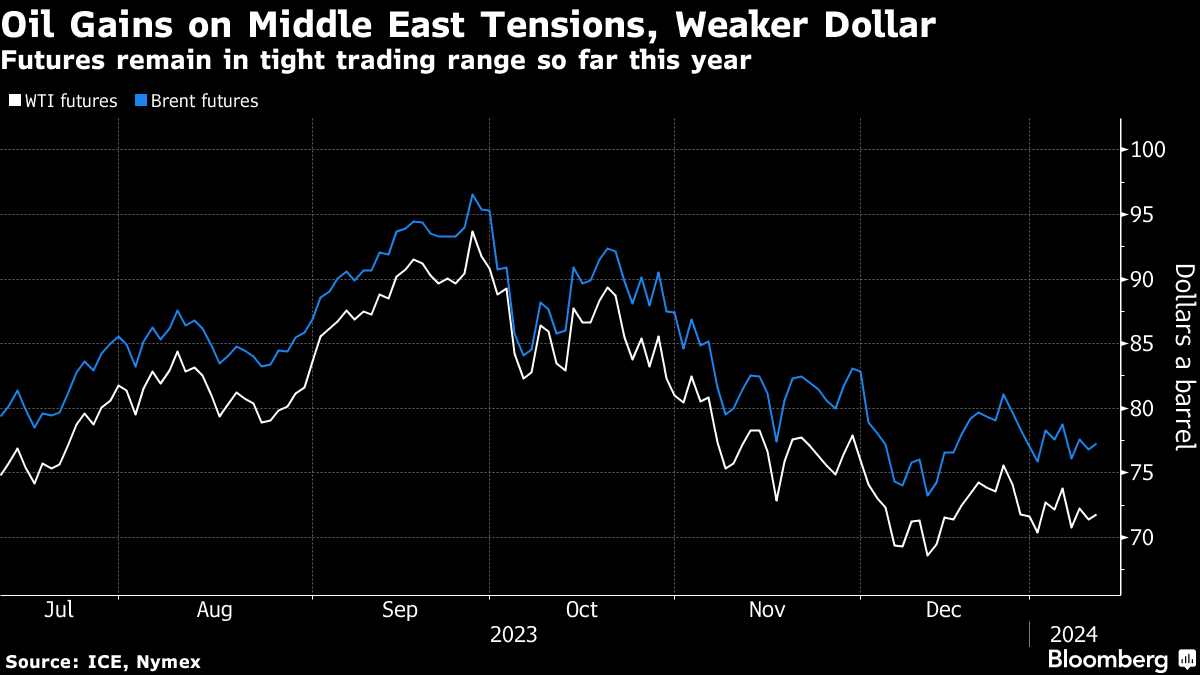

Oil Pushes Higher With Red Sea Risks and Weaker Dollar in Focus

(Bloomberg) -- Oil ticked higher as tensions in the Middle East persisted, and the US dollar weakened before key inflation data, aiding commodities.

Global benchmark Brent advanced above $77 a barrel, retracing some of Wednesday’s 1% drop that was spurred by data showing an unexpected rise in US stockpiles. West Texas Intermediate headed toward $72 a barrel.

In the Middle East, tensions continued to ratchet higher as the US and allies weighed options for retaliating against Yemen-based Houthi militants for attacks on Red Sea shipping. The assaults have reduced the number of tankers carrying crude and products through the Bab el-Mandeb Strait by about a third.

Oil has struggled to find a clear direction so far this year, swinging between daily gains and losses, as traders attempt to gauge the outlook. The market will be relatively balanced in 2024 as demand growth struggles to keep pace with new supply from outside OPEC, according to Vitol Group.

Additional support for crude — as well as other raw materials including copper — came from a weaker US currency, which makes purchases cheaper for overseas buyers. Inflation data later Thursday will be scrutinized for clues on what pace inflation is easing, and the consequences for monetary policy.

“It’s an uneven tug-of-war between a bearish global oil demand-supply outlook and a supportive, albeit fleeting, risk premium from the Red Sea attacks and tensions,” said Vandana Hari, founder of Vanda Insights. “Sentiment appears more predisposed to panicky selling than protective buying.”

©2024 Bloomberg L.P.