China Defies Global Copper Squeeze With Near-Record Production

(Bloomberg) -- The global copper market is gripped by fears of a shortage, which has propelled prices to record levels and sparked a $49 billion takeover battle. But in China, the world’s biggest producer and consumer of the refined metal, there’s more than enough to go around.

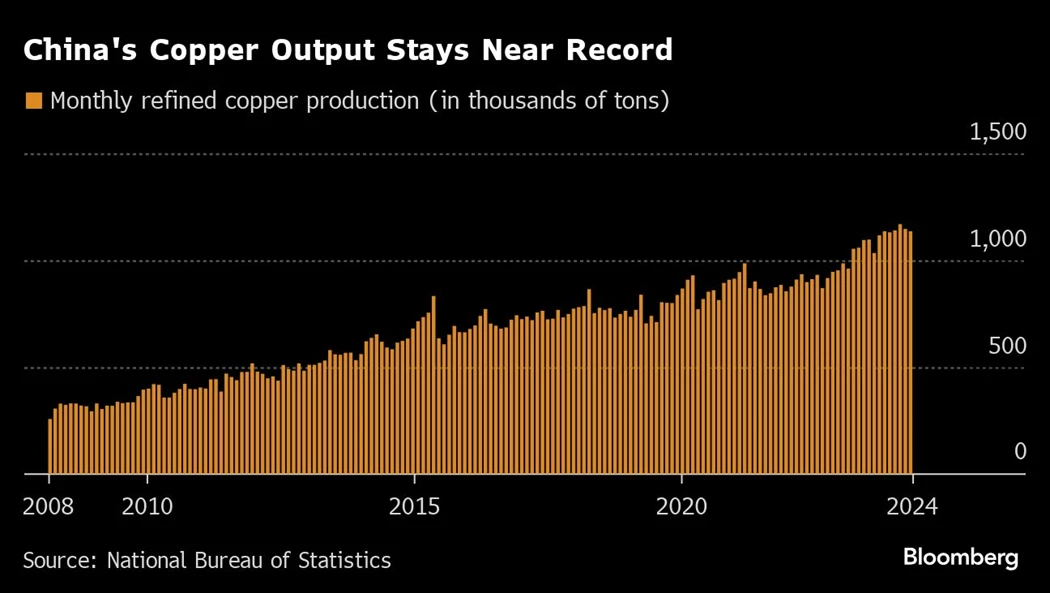

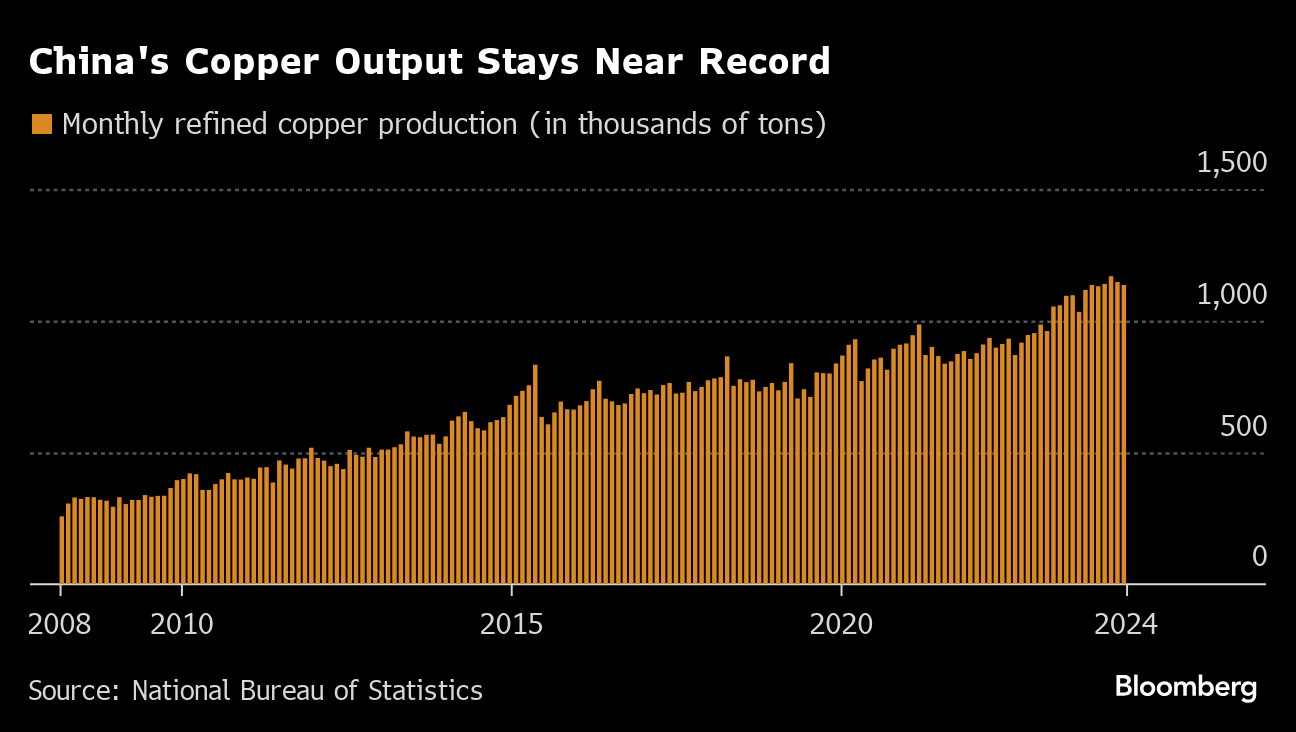

At the center of that conundrum are the nation’s ever-expanding copper smelters. The industry is maintaining production at near-record levels — defying a scarcity of raw materials — as higher prices unlock more scrap metal for processing.

Smelters had pledged to reduce capacity after their fees collapsed because of a supply squeeze on the imports of ore they use as feedstock. The prospect of insufficient copper in China is just one of the pillars supporting a barnstorming rally that took the metal above $11,000 a ton for the first time at the start of last week. But the cuts haven’t happened and China’s faltering economy isn’t able to absorb the excess.

The mismatch between supply and demand has become more glaring in recent days, with prices retreating to just above $10,300 a ton. Although that’s still a 21% gain for the year, it suggests that as long as China remains oversupplied, copper will struggle to make further headway.

The availability of scrap from discarded pots, pipes and wires has risen quickly after copper prices surged, said Liang Kaihui, an analyst with Shanghai Metals Market. Fabricators have been busy turning that into blister, a semi-processed version of the metal, and feeding it back to smelters, he said, where it’s used as a substitute for the overseas ore that’s now in short supply.

The abundance of scrap is seen in its discount to refined copper, which blew out to 4,615 yuan ($637) a ton last week, the widest in at least eight years, according to SMM.

The smelting industry, meanwhile, keeps adding capacity. As long as they’re profitable, individual firms prefer to defend market share at the expense of margins. Local governments also want them to keep churning out metal so that they can meet their economic growth targets and maintain employment levels.

On the Wire

China’s PMI surveys for May will likely show manufacturing continuing to grow at a modest pace, supported by solid production, according to Bloomberg Economics.

Ten years ago almost to the day, while checking out a handful of luxury sedans from one of China’s largest automakers SAIC Motor Corp., President Xi Jinping gave a pivotal speech that would set China on the course to dominate the electric vehicle industry.

Chinese industries plan to ask authorities to start an anti-dumping investigation into pork imports from the European Union, the state-run Global Times said, citing information from a “business insider.”

China’s engagement in the global system of commerce was roundly criticized by Group of Seven finance chiefs in a show of unity accompanied by a threat of further escalation.

This Week’s Diary

(All times Beijing unless noted.)

Monday, May 27:

- China industrial profits for April, 09:30

Tuesday, May 28:

- SHPGX hosts China gas power forum, day 1

Wednesday, May 29:

- CCTD’s weekly online briefing on Chinese coal, 15:00

- SHPGX hosts China gas power forum, day 2

Thursday, May 30:

- Nothing major scheduled

Friday, May 24:

- China’s official PMIs for May, 09:30

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2024 Bloomberg L.P.