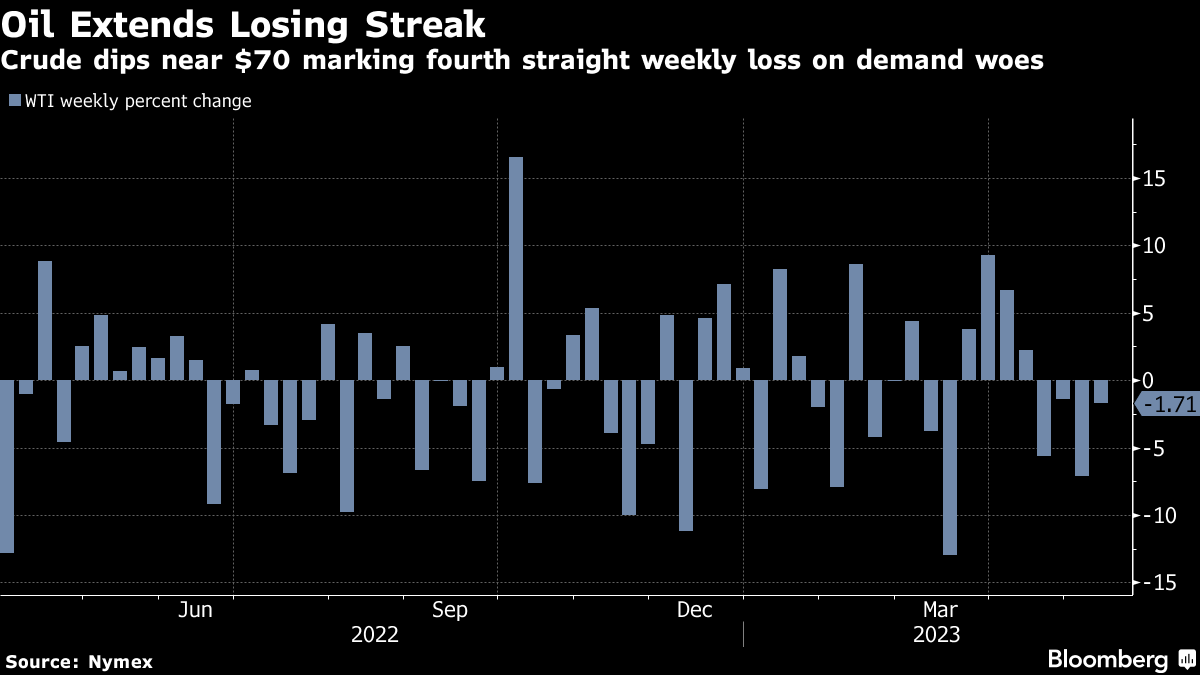

Oil Declines for a Fourth Week on Persistent Demand Concerns

(Bloomberg) -- Oil slumped near $70 to mark a fourth-straight week of losses as concerns about demand growth persist.

It briefly appeared like West Texas Intermediate would manage to snap its losing streak, supported by signs that Iraqi oil exports likely won’t resume on Saturday and the US signaling it could purchase crude to refill the strategic reserve after next month. But a strong dollar Friday, which makes oil more expensive for holders of other currencies, wiped out those gains.

Over the week, oil has been pressured by the physical market showing signs of weakness amid poor refining margins and lackluster buying in some areas. The world’s two biggest economies demonstrated further evidence of cooling, with US jobless claims rising and China’s recovery waning. Money managers have piled into bearish bets in Brent, sending net longs to the lowest since December.

“The near term momentum in crude futures remains with the bears at least until we see more positive fundamentals from the demand side,” said Dennis Kissler, senior vice president of trading at BOK Financial Securities.

Crude has retreated by about 15% over the past month as bearish sentiment has gripped the market. Traders expect the US economy to inch closer to recession and China’s rebound has disappointed some market watchers, putting a question mark over energy demand. On Friday, Citigroup cut its forecast for Brent crude from $84 a barrel to average around $82 a barrel this year with demand continuing to underperform expectations.

So far, that’s outweighed the lift from supply cuts announced by the Organization of Petroleum Exporting Countries and its allies. However, further cuts may not be on the table for now, Reuters reported, citing an interview with Hayyan Abdul Ghani, Iraq’s oil minister.

Prices have found technical support near $70 and $75 a barrel so far but a decline below those levels could send oil tumbling quickly toward the mid-60s, market participants said.

©2023 Bloomberg L.P.