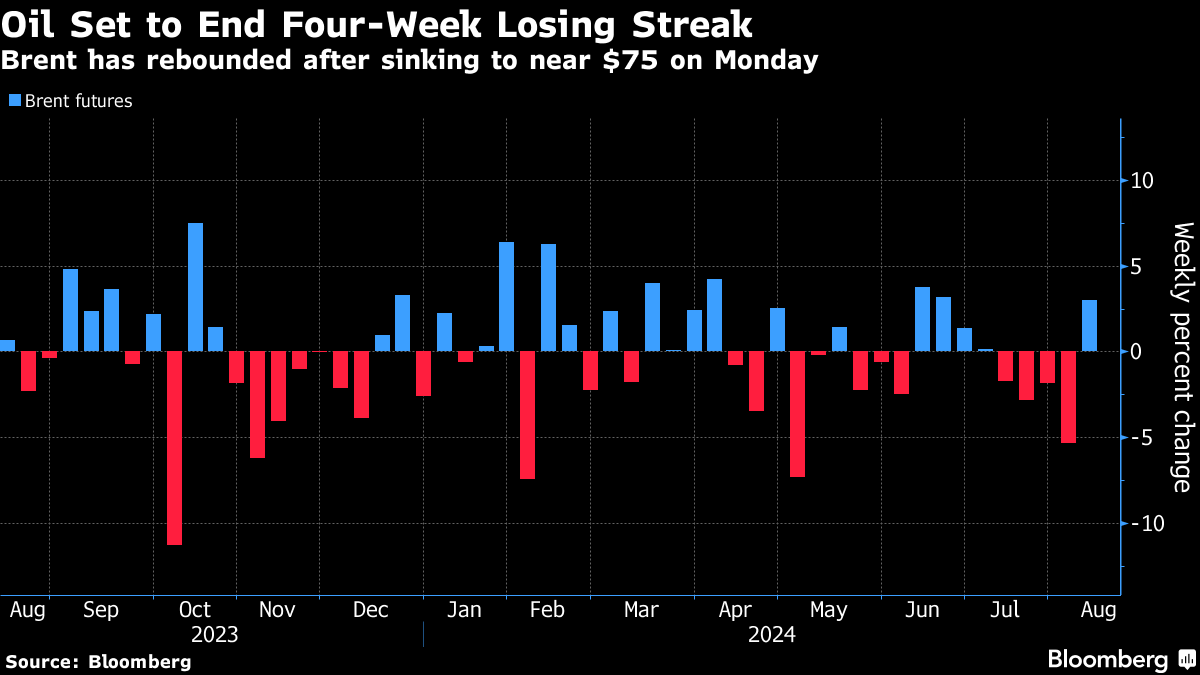

Oil Poised for Weekly Gain With Eyes on Middle East, Equities

(Bloomberg) -- Oil steadied after a three-day rebound, with traders monitoring developments in the Middle East and a rally in wider markets.

Brent traded near $79 a barrel after rising 1.1% on Thursday and West Texas Intermediate was above $76, as signs of resilience in the US labor market lifted stocks. The US, Qatar and Egypt are calling for a new round of cease-fire talks to end the war in Gaza, while the region braces for an expected Iranian attack on Israel.

Oil has rallied after Brent tumbled on Monday to a seven-month low, tracking a rout in global equity markets. Futures are set to end a four-week run of losses, with the halting of Libya’s biggest field, a sixth week of US stockpile draws and Ukraine’s incursions into Russia compounding the bullishness.

“The market shouldn’t get its hopes too high” after the recent correction, said Gao Jian, an analyst at Shandong-based Qisheng Futures Co. The end of the peak summer driving season in the US and the planned return of OPEC+ production from next quarter are bearish factors that will need to be gradually priced in, he said.

Meanwhile, jet fuel demand is on the mend in China. The rare bright spot comes after months of bearish signals, including data this week that showed that the world’s biggest crude importer had shipped in the fewest barrels in almost two years in July.

©2024 Bloomberg L.P.