Oil Heads for Weekly Drop as Talks for Gaza Ceasefire Advance

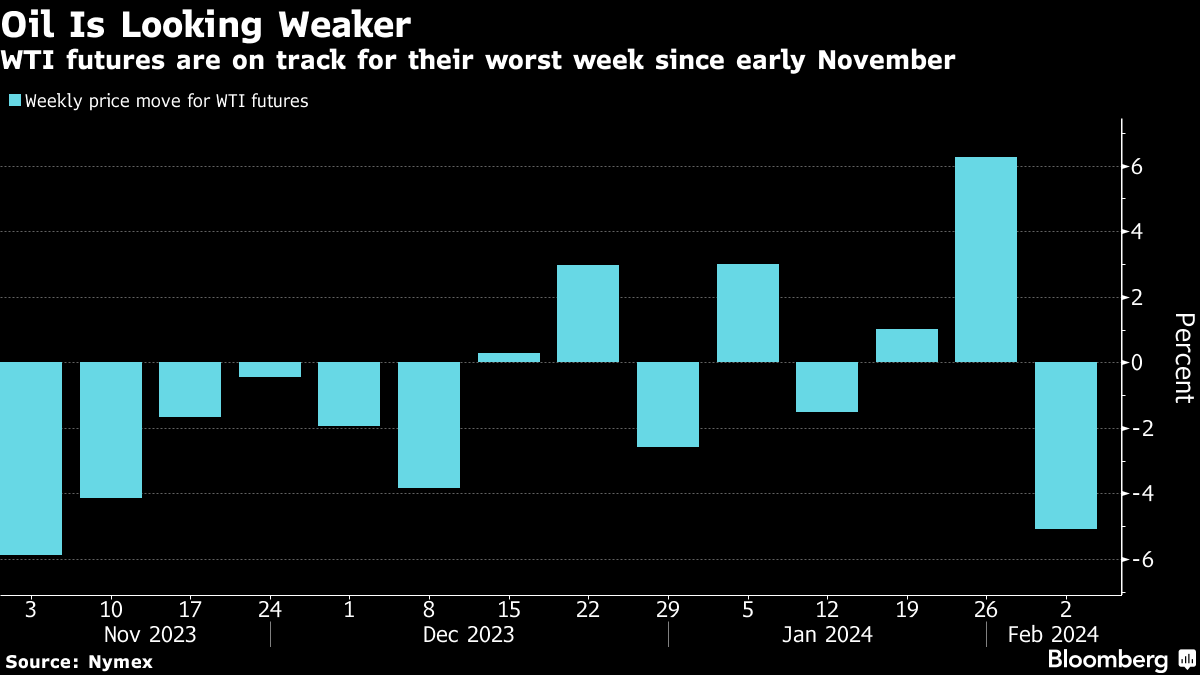

(Bloomberg) -- Oil headed for the biggest weekly loss since early November as negotiations advance for an agreement to pause the Israel-Hamas war in what could be a crucial step toward ending the conflict.

West Texas Intermediate rose above on $74 a barrel Friday, but was still down almost 5% for the week. Brent was also on track for a weekly drop. Talks on a ceasefire are still in the early stages and a breakthrough isn’t expected in the coming days, people familiar with the matter said.

There are still concerns simmering tensions in the Middle East could escalate quickly. Yemen-based Houthi rebels continue to target shipping in the Red Sea and Gulf of Aden, while the market waits for a US response to a drone assault that killed American troops in Jordan over the weekend.

“It’s no surprise that geopolitical risk premium placed on crude is fading as hopes of progress on Gaza ceasefire talks grow,” said Vishnu Varathan, an economist at Mizuho Bank Ltd. “But a conflict this entrenched and polarized is unlikely to have a linear, unfettered and short path to resolution.”

Oil capped a monthly advance in January following the attacks on commercial shipping in the Red Sea, but robust supply and concerns around demand from key consumers has kept prices from rising much higher. OPEC+ signaled on Thursday that it would stick with output cuts this quarter.

OPEC reduced daily oil production by 490,000 barrels last month as the producer group and its allies embarked on a new effort to prevent a global glut and buoy prices, according to a Bloomberg survey.

©2024 Bloomberg L.P.