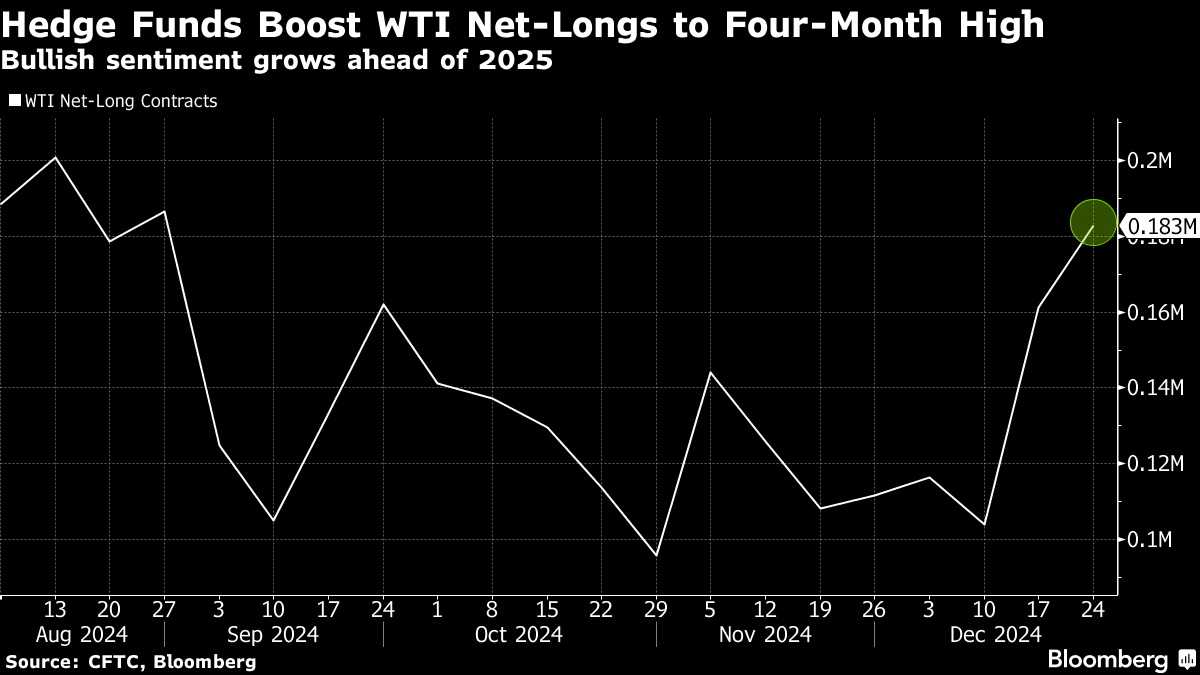

Bullish Oil Bets at Four-Month High as Investors Eye 2025 Risks

(Bloomberg) -- Bullish oil bets reached a four-month high in the penultimate week of 2024 as investors position for a new year that will see Donald Trump’s return to the White House.

Money managers boosted net-long positions on West Texas Intermediate by 21,694 lots to 182,895 lots during the week ended Dec. 24, according to the Commodities Futures Trading Commission. Oil futures traded in a less-than $3 band during that week, suggesting the rise in bullish bets were due to longer-term positioning changes rather than short-term price reactions.

The increase comes a week after hedge funds boosted bets on rising prices by the most in a year. While a looming supply glut and tepid China demand are weighing on the market heading into 2025, investors are nevertheless positioning for upside risk as Donald Trump returns to the White House and conflicts in Ukraine and the Middle East continue to simmer. The US president’s position on major oil exporter Iran is a key wildcard for traders.

READ: Trafigura, Gunvor Weigh Trump Wildcard Against Oil Glut in 2025

Algorithmic traders flipped to net-long on both WTI and Brent crude earlier in the month and have continued to extend those positions, according to Bridgeton Research.

©2024 Bloomberg L.P.