Oil Pushes Higher as Trump Signals No Intention to Ax Powell

(Bloomberg) -- Oil extended gains as President Donald Trump said he had no intention of firing Federal Reserve Chair Jerome Powell, while an industry report pointed to a large decline in US crude stockpiles.

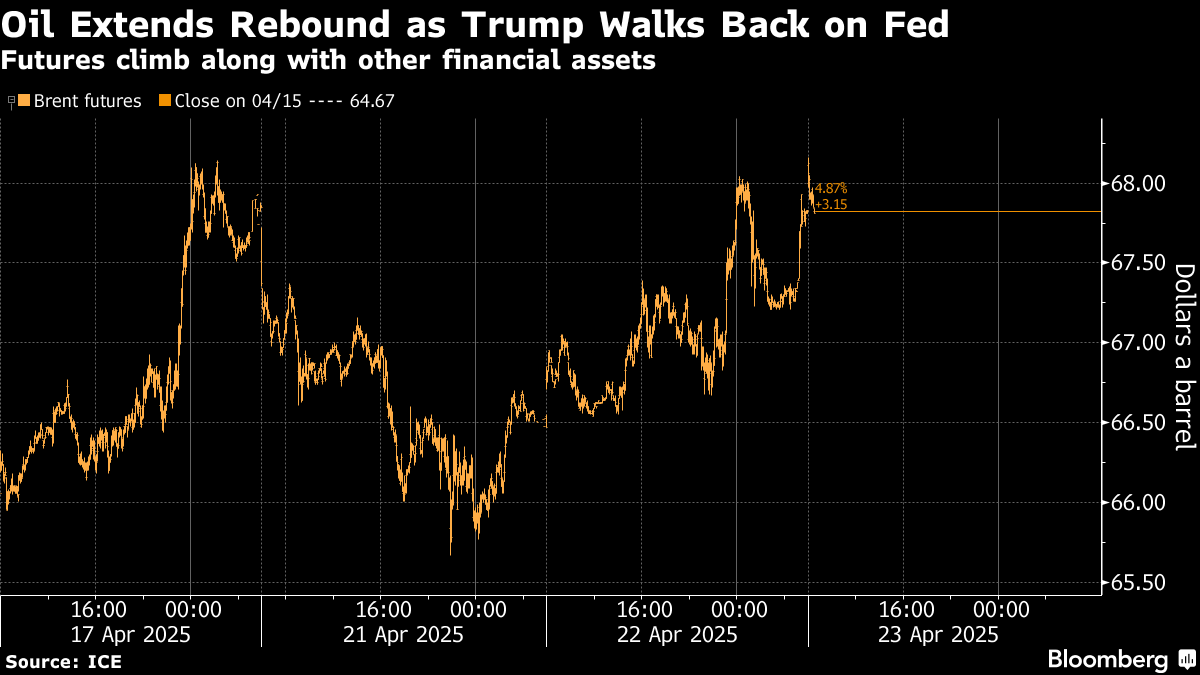

Brent traded near $68 after closing 1.8% higher on Tuesday, and West Texas Intermediate climbed above $64 a barrel after Trump’s comments on the Fed chief. His criticism of Powell prompted a global selloff on Monday before oil and other financial assets clawed back some losses in the following session.

“Crude has taken in the tailwinds from the reduction in cross-asset volatility and the general feeling that we’re averting a policy mistake in Trump’s push for Powell’s early removal,” said Chris Weston, the head of research at Pepperstone Group Ltd. in Melbourne.

Oil’s rebound on Tuesday was aided by speculation that Iranian flows may be curtailed after the US announced sanctions against liquefied petroleum gas magnate Seyed Asadoollah Emamjomeh and his corporate network. The Trump administration has previously vowed “maximum pressure” on Tehran.

US crude inventories, meanwhile, shrunk by 4.57 million barrels last week, the American Petroleum Institute reported. That would be the biggest draw since November if confirmed by official figures later on Wednesday.

Futures are still on track for a heavy monthly loss on concerns that rising tensions between US and its top trading partners could stifle economic growth and throttle energy demand. In a closed-door investor summit on Tuesday, US Treasury Secretary Scott Bessent said the tariff standoff with China cannot be sustained and that the two countries will have to find ways to de-escalate.

Still, some market gauges are pointing to a stronger near-term market. The prompt spread for benchmark Brent is in the widest backwardation since January, a bullish structure that signals tighter supply.

©2025 Bloomberg L.P.