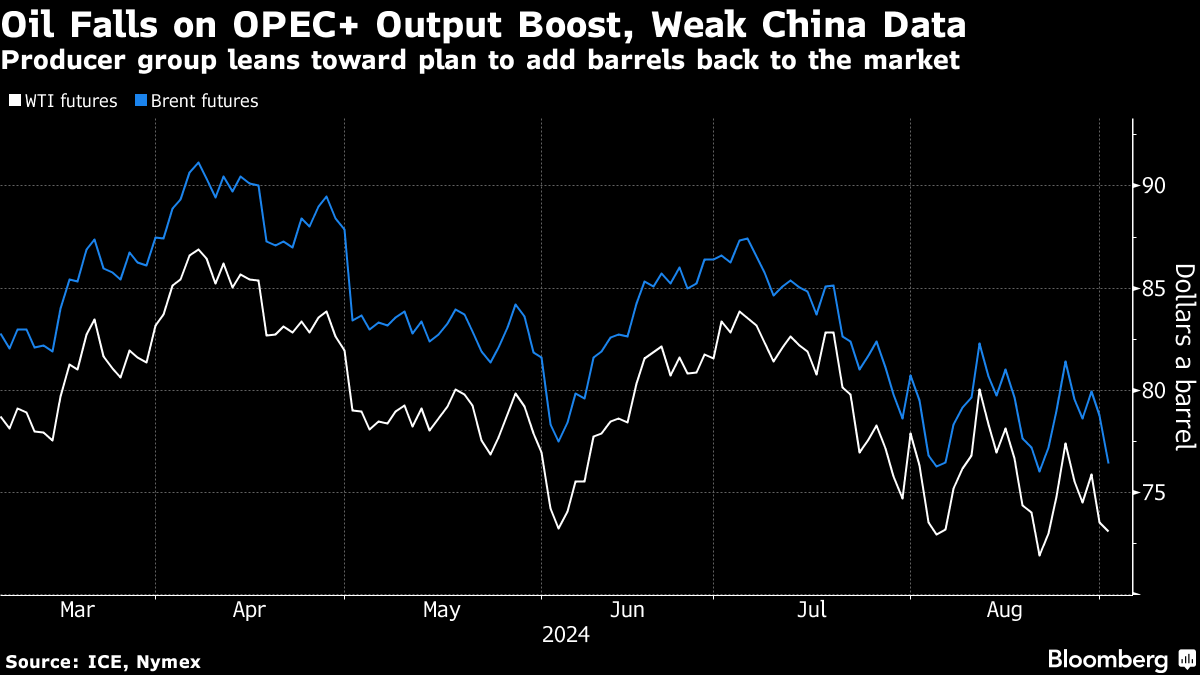

Oil Extends Drop on Signs of OPEC+ Output Boost and China Woes

(Bloomberg) -- Oil pushed lower on signs OPEC+ will progress with a plan to lift output from October, while economic headwinds mount in China.

Brent for November slipped toward $76 a barrel after losing more than 2% on Friday, and West Texas Intermediate traded near $73. The cartel is due to add 180,000 barrels a day as it gradually restores production that’s been halted since 2022, according to delegates involved in the discussions.

Over the weekend, Chinese data showed factory activity contracted for a fourth month in August and a residential slump deepened, raising concerns the world’s top crude importer may struggle to meet this year’s economic growth target. India’s diesel sales also registered a sharp decline last month.

Oil has given up most of its gains this year as expectations of ample supply and signs of economic headwinds, including in the US, weighed on prices. Volatility has ramped up in recent weeks, with crude futures facing some of their largest intraday swings during August.

OPEC+ has repeatedly said that it could “pause or reverse” its planned output hikes if necessary, though a political crisis in Libya that’s halved the nation’s production may have given the alliance the space to add more barrels.

“There are still concerns over whether the market needs this supply,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “Chinese demand worries are not disappearing anytime soon.”

©2024 Bloomberg L.P.