Oil Rises With Mideast Tension to the Fore as Truce Talks Falter

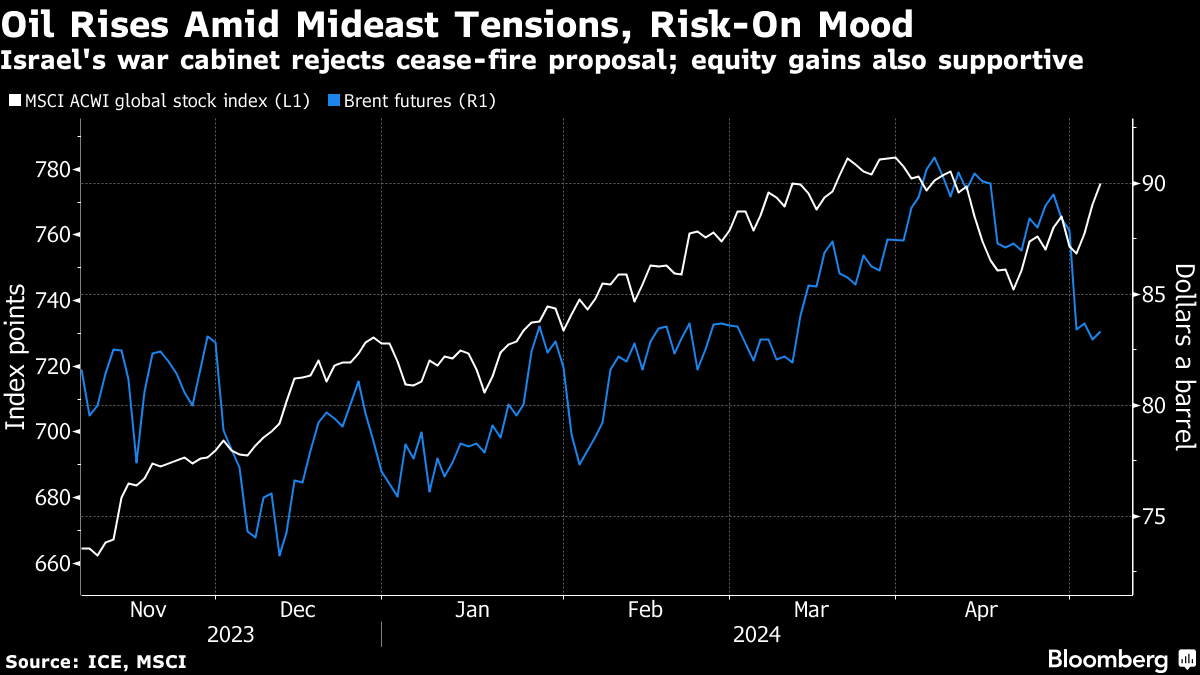

(Bloomberg) -- Oil advanced for a second day on tensions in the Middle East, with Israel rejecting a cease-fire proposal for the Gaza Strip, and a risk-on mood that helped lift wider financial markets.

Global benchmark Brent pared an earlier advance but was still pushing toward $84 a barrel, after closing 0.5% higher on Monday. West Texas Intermediate was near $79. Israel’s war cabinet unanimously rejected a cease-fire proposal agreed to by Hamas. The Jewish state has vowed to continue military operations in Rafah, a major Gazan city.

Crude’s advance came as Asian stocks pushed higher on Tuesday on optimism the Federal Reserve will start cutting interest rates this year. Lower US borrowing costs should be a plus for the nation’s energy demand.

Oil is clawing back some ground after posting its worst weekly drop since February. Prices remain higher year-to-date as OPEC+ production cuts have tightened the market. While the cartel is expected to keep supplies tight, the demand outlook is clouded, with diesel flashing signs of weakness.

“Geopolitics is back in the driving seat for crude oil traders after last week’s drop,” said Charu Chanana, an analyst at Saxo Capital Markets Pte in Singapore. “The demand outlook remains supported by expectations of Fed’s rate cuts, and focus today will be on the EIA outlook report.”

The Energy Information Administration is due to release its Short-Term Energy Outlook later Tuesday, offering clues on market dynamics, including the pace of US oil supply and prospects for further growth. Nationwide output recently hit a record above 13 million barrels a day.

©2024 Bloomberg L.P.