company said it remains on track to meet its annual target with as much as $15 billion in repurchases.

Chevron will end this year with production close to the equivalent of 4 million barrels a day, up from 2.9 million barrels just a few years ago, Wirth said during a call with analysts. Yet Wirth also said he was frustrated with exploration disappointments and suggested changes will be made.

“I’m not happy with the results out of exploration,” Wirth said.

Despite the upbeat earnings, Chevron sees the potential for lower oil prices later this year as supply increases from OPEC and its allies saturate global crude markets.

“With those dynamics, we probably see some price pressure in the second half of the year,” Chief Financial Officer Eimear Bonner said in an interview. “We’re positioned for all price environments so if we see the softening, if it does in fact play out, we’re in a good spot.”

Exxon has now cut $13.5 billion of annual costs over the past six years, which it says is more than all its Big Oil rivals combined. The company has sold assets, cut jobs and centralized internal functions like engineering. It expects to reduce annual expenses by a further $4.5 billion by 2030.

Chevron’s results may provide fresh momentum for a stock that underperformed Big Oil competitors over the last three years. Chief Executive Officer Mike Wirth is bringing on major new projects in the Gulf of Mexico and Kazakhstan, while transitioning to a profits-over-production model in the Permian Basin.

Chevron raised its guidance for free cash flow growth by 25% to $12.5 billion by next year if oil remains around $70 a barrel.

(Updates with details starting in the fifth paragraph.)

©2025 Bloomberg L.P.