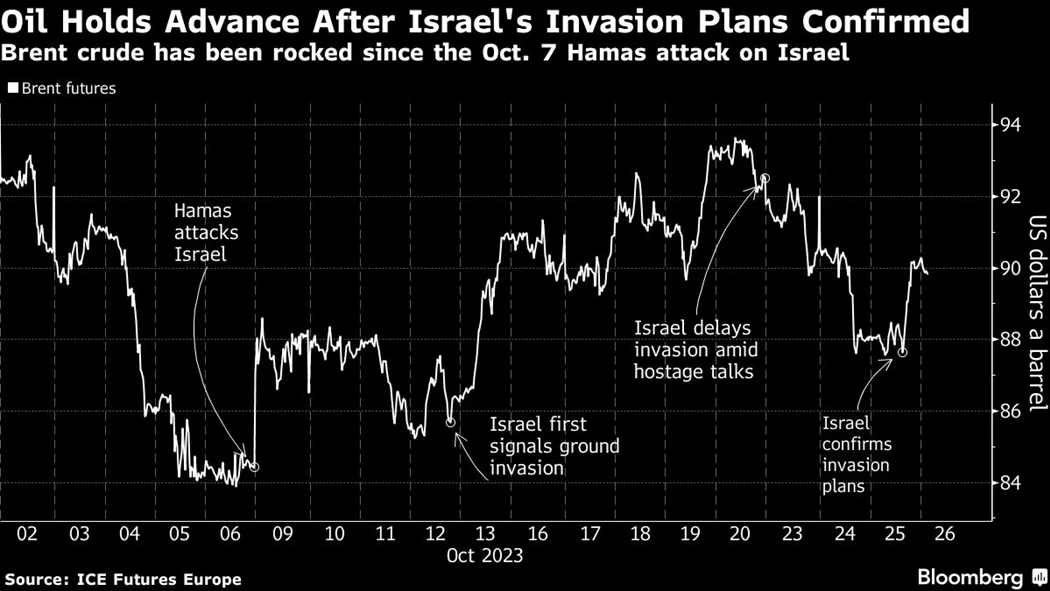

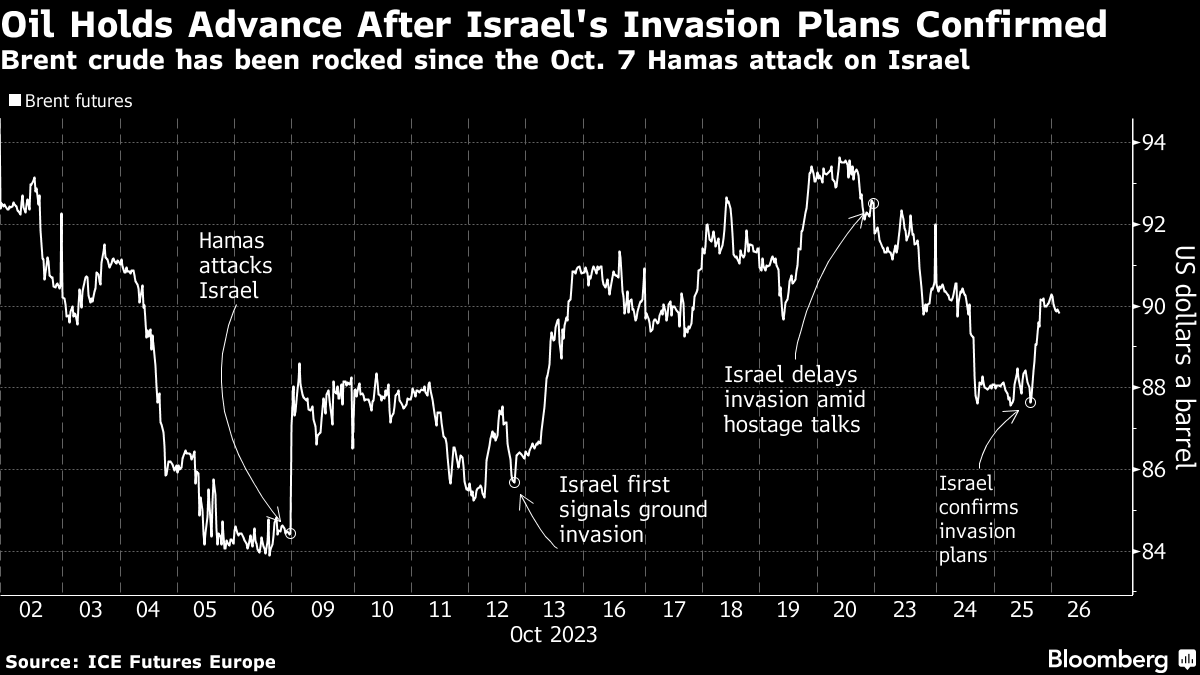

Oil Steadies After Surge as Israel Confirms Gaza Invasion Plan

(Bloomberg) -- Oil steadied after jumping Wednesday on signs Israel will proceed with a ground invasion of Gaza, reviving concerns the conflict could escalate and threaten energy supplies.

Global benchmark Brent traded near $90 a barrel, after rising more than 2% in the prior session, while West Texas Intermediate held above $85. Israel’s Prime Minister Benjamin Netanyahu said his nation was in a battle for its very existence, and that an invasion was being prepared.

The remarks reignited a war premium in oil futures that had been subsiding over the last few days. The main threats in the Middle East, which accounts for about a third of the world’s crude, include the US taking steps to curb Iranian exports and disruptions to shipping.

The widely expected ground offensive had been delayed to allow the US to deploy air-defense systems in the region, according to the Wall Street Journal. Meanwhile, diplomatic efforts to avert a wider war continued, with French President Emmanuel Macron saying a massive ground operation would be a mistake during a visit to the region.

“We think oil prices can rise as markets adapt to the probability of the conflict escalating,” with WTI likely to trade around $90 a barrel in the near term, said Han Zhong Liang, investment strategist at Standard Chartered Plc.

Beyond the Middle East, US nationwide stockpiles rose by 1.37 million barrels last week, Energy Information Administration data showed. Inventories at the Cushing, Oklahoma, storage hub expanded by 213,000 barrels. Physical oil markets across the world are also seeing a slump in prices, as profits from making fuels such as gasoline dip ahead of the winter season.

©2023 Bloomberg L.P.