Oil Rises a Second Day After US Cracks Down on Iranian Supply

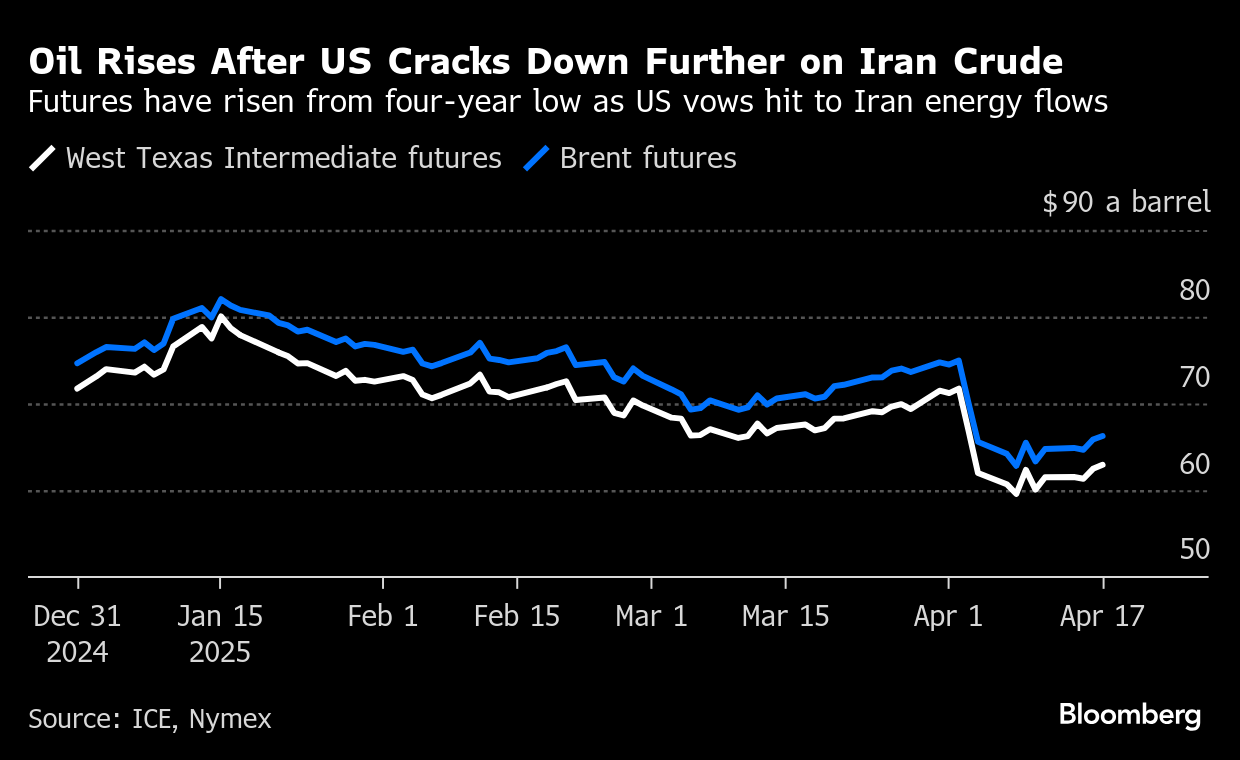

(Bloomberg) -- Oil rose for a second day after the US vowed to reduce Iran’s energy exports to zero.

Brent crude climbed above $66 a barrel after advancing almost 2% on Wednesday, putting futures on track for their first weekly gain this month. West Texas Intermediate traded near $63. Treasury Secretary Scott Bessent said the US would apply maximum pressure to disrupt the OPEC member’s oil supply chain, as his department sanctioned a second Chinese refinery accused of handling crude from the Islamic Republic.

The so-called teapot oil processor sanctioned by the US — Shandong Shengxing Chemical Co. Ltd. — had allegedly handled over $1 billion worth of Iranian crude, the Treasury Department said. Tehran, meanwhile, warned that fledgling nuclear talks with Washington may fall apart if the Trump administration “moves the goalposts.”

The sanctioning of the refinery might do little to stem the flow of Iranian crude to China, because the nations have set up supply chains and payment methods outside international systems, “minimizing the chance of disruption,” said Brian Leisen, global oil strategist for RBC Capital Markets LLC.

This week’s rebound was aided by US government data that showed inventory levels at Cushing, Oklahoma — the delivery point for WTI — fell by roughly 650,000 barrels to the lowest since 2008 for this time of the year. However, it still pales in comparison to the more than $10 drop earlier this month that saw futures sink to a four-year low following President Donald Trump’s chaotic tariff moves that threaten global growth and energy demand.

Elsewhere, OPEC+ production remains in focus as the alliance makes yet another push for members to rein in output to nearer quota levels. The latest data, however, show that Iraq and Russia have made only minor progress, and habitual quota-violator Kazakhstan’s backlog expanded by more than 40%.

Oil futures won’t trade on Friday, a holiday in many countries.

©2025 Bloomberg L.P.