Tanker Giants Sprout From Nowhere to Keep Russian Oil Moving

(Bloomberg) -- At a downtown office block in Mumbai, packing tape peels off a black door whose handle appears to have been ripped out. A pile of post is strewn on the floor outside. A guy from a neighboring office says the staff moved out a few weeks ago, destination unknown.

Almost 1,200 miles away in Dubai, a small office in a run down industrial estate, offers no clues that it, too, is a small cog in Russia’s vast new petroleum supply chain.

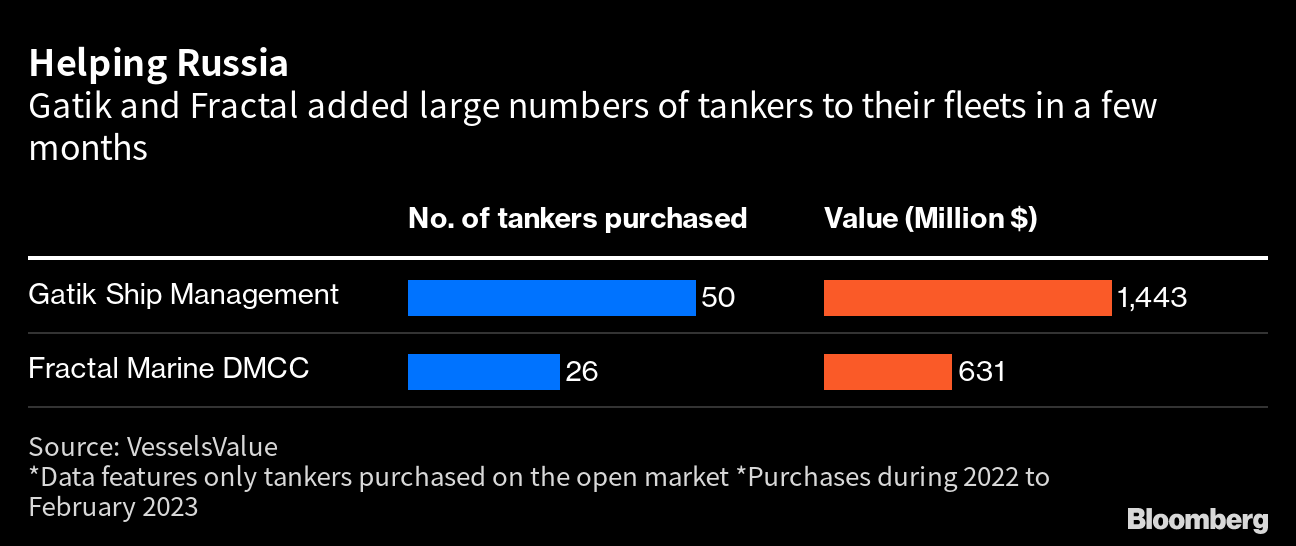

The two locations are listed on an international maritime database as belonging to firms running $2 billion in tanker assets between them. They assembled fleets in under a year that are now delivering millions of barrels of Russian oil across the globe.

The first address is for a firm called Gatik Ship Management in Mumbai. The second is for Fractal Shipping. They’re part of a sprawling network of maritime operations that came to prominence soon after the invasion of Ukraine, helping Russia’s oil exports continue substantially unscathed despite sanctions from the west.

“It is this new breed of tanker market players who have helped Russian oil to continue to flow around the world,” said Rebecca Galanopoulos Jones, senior content analyst at VesselsValue, a firm that tracks the prices of thousands of merchant ships. “The sanctions on Russian oil seem to have had very little impact on overall export levels.”

Europe banned almost all seaborne oil imports from Russia from Dec. 5 and simultaneously joined the Group of Seven industrialized nations in imposing a price cap on the country’s crude sales. That extended to refined fuels on Feb. 5.

Anyone wishing to access key western services — especially insurance — had to provide an attestation that the cargoes they were transporting cost $60 per barrel or less. The cap was set high on purpose — the US wanted already discounted Russian crude to keep flowing — and both upstart shippers are using plenty of western insurance.

About three-quarters of Gatik’s fleet is covered by mutuals within the International Group of Protection and Indemnity Clubs in London, data compiled by Bloomberg show. For Fractal, the proportion is higher still.

Both firms have numerous ships in their fleets covered by one of the International Group’s 13 member organizations, the American Club, whose head office is in New York, according to industry data compiled by Bloomberg.

The American Club’s chief operating officer, Daniel Tadros, confirmed his organization covers ships in both firms’ fleets, adding both have provided the so-called attestations — documented statements confirming that oil purchases are in accordance with the G7 price cap.

The need for firms like Gatik and Fractal grew because many conventional western shipping firms stopped lifting Russian barrels, either to protest at the invasion or because of the threat of falling foul of sanctions.

Even before the measures began, a huge number of tankers started to be sold to a new group of buyers, whose identities and affiliations were often not clear.

Permitted Trade

There are no results when searching for the company Gatik Ship Management on India’s Ministry of Corporate Affairs website. A Gatik website address shows that it is under construction. The firm declined to answer questions about its activities.

Fractal’s website only has an email address for recruitment. Emails, a WhatsApp message, and a call requesting comment — to addresses and phone numbers provided by people who know Fractal officials — were not returned.

Its Dubai address is listed on Equasis as the location for the commercial manager of most of Fractal’s tankers. The firm also recently moved out of a shared work space in Geneva — the home of its head office, according to a manager there.

Gatik’s fleet can haul about 30 million barrels of oil and fuels, according to data compiled by Bloomberg. Fractal’s has a transportation capacity closer to 15 million barrels.

Almost all Fractal’s and Gatik’s tankers made calls to Russian ports this year, or took Russian cargoes by ship-to-ship transfer, according to tanker tracking data compiled by Bloomberg.

India and the United Arab Emirates did not sign up to the price cap, nor do they have other sanctions on Russian oil. They can legally use western services too, providing they give an attestation the cargoes were bought at or below the cap.

Russia-Serving

Gatik’s earliest recorded tanker acquisition was in June 2022, with its most recent in February this year, according to VesselsValue, a firm that monitors sale and purchase of merchant ships. Fractal’s was in the same month, Equasis data show.

One such example is the Gatik tanker Jumbo, which was observed calling at the port of Ust-Luga in Russia’s Baltic Sea on Feb. 11. It is now near Kalamata in Greece, a popular location for ship-to-ship cargo transfers of the nation’s oil, according to ship-tracking by Bloomberg. The ship came under Gatik’s management on Feb. 3, according to Equasis.

Russia exported about 3.2 million barrels a day of crude oil from its ports in the two months after the cap and Europe’s imports ban were imposed on Dec. 5, little changed from the prior two months. The two firms are part of the new supply chain network allowing that to happen.

Neither Gatik nor Fractal is listed as the beneficial owner of the tankers in their fleets, meaning they are probably operating the ships for others, whose identity is often not made public. They are described as the “registered owners” of their vessels on the American Club’s website.

This is a common form of vessel ownership in the shipping industry but does not denote the ship’s true owner.

Beneficial ownership is a more important detail for understanding who really owns the assets and, according to information from IHS, which maintains a shipping database for the International Maritime Organization.

“We’re seeing how easy it is to transfer ownership with these large, new groups,” Steve Cicala, co-director of the Project on the Economic Analysis of Regulation at the National Bureau of Economic Research.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.