Oil Extends Relief Rally to Fourth Day on Better Demand Signals

(Bloomberg) -- Oil rose for a fourth day, the longest run of gains in over two months, on signs the demand outlook may not be as bad as previously feared.

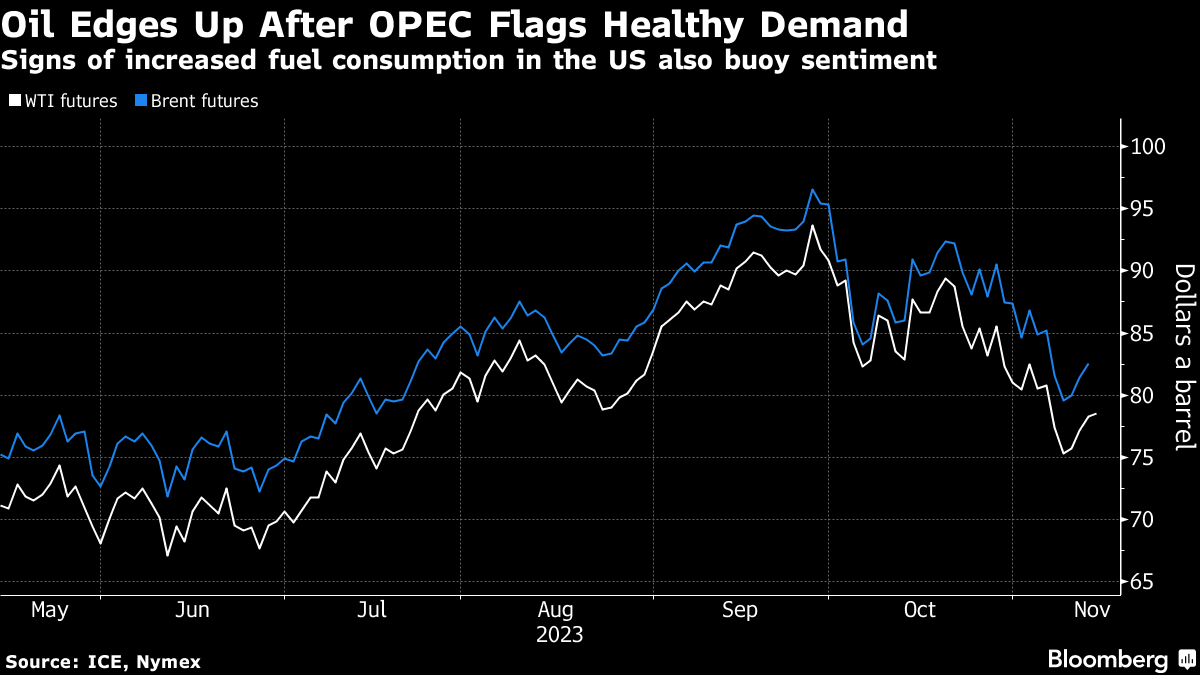

Global benchmark Brent traded near $83 a barrel, and is up around 4% since Wednesday’s close. West Texas Intermediate was close to $79. Demand is robust, and “overblown negative sentiment” has been dominating the market, OPEC said in a monthly report on Monday. The American Automobile Association said the US Thanksgiving travel period will be the busiest since 2019.

Fundamentals “are still supportive, with the market likely to be in deficit for the remainder of this year,” said Warren Patterson, head of commodities strategy for ING Groep NV. “The surplus we see early next year could even be erased if the Saudis roll over their additional voluntary supply cuts.”

There are still plenty of bearish indicators, however, and, despite OPEC’s optimism, Saudi Arabia is keeping its output at the lowest level in years. Supply also looks healthy as flows from the Middle East remain unaffected by the Israel-Hamas war, and shipments from Russia and the US increase.

Brent is down around 14% from this year’s peak in late September. Meanwhile, money managers have quadrupled their bearish bets on WTI in the past month.

In the Middle East, Israel’s forces pressed on with the offensive against Hamas. President Joe Biden called on Israel to take “less intrusive action” at the al Shifa hospital in the Gaza Strip, stepping up the pressure to reduce civilian casualties. The US had also conducted airstrikes in eastern Syria on targets linked to Iran.

The International Energy Agency’s monthly report due later Tuesday will be closely watched for more clarity on the outlook, while US inflation figures are also due. The Energy Information Administration will release two weeks of American inventories data on Wednesday.

©2023 Bloomberg L.P.