Oil Fluctuates as US Seeks to Calm Markets After Banking Turmoil

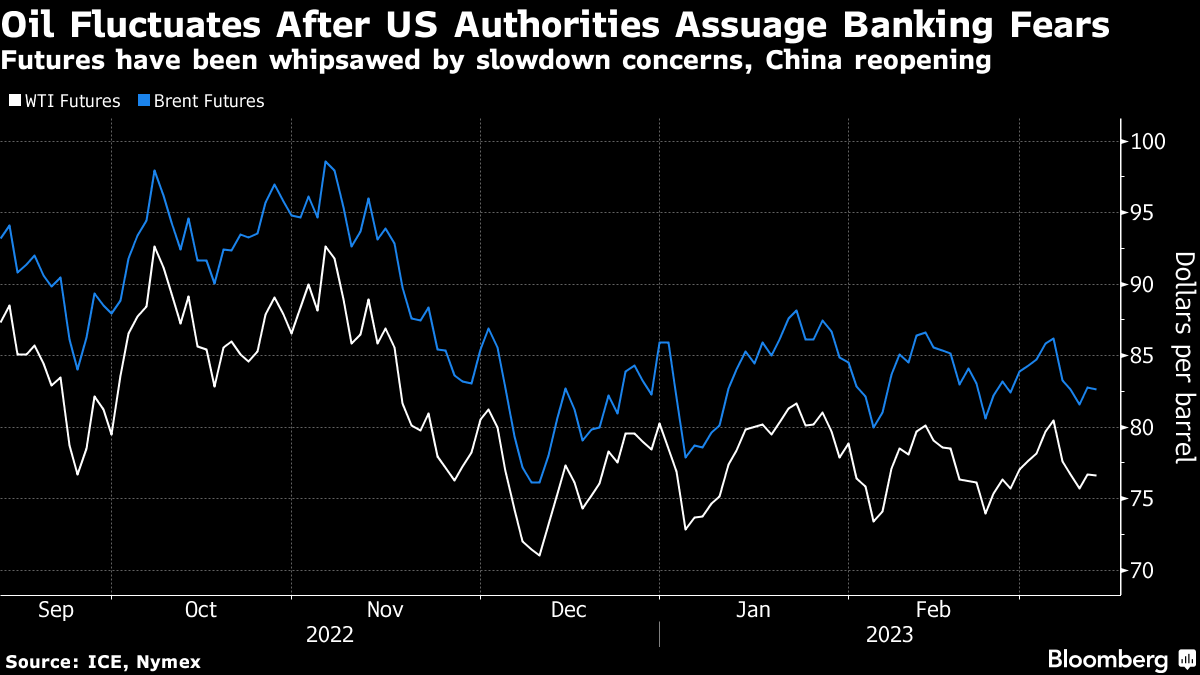

(Bloomberg) -- Oil fluctuated near $77 a barrel in a volatile start to the week as the fallout from the collapse of Silicon Valley Bank — the worst since the 2008 financial crisis — rippled across markets.

US authorities announced late Sunday efforts aimed at strengthening confidence in the banking system, while Goldman Sachs Group Inc. scrapped its call for an interest-rate hike from the Federal Reserve next week due to the turmoil. That led to the dollar tumbling, providing a tailwind for commodities.

In recent days, traders have been paying increasingly large premiums for bearish put options as the demise of SVB pushed some to hedge against the risk of a price decline. The premium of puts over bullish calls climbed to the highest since November last week.

The banking turmoil has added further volatility to the oil market, which has been whipsawed this year by concerns over tightening monetary policy in the US and optimism around China’s economic recovery. Most are bullish on the longer term outlook, with Saudi Aramco forecasting consumption will probably hit a record of 102 million barrels a day by the end of 2023.

“Fears of further monetary tightening, coupled with risks of a financial contagion, raised concerns of demand weakness,” said Charu Chanana, market strategist for Saxo Capital Markets Pte. Measures by US regulators to address the fallout from SVB provided some respite to the market, she added.

The Organization of the Petroleum Exporting Countries and the International Energy Agency are scheduled to release monthly market reports this week, providing investors with a snapshot on the outlook for supply and demand.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.