S&P 500 Posts 15th Record This Year as Tech Roars: Markets Wrap

(Bloomberg) -- The stock market powered ahead amid a renewed rally in technology companies, with traders also sifting through the latest remarks from a slew of Federal Reserve speakers for clues on the interest-rate path.

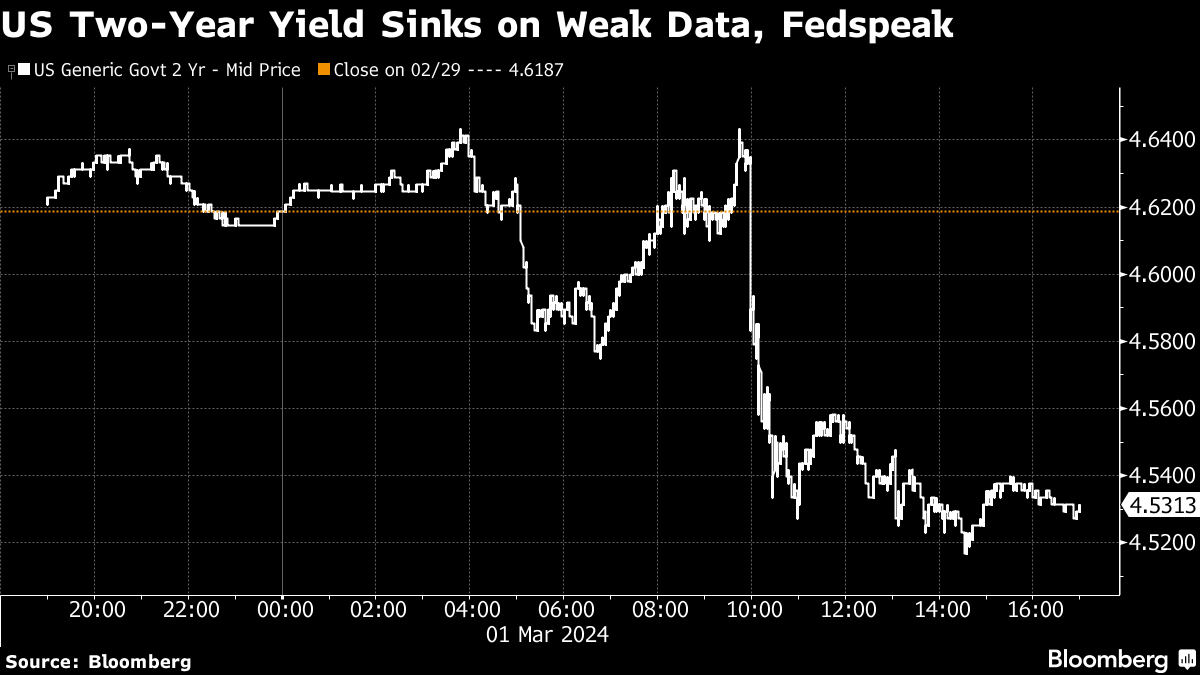

The S&P 500 topped 5,100 — hitting its 15th record this year. Traders looked past weak economic data amid bets policymakers will be able to cut rates as soon as June. US two-year yields sank as Fed Governor Christopher Waller noted he’d like a shift in the central bank’s holdings toward a larger share of short-term Treasuries.

“Market momentum remains intense, with any momentary period of weakness quickly bought by bulls,” said Mark Hackett, chief of investment research at Nationwide. “The bear case has come apart as the technicals and fundamentals both support the rally, though elevated valuations and near-universal optimism are things to watch from a contrarian basis.”

The Nasdaq 100 climbed almost 1.5%, a gauge of chipmakers jumped over 4% and Nvidia Corp. led gains in megacaps. Dell Technologies Inc. soared 32% on solid sales. Boeing Co. is in discussions to acquire Spirit AeroSystems Holdings Inc. Treasuries rose across the curve, with two-year yields sinking nine basis points to 4.53%. Oil hovered near $80. Bitcoin rose above $62,000.

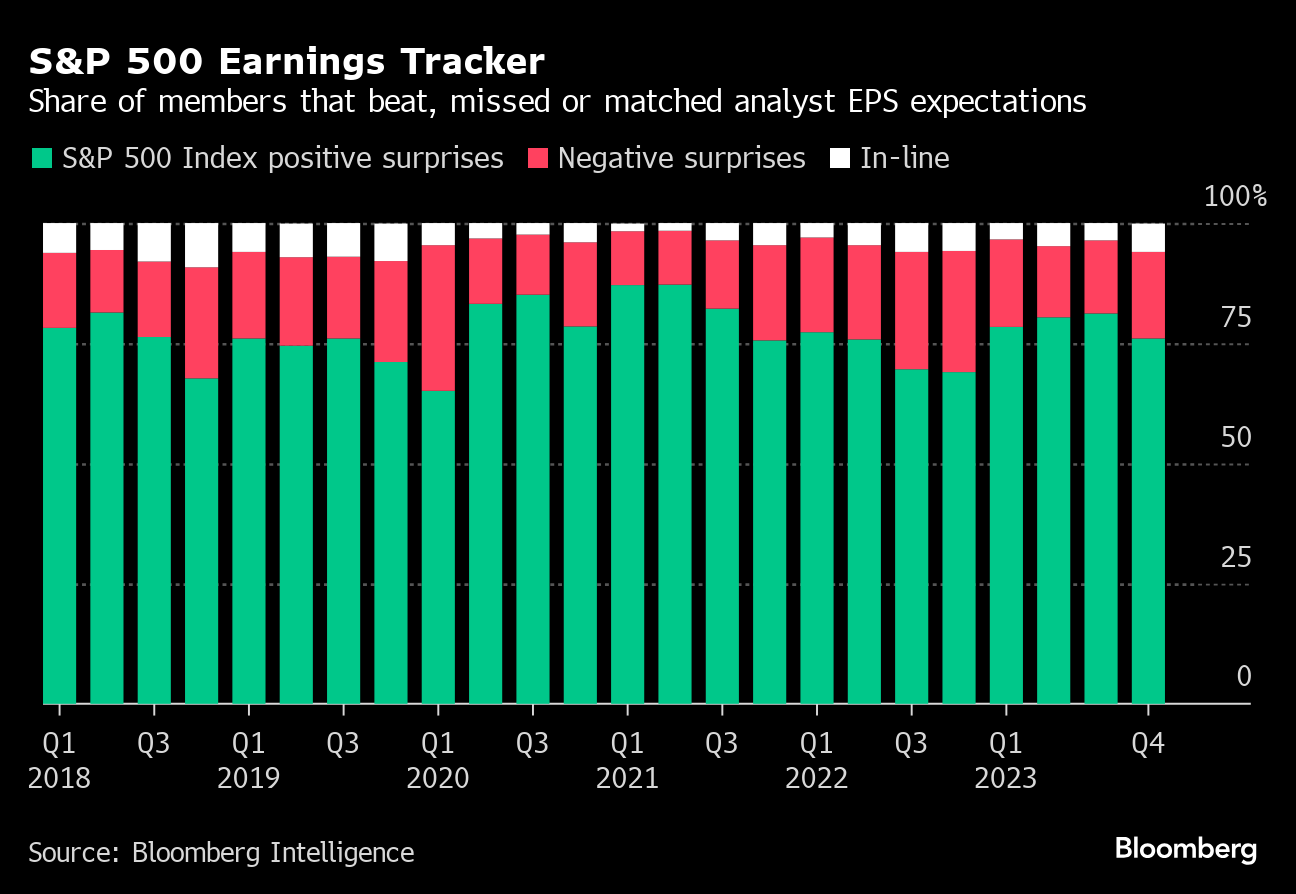

With results out from nearly all S&P 500 companies, fourth-quarter earnings look stellar. Growth was nearly 8%, compared with expectations for a 1.2% rise before the season started. Those beats helped to offset macroeconomic uncertainty.

Over the past two months, traders have pushed back their bets on when the Fed will start to cut rates. Fading hopes for easing monetary policy did little to aid equities at the start of the year just as earnings season came into focus. Some 76% of firms surprised to the upside — outperforming the 10-year average of 74%, according to data compiled by Bloomberg Intelligence — prompting Wall Street to confidently snap up equities at a rapid clip.

Meantime, the frenzy around artificial-intelligence has blindsided Wall Street forecasters, spurring a race among strategists to keep up with a stock market rally that’s already blowing past their expectations when 2024 began.

Five Wall Street firms have already lifted their forecasts for the S&P 500, which is up over 7% to start the year after rising 24% in 2023. In the past week alone, Piper Sandler & Co., UBS Group AG and Barclays Plc boosted their targets. Two firms — Goldman Sachs Group Inc. and UBS — have done it twice since December.

The S&P 500 wrapped up February with a rally of over 5%, extending its winning run to four consecutive months.

Since 1950, whenever the gauge finished higher in both January and February, full-year returns for the index have averaged 19.8%, according to Adam Turnquist at LPL Financial.

“Can the winning streak continue?,” Turnquist said. “March has historically been a good month for stocks as the S&P 500 has posted an average return of 1.1%. However, during election years, average March returns dip to only 0.4%, with notable historical weakness mid-month.”

A stock indicator from BofA that’s tracking Wall Street strategists’ average recommended equity allocations ticked higher last month, moving closer to flashing a contrarian “sell” signal than a “buy” for the first time since April 2022. Still, the gauge remains in “neutral,” not “sell,” territory.

Equities managed to gain Friday despite data showing US factory activity shrank at a faster pace in February as orders, production and employment contracted.

Bond yields reached the lowest levels of the day after a large block trade in Treasury five-year note futures at a price consistent with a purchase. However, the bulk of the move occurred earlier in the session, when weaker-than-anticipated data was followed shortly by comments by Fed Governor Waller in support of slowing the pace at which Treasury securities are rolling off its balance sheet.

He was among the several Fed officials speaking Friday.

Governor Adriana Kugler is “cautiously optimistic” that inflation will cool without a notable rise in unemployment. Atlanta Fed President Raphael Bostic wants to wait to start cutting rates until inflation recedes further so the central bank doesn’t have to go back and reverse course. His Dallas counterpart Lorie Logan noted it’ll likely be appropriate to start slowing the pace at which the Fed shrinks its balance sheet.

Chicago Fed chief Austan Goolsbee told CNBC officials should keep rates elevated until they’re convinced inflation is on track to return to the 2% target. His Richmond counterpart Thomas Barkin said markets are pricing in fewer rate reductions this year in response to economic data, not because the central bank is winning a battle with investors.

In recent weeks, many policymakers have indicated that interest rates will remain at a 22-year high at least through the Fed’s next meeting on March 19-20, with the first cut likely later this year. Officials are watching to see whether January’s surprise jump in consumer prices was a fluke or a roadblock on the way toward lower inflation.

Fed Chair Jerome Powell looks set to echo his colleagues in suggesting that rate cuts are likely to begin “later this year” in his testimony to Congress next week, according to Andrew Hunter at Capital Economics. But with the downward trend in core inflation still looking intact, that doesn’t rule out a first cut in June, he noted.

US officials are likely to raise their 2024 projections for economic growth and inflation at their upcoming meeting this month, upping the chances the central bank might signal fewer rate cuts for this year, according to rate strategists at Bank of America Corp.

Apollo Management Chief Economist Torsten Slok said that a re-accelerating economy, coupled with a rise in underlying inflation, will prevent the Fed from cutting rates in 2024.

“The bottom line is that the Fed will spend most of 2024 fighting inflation,” Slok wrote. “As a result, yield levels in fixed income will stay high.”

Treasury yields could soon be heading back toward 5% if strong economic performance delays the Fed’s rate-cut plans, according to Capital Group Inc.’s Pramod Atluri.

Corporate Highlights:

- Reddit Inc. is eyeing a valuation of as much as $6.5 billion in its initial public offering, according to a person familiar with the matter.

- New York Community Bancorp said its disclosure of “material weaknesses” in how it tracks risks won’t require additional reserves for future loan losses.

- Elon Musk sued OpenAI and its Chief Executive Officer Sam Altman, alleging they violated the artificial intelligence startup’s founding mission by putting profit ahead of benefiting humanity.

- Archer-Daniels-Midland Co. delayed its annual report and indicated that a “material weakness” in its internal controls won’t have a broad impact on earnings.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.8% as of 4 p.m. New York time

- The Nasdaq 100 rose 1.4%

- The Dow Jones Industrial Average rose 0.2%

- The MSCI World index rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.3% to $1.0837

- The British pound rose 0.2% to $1.2656

- The Japanese yen fell 0.1% to 150.15 per dollar

Cryptocurrencies

- Bitcoin rose 2.1% to $62,740.66

- Ether rose 2.6% to $3,439.08

Bonds

- The yield on 10-year Treasuries declined seven basis points to 4.18%

- Germany’s 10-year yield was little changed at 2.41%

- Britain’s 10-year yield declined one basis point to 4.11%

Commodities

- West Texas Intermediate crude rose 1.9% to $79.77 a barrel

- Spot gold rose 1.9% to $2,083.66 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.