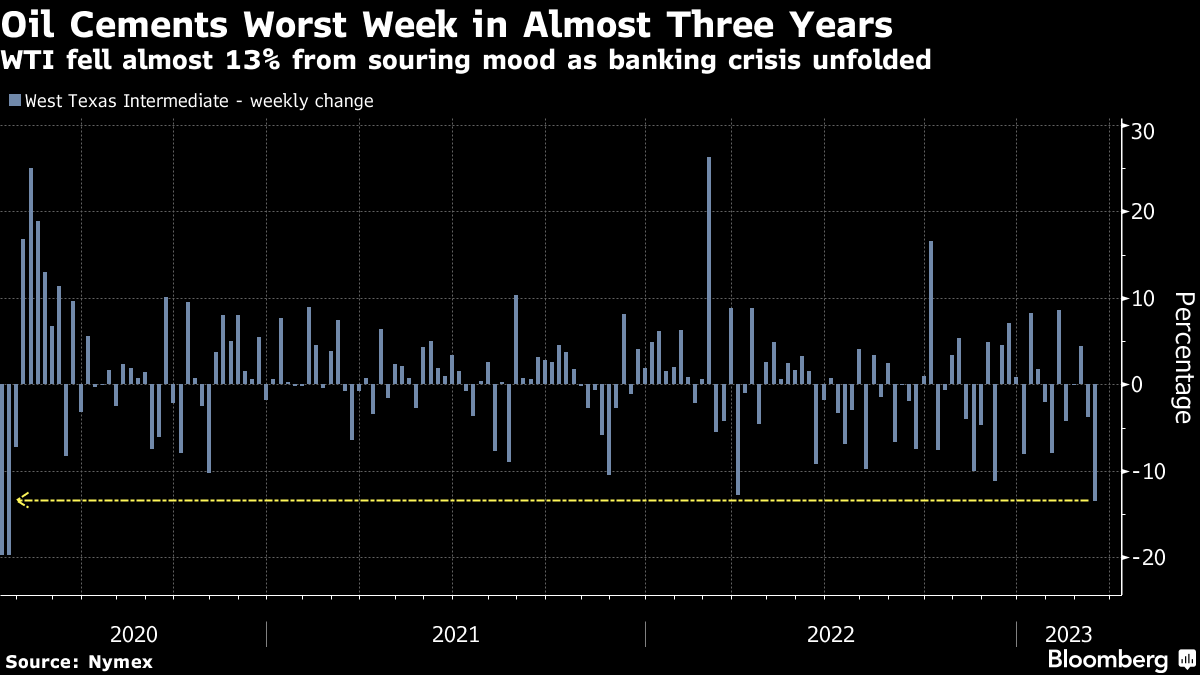

Oil Posts Worst Weekly Loss Since April 2020 Amid Bank Chaos

(Bloomberg) -- Oil posted the worst weekly loss since the early months of the coronavirus pandemic as banking turmoil poisoned investor sentiment.

West Texas Intermediate lost nearly 13% this week, the largest drop in almost three years. The failure of Silicon Valley Bank and troubles at Credit Suisse Group AG drove investors from risk assets, with oil-options covering accelerating the selloff.

“Crude action this week reminded many of how quickly the commodity can be decimated by macro economic events,” said Rebecca Babin, senior energy trader at CIBC Private Wealth. “The commodity broke a significant level of support as the market tries to quantify the economic ramifications of banking turmoil.”

Traders had been waiting for a catalyst to break prices out of the relatively narrow trading range that has dominated the market as expectations for rebounding Chinese demand compete with weaker economic outlook in the West.

This week’s banking crisis provided the spark, driving oil prices to a 15-month low. That plunge triggered another: Prices went so low that 43,000 options contracts totaling more than 40 million barrels of crude came “into the money,” resulting in a tidy payday for some while at the same time further deepening the downturn.

Oil’s next leg may depend on decisions by the US Federal Reserve and the Organization of Petroleum Exporting Countries. The Fed will decide next week whether to raise rates again, a move that has implications for oil demand. Meanwhile, OPEC and its allies will convene April 3 to revisit the group’s production policy. Several technical measures suggest that the recent plunge has pushed the commodity into oversold territory.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.