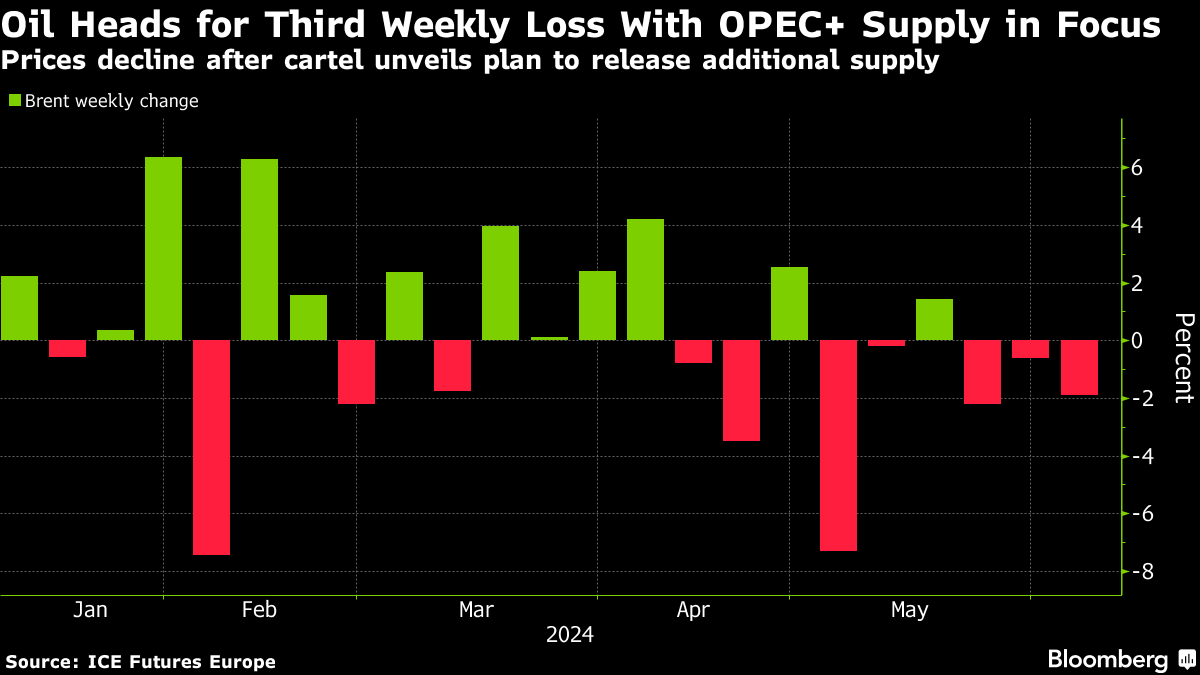

Oil Set for Weekly Loss After OPEC+ Supply Plan Rattles Market

(Bloomberg) -- An unexpected plan by OPEC+ to return some supply this year has put oil on track for a weekly decline, prompting some members of the alliance to reassure the market they are committed to stability.

OPEC+ ministers including from Saudi Arabia said on Thursday that the group can still react to any changes in the market and adjust supply. That sparked a sharp rebound in oil prices, which had already staged a modest recovery after tumbling into oversold territory for the first time in about a year.

Brent futures are back trading near $80 a barrel after advancing 1.9% on Thursday, but prices are still heading for a third weekly drop. West Texas Intermediate was below $76, also set for a loss this week.

The OPEC+ plan has drawn a mixed reaction from Wall Street. JPMorgan Chase & Co. expressed doubt over its bearish effect because many members are already pumping above their assigned quotas, while Citigroup Inc. predicts full cuts will be maintained into next year.

Oil has trended lower since early April in part due to concerns over the demand outlook. However, geopolitical risks surrounding the war in Ukraine and the Middle East continue to simmer, which could spur further price gains.

Near-term catalysts of OPEC+ losing cohesion, or damage to oil infrastructure in Russia or the Middle East are in focus, said Stefano Grasso, a senior portfolio manager at Singapore-based fund 8VantEdge Pte.

©2024 Bloomberg L.P.