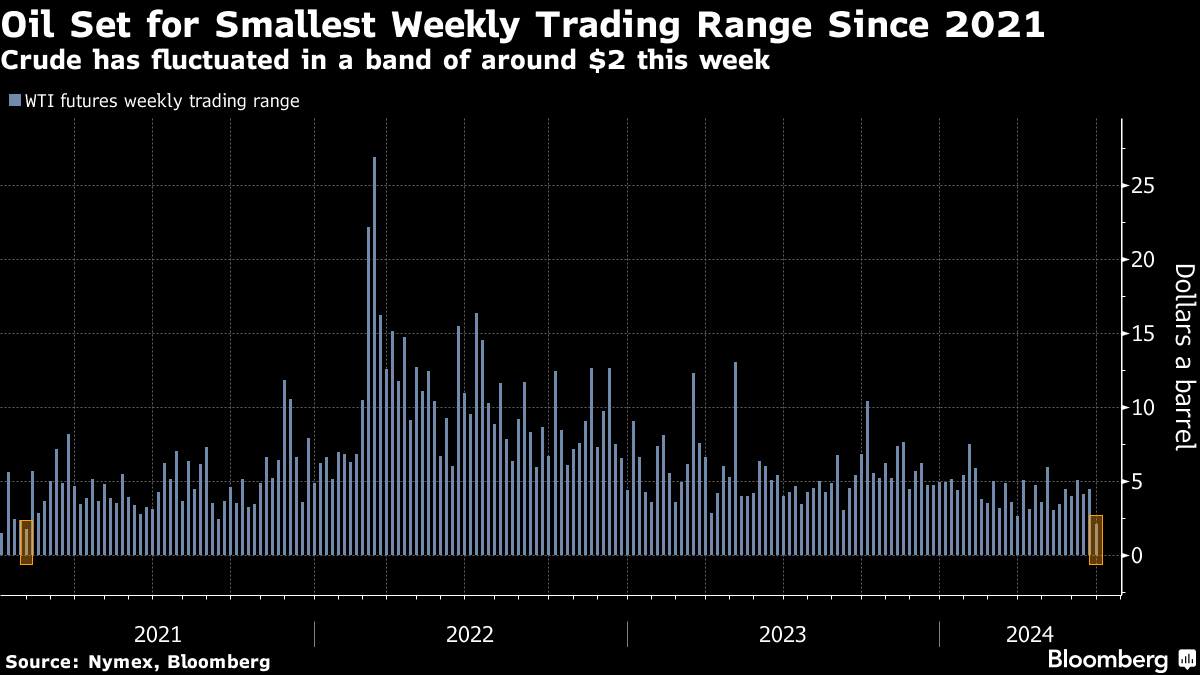

Oil Stuck in Tightest Trading Range Since 2021 Ahead of US Data

(Bloomberg) -- Oil held in the narrowest trading range since 2021, ahead of US economic data that may help set the tone for broader markets.

West Texas Intermediate edged above $82 a barrel after rising 1% on Thursday, with prices moving in a band of around $2 this week. Brent was near $87. The stalemate in crude markets has prompted investors to focus on further-dated contracts next year including for June and December.

Traders will be watching personal consumption data later Friday for clues on the path forward for US monetary policy. Federal Reserve Bank of Atlanta President Raphael Bostic said he continues to expect one interest rate cut this year in the fourth quarter as inflation shows progress.

Oil is set for a monthly gain after stumbling at the start of June following an announcement from OPEC+ that the group would start returning some supply later this year. The alliance was forced to clarify that it could pause or reverse production changes if needed, and prices have trended higher since.

Prompt spreads are signaling some strength, with the measure for Brent crude rallying to over $1 a barrel in a bullish backwardation structure ahead of the contract expiry. Market watchers are also positive on the price outlook for the third quarter due to seasonal demand.

“Crude at current levels looks pricey,” said Vandana Hari, founder of Vanda Insights in Singapore. “The summer demand bump narrative is a bit overblown. Jet fuel demand may be strong but gasoline and gasoil are struggling around the world.”

Persistent concerns about China’s economic outlook remain an issue for the market. The nation’s refiners have been forced to cut operating rates and prolong maintenance due to a demand slowdown in the world’s biggest crude importer.

©2024 Bloomberg L.P.