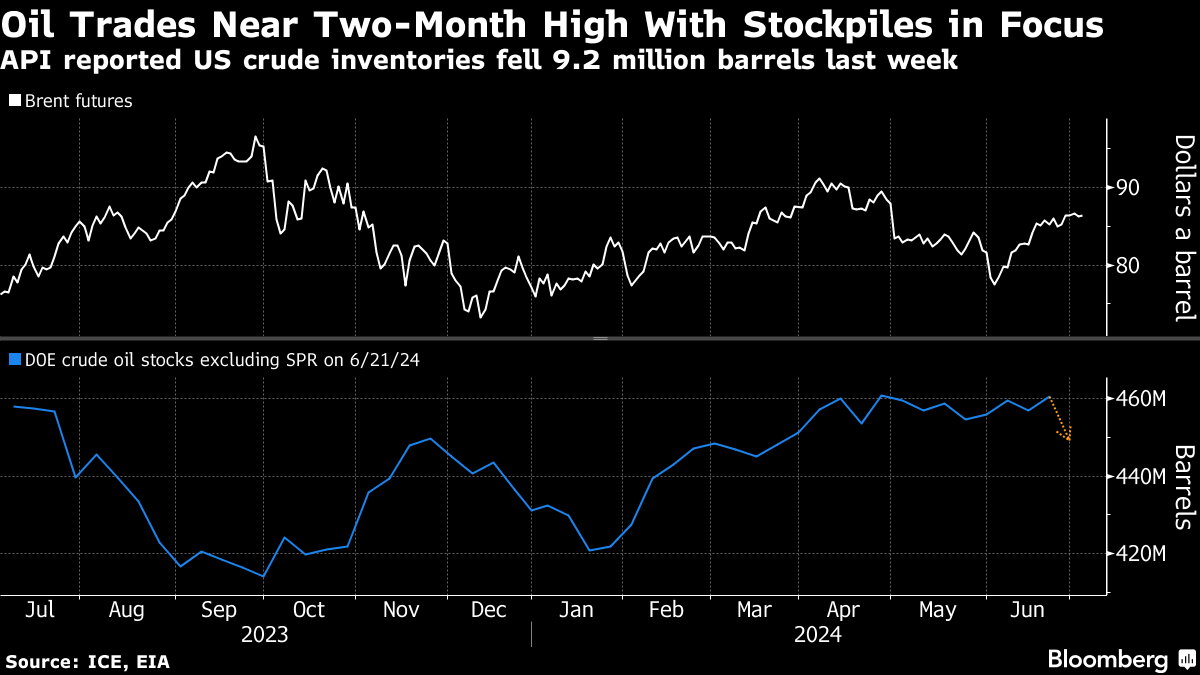

Oil Trades Near Two-Month High on Signs of US Inventory Drawdown

(Bloomberg) -- Oil climbed to near a two-month high on signs of a significant drawdown in US crude stockpiles.

Brent crude traded above $86 a barrel after slipping 0.4% on Tuesday, with West Texas Intermediate near $83. The American Petroleum Institute reported crude inventories shrank 9.2 million barrels last week, according to people familiar with the data. If confirmed in official figures later Wednesday, that would be the largest drop in barrel terms since January.

Crude remains solidly higher this year, with futures helped by a wider risk-on mood in equity markets as the US benchmark S&P 500 hits record after record. Anxieties over a potentially active hurricane season have also been supportive. Options markets reflect the bullishness, with call options once again going at a rare premium to opposite puts.

Geopolitical risks are also salient, with investors monitoring elections in France and the UK. In the Middle East, escalations in the war between Israel and Hezbollah threaten to spill over into an all-out war, while the Israel Defense Forces warned Palestinians to leave parts of Gaza’s Khan Younis ahead of a possible new assault.

“The key risk for oil markets is that an Israel‑Hezbollah war widens into a broader conflict,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia. “In particular, the more direct involvement of Iran in an Israel‑Hezbollah war may put at risk Iran’s oil supply and related infrastructure.”

©2024 Bloomberg L.P.