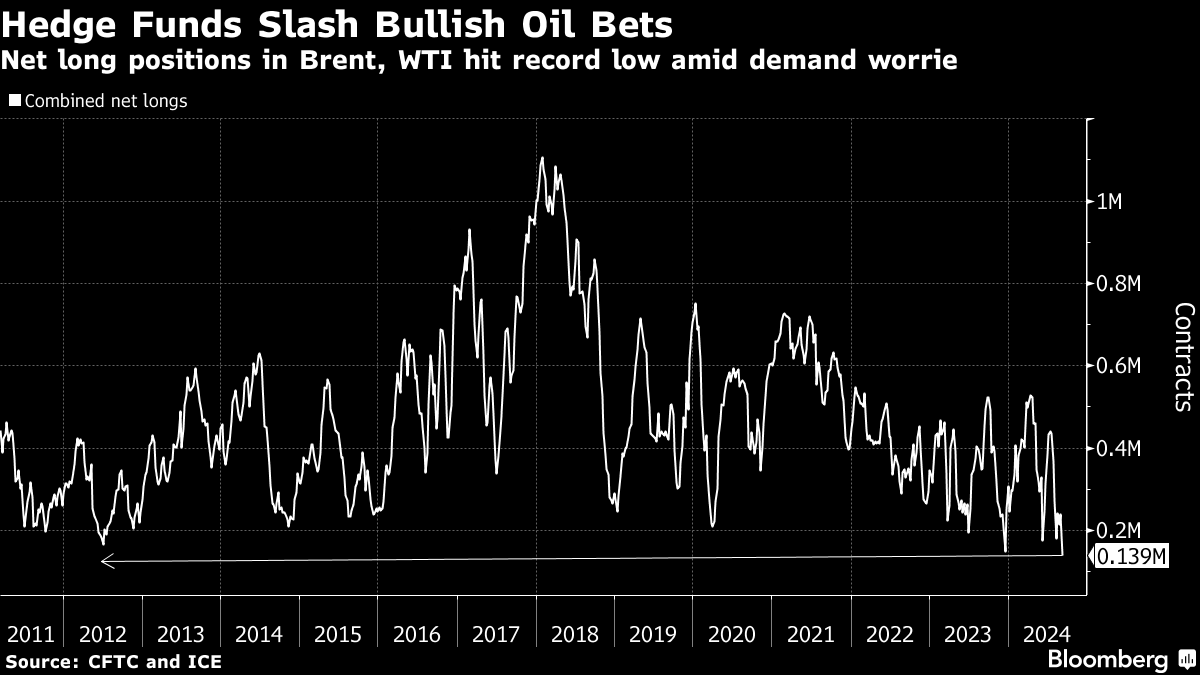

Hedge Funds Slash Bets on an Oil Rally to Lowest Ever Amid Rout

(Bloomberg) -- Hedge funds turned the least bullish on crude in records going back more than 13 years on the prospect of swelling supplies and waning demand.

Money managers decreased their combined positions on Brent and West Texas Intermediate oil by 99,889 lots to a total net-long position of 139,242 lots, according to ICE Futures Europe and CFTC data for the week ended Sept. 3. That’s the lowest in data stretching back to March 2011.

The souring sentiment comes amid a plunge in prices in recent weeks, driven by worries about demand in the US and China and exacerbated by heavy selling from algorithmic-based funds. Inflaming the negative sentiment was a potential deal to restore Libya’s production as well as the possibility OPEC+ would increase output next month. The group has since paused the plan to revive production, but the reversal has failed to increase prices.

©2024 Bloomberg L.P.