Oil Climbs After Separate Attacks Escalate Middle East Tensions

(Bloomberg) -- Oil rose after separate attacks in the Middle East that killed US troops in Jordan and hit a fuel tanker in the Red Sea, an escalation of tension in the region that accounts for around a third of the world’s crude output.

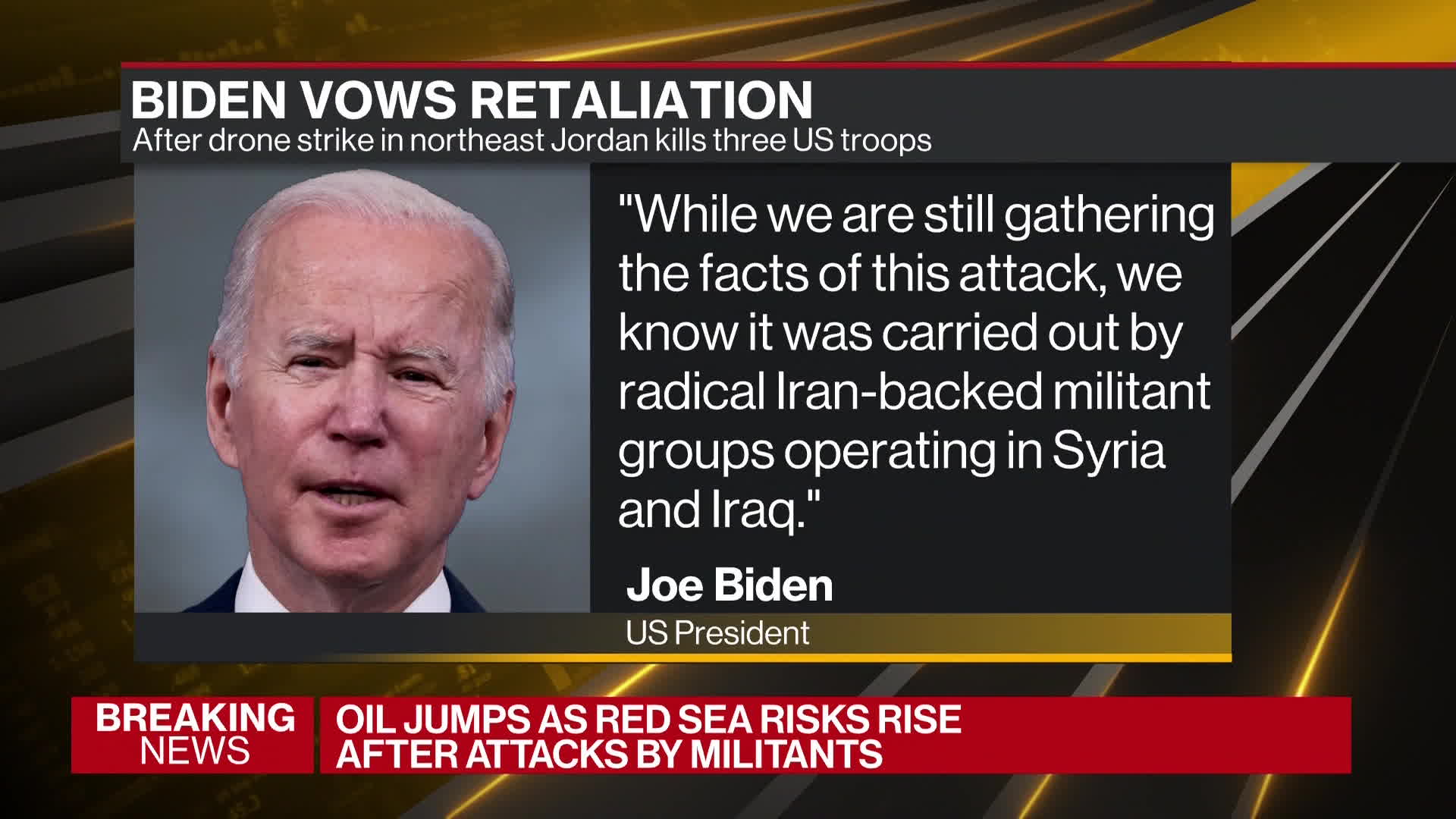

The White House said Iranian-backed militants killed three soldiers and wounded others in a drone assault, which Tehran denied carrying out. That followed a Houthi missile strike Friday on a vessel operated on behalf of Trafigura Group carrying Russian fuel, the most significant yet on an energy-carrying ship.

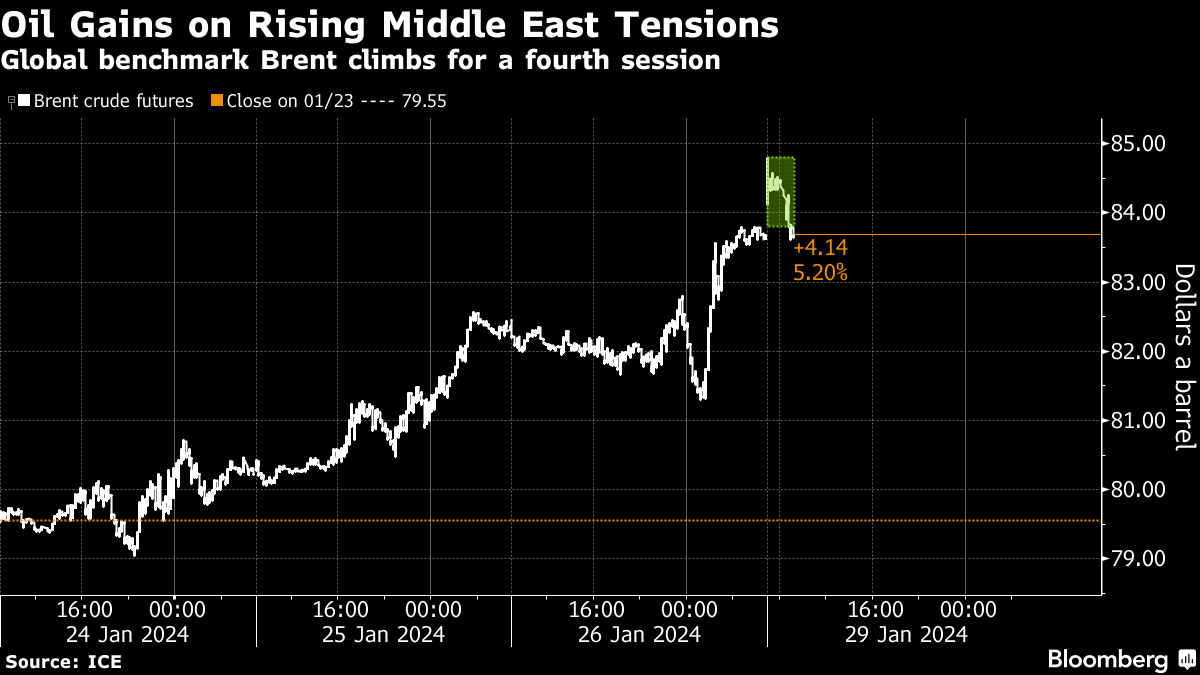

Brent crude jumped as much as 1.5% in early Asian trading before paring most of those gains. That came after the global benchmark rose more than 6% last week in the biggest increase since October. West Texas Intermediate climbed toward $79 a barrel, while diesel futures in London gained almost 5%.

The oil market “has been exposed to a buffet of supply-side risks,” said Vishnu Varathan, a chief economist for Asia ex-Japan at Mizuho Bank Ltd. “It does appear that even with any softening we’re seeing to demand, geopolitics is shaping up so that oil prices could have more upside risk in them.”

The deaths of American troops, the first under enemy attack since Israel and Hamas went to war, will put President Joe Biden under intensifying pressure to confront Iran directly, risking a wider conflict in a region vital for global trade. The attack on the tanker was consequential as shippers had previously assumed the safe passage of vessels tied to Russia and China after earlier assurances by Houthi militants, who mostly targeted ships linked to Israel, US and UK.

Brent has risen around 9% this month as the situation in the Middle East became more tense, but it’s still well below where it was shortly after the Hamas attack on Israel in October. The prospect of robust supply from non-OPEC producers and slowing demand growth is helping to keep a lid on prices. And while the attacks in the Red Sea have led to some re-routing of cargoes — adding to freight costs — it hasn’t yet led to shortages or affected production.

Biden vowed retaliation for the killing of US troops near the Syrian border, and some Republican lawmakers urged the president to launch strikes on Iran — a level of escalation that the US has said it’s intent on avoiding.

A Trafigura spokesman said the vessel that was attacked by the Yemen-based Houthi rebels was carrying Russian-origin naphtha — a product used to make plastics and gasoline — purchased below the price cap imposed by the Group of Seven nations. The strike was carried out on the Marlin Luanda.

“None of the actors want a full-blown war,” said John Kilduff, founding partner of Again Capital LLC. “The oil is still flowing, no oil fields have come into the cross hairs and we’re still seeing vessels going through the Suez Canal.”

©2024 Bloomberg L.P.