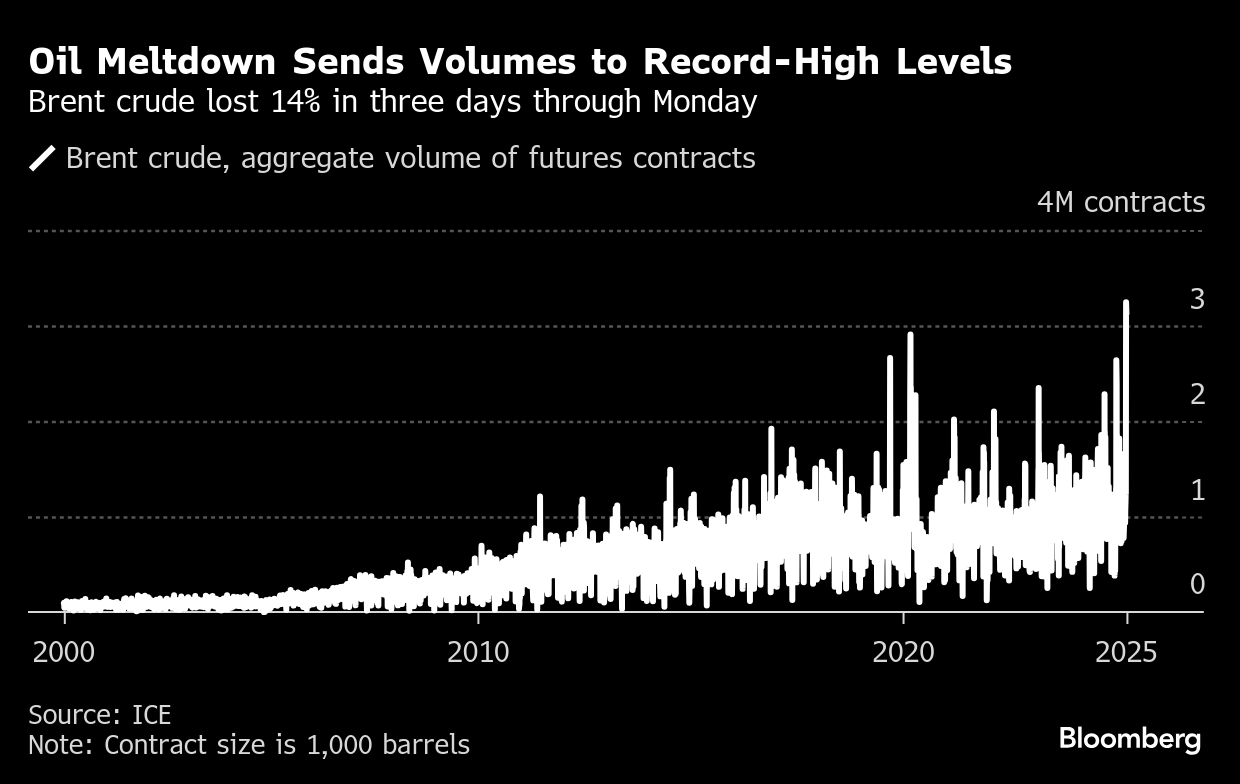

Oil Edges Higher After Three-Day Tumble With Trade War in Focus

(Bloomberg) -- Oil rebounded after a three-day slump as a slightly calmer tone returned to global markets, with traders assessing the latest tariff moves from US President Donald Trump as well as possible retaliatory measures.

Brent rose above $65 a barrel after hitting a four-year low in the previous session, while West Texas Intermediate traded near $62. Trump has threatened to slap an additional 50% levy on Chinese imports, while Beijing responded by saying it’s prepared to “fight to the end” as the two nation’s square off.

Crude — along with equities, bonds and other commodities — has been roiled this month as the US president presses on with his aggressive trade policy. The ructions have stoked concerns about a global slowdown or recession that would jeopardize energy demand. At the same time, OPEC+ delivered a bigger-than-expected output hike, hurting the outlook for oil-market balances.

Trump’s threatened 50% charge on Chinese goods would come on top of the 34% duty imposed on all the nation’s imports — set to begin Wednesday — as well as a 20% levy put in place earlier. That effectively doubles the import price of any good shipped from China to the US. Elsewhere, trade chiefs in the European Union are weighing a full spectrum of countermeasures to sweeping US tariffs.

“Recession risk will only rise — and the perception of global oil demand will be taken down — unless we hear some signs of Trump working with the EU or China in a more constructive capacity,” said Chris Weston, head of research at Pepperstone Group in Melbourne.

Chinese crude buyers are likely to halt imports of American oil as the trade war drags on, including levies imposed by Beijing on US goods, according to local industry consultant JLC. Companies could instead look to source more cargoes from Russia, the Middle East, West Africa and South America, it said.

The escalating trade war has prompted banks including Goldman Sachs Group Inc. and Morgan Stanley to cut oil-price forecasts for the coming quarters. Societe Generale SA also slashed its outlook, citing the threat posed by the US tariffs for the Chinese economy and global crude demand.

©2025 Bloomberg L.P.