China Set to Tackle Petrochemicals Overcapacity With Overhaul

(Bloomberg) -- The Chinese government is set to launch a sweeping overhaul of its petrochemicals and oil refining sector, phasing out smaller facilities and targeting outdated operations for upgrades, while redirecting investment to advanced materials.

Remedies to curtail longstanding overcapacity in lower-value parts of the industry are likely within the next month, according to people familiar with the matter. The detailed plan is awaiting final approval from the Ministry of Industry and Information Technology, they said, declining to be identified discussing matters that aren’t public yet.

Under the measures proposed, petrochemicals facilities over 20 years old — or about 40% of the country’s total — will need retrofitting to increase their yields, according to the people. Plants will also be encouraged to shift to specialty fine chemicals, rather than bulk materials already threatened by oversupply, they said.

Chemicals that will be favored under the new investment regime include those used in artificial intelligence, robotics, semiconductors, biomedical devices, batteries and renewable energy, they said.

The industry ministry didn’t respond to a request for comment.

Beijing flagged its intention in March to force plants to produce less transport fuels and more petrochemicals, as electrification rapidly undermines traditional energy usage. Refining profits have only worsened since then, while Beijing’s efforts to combat involution across industries has taken on greater urgency due to persistent deflationary and trade pressures on the economy.

China has long sought, though not always successfully, to curb excessive domestic refinery production, in part to clamp down on highly polluting sectors but also to limit damage to profit margins and with an eye on crude imports. The target for 2025 is to cap capacity at one billion tons a year.

The latest plan also targets smaller oil refiners, and those with less than 2 million tons of annual capacity could be shut, the people said. That’s necessary to offset a contraction in demand for gasoline and diesel, which has cut operating rates and left the sector with about 60 million tons of excess capacity, they said.

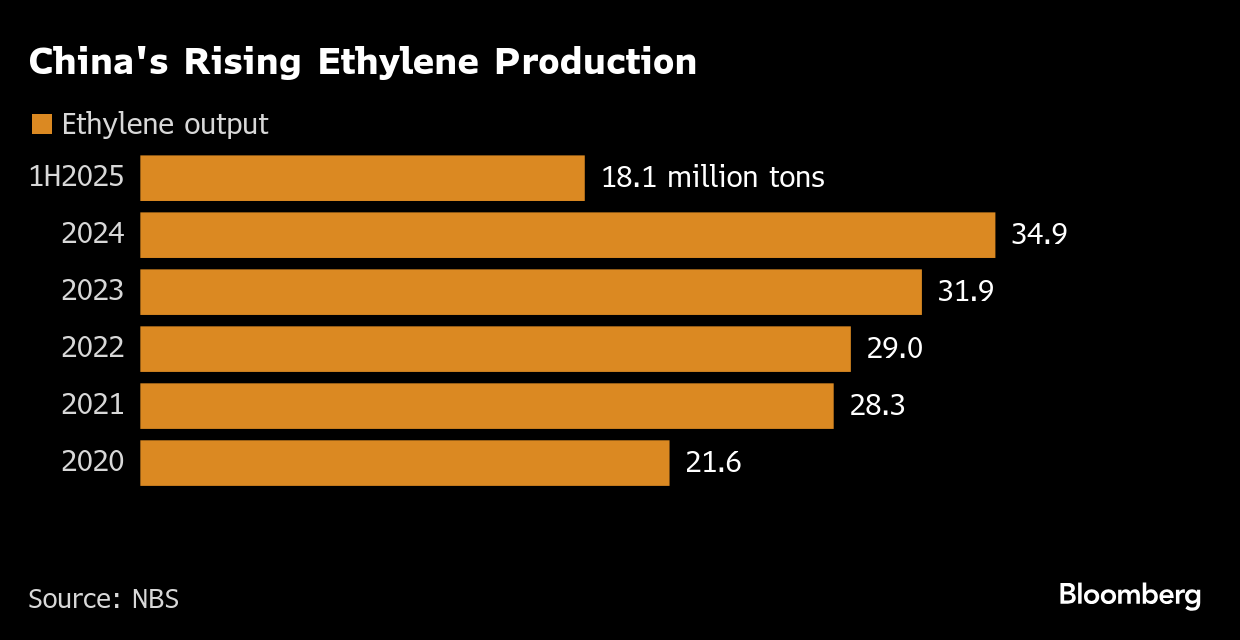

An emerging concern that may not be directly tackled in the current overhaul is ethylene — an ingredient in textiles, rubber and plastics — which could face curbs on new permits from 2026 due to a looming glut, the people said. This has been pitched by the industry as a priority for the coming Five Year Plan, to be unveiled in March.

Ethylene is a prime example of how China is fighting a rising tide of chemicals capacity after a decade of overzealous investment. New plants are still scheduled to come online through 2028. If that supply can’t be absorbed at home, it may end up as yet another Chinese export drawing accusations of dumping from trade partners that can’t compete on price.

Overcapacity isn’t just a problem for China. In Europe, several producers have restructured or halted their ethylene operations, according to BloombergNEF. The European Union responded last month with an action plan to help deter unfair competition from foreign suppliers, and China in particular. The EU’s carbon tax from 2026 is another mechanism that’s likely to penalize Chinese chemicals exporters.

On the Wire

The Trump administration said it will step up scrutiny of imports of steel, copper, lithium and other materials from China to enforce a US ban on goods allegedly made with forced labor in the country’s Xinjiang region.

Xiaomi Corp. intends to sell its first electric vehicle in Europe by 2027, declaring plans to take on Tesla Inc. and BYD Co. globally after gaining traction with its year-old Chinese EV business.

China’s broad fiscal spending expanded at the fastest pace in almost three years, pushing the deficit to another record as the government steers an economy grappling with weakening demand and higher tariffs.

Indian Prime Minister Narendra Modi welcomed improving ties with China as the two sides seek to reset relations amid mounting tariff pressure from US President Donald Trump.

This Week’s Diary

(All times Beijing)

Wednesday, Aug. 20

- China sets monthly Loan Prime Rates, 09:00

- China’s 3rd batch of July trade data, including country breakdowns for energy and commodities

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

- EARNINGS: HKEX, Jiangsu Shagang

Thursday, Aug. 21

- CSIA’s weekly solar wafer price assessment

- EARNINGS: Sinopec, Eve Energy, China Resources Power, Shandong Steel

Friday, Aug. 22

- China’s weekly iron ore port stockpiles

- Sinopec earnings press conference in HK, 14:30

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Goldwind, JA Solar, Trina, Ganfeng Lithium, China Coal, CMOC

©2025 Bloomberg L.P.