Oil Edges Higher as Attention Shifts to Outlooks From OPEC, US

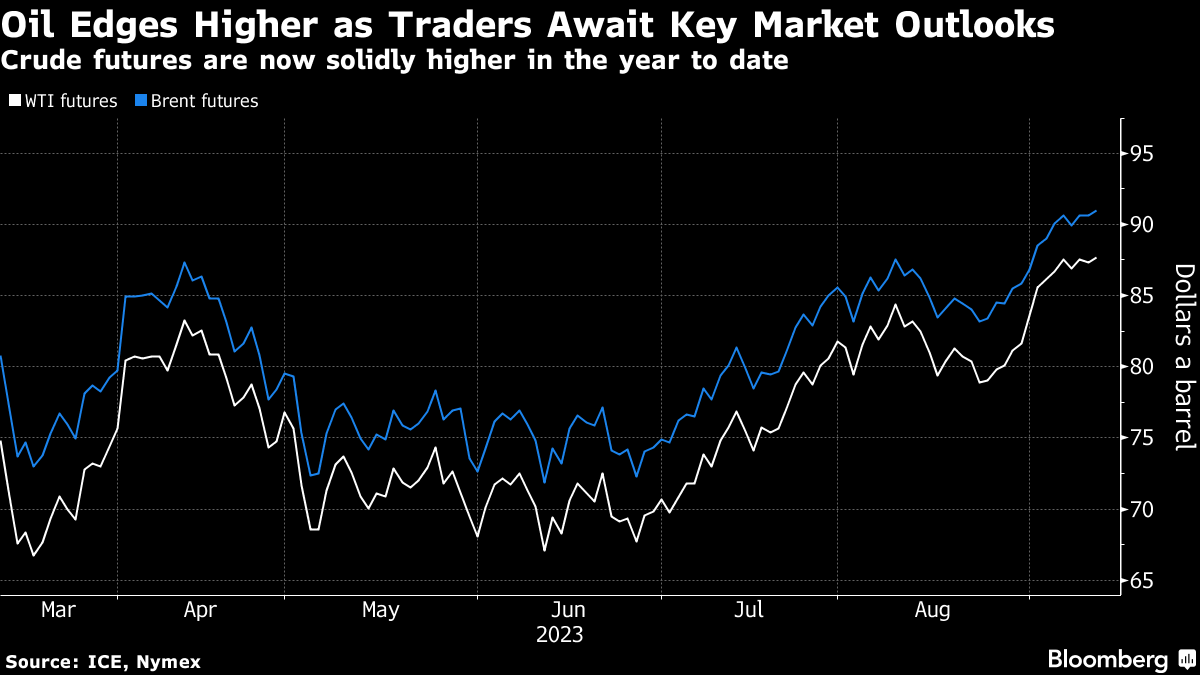

(Bloomberg) -- Oil edged up, trading near the highest level this year before reports that may offer further insight into the market’s balances.

West Texas Intermediate advanced toward $88 a barrel, after slipping 0.3% on Monday as technical indicators suggested its earlier gains may be overdone. The Organization of Petroleum Exporting Countries and US Energy Information Administration will both publish monthly market reports later Tuesday, with the International Energy Agency’s to come on Wednesday.

The fundamentals that have fueled a rally in crude since June remain strong. OPEC+ stalwarts Russia and Saudi Arabia are keeping a lid on supply, while the outlook for demand in top importer China is brightening and the US looks less likely to enter a painful recession.

The US dollar also held the biggest tumble in nearly two months on Monday, making commodities priced in the currency more attractive for most buyers.

“The upward momentum is exhausted for now,” said Vandana Hari, founder of Vanda Insights in Singapore. “Crude needs fresh cues to pick a direction. We may see a holding pattern of around $90 for Brent.”

Meanwhile, diesel is rallying after Russia limited exports of the workhorse fuel of the global economy this month. That’s helped European futures blow past $1,000 a ton for the first time since January.

©2023 Bloomberg L.P.